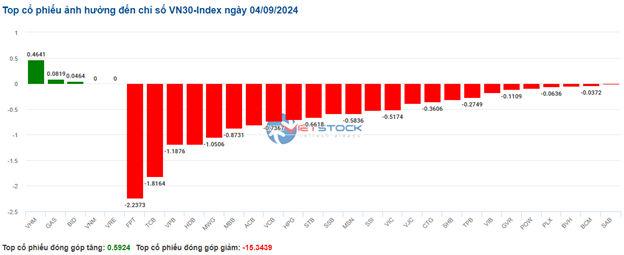

Most of the stocks in the VN30 basket are facing strong selling pressure. Specifically, FPT, TCB, VPB, and HDB respectively took away 2.23 points, 1.82 points, 1.19 points, and 1.18 points from the overall index. On the contrary, VHM, GAS, and BID were the rare codes that managed to stay in the green, but the increase was not significant.

Source: VietstockFinance

|

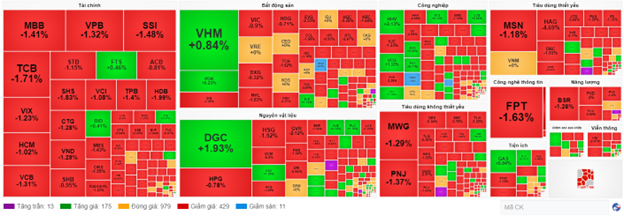

The information technology sector recorded a sharp decline in the market. FPT and CMG accounted for most of the selling pressure in this sector, falling by 1.63% and 1.57%, respectively.

Although the financial sector’s decline was not substantial, it had the most negative impact on the index due to its over 34% market capitalization weight. Most of the stocks in this sector were in the red, including MBB, VPB, SSI, and TCB. Only a few stocks, such as FTS, BID, CSI, and VNR, managed to stay in positive territory, but their gains were modest.

In contrast, the healthcare sector performed relatively well, building on the gains from the previous three sessions. However, there was still some differentiation within the sector, with nearly 30 stocks trading flat. IMP, DCL, DHT, and AMV were among the gainers, while DHG, OPC, TNH, and DVM faced selling pressure and traded in negative territory.

As of now, the sellers have a slight edge over the buyers. There are 429 declining stocks (including 11 at their lower circuit) and 175 advancing stocks (including 13 at their upper circuit).

Source: VietstockFinance

|

Open: VN-Index dips amid pressure from VN30 constituents

The market opened on a negative note, with most sectors trading in the red. The VN30 index, in particular, dragged the market down as most of its constituent stocks fell.

A slew of VN30 stocks witnessed sharp declines, including GVR, BCM, MWG, VRE, TCB, SSI, MSN, FPT, MBB, VPB, and CTG, among others.

The energy sector followed a similar trend, with most stocks trading in the red from the start of the session. Notable losers included BSR (-1.67%), PVD (-1.64%), PVS (-0.98%), PVC (-1.5%), PVB (-1.71%), and POS (-4.55%), to name a few.

The telecommunications services sector also witnessed a broad-based decline, led by large-cap stocks such as VGI (-2.51%), CTR (-1.25%), VNZ (-1.1%), and FOX (-0.86%). Smaller stocks in the sector, such as FOC (-1.51%), YEG (-0.55%), and ELC (-1.46%), also contributed to the sector’s negative performance.