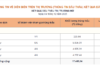

Moody’s has affirmed the long-term local and foreign currency bank deposit ratings of OCB at Ba3. The bank’s Baseline Credit Assessment (BCA) and Adjusted BCA were also maintained at B1.

Additionally, the rating agency held steady the long-term foreign and local currency Counterparty Risk Ratings (CRRs) at Ba3 and the long-term Counterparty Risk Assessment at Ba3 (cr). Moody’s has also upgraded OCB’s outlook to stable.

According to Moody’s, the affirmation of the BCA, coupled with the stable outlook, reflects the expectation that OCB’s capital buffers are stronger than peers and will continue to be so over the next 12-18 months, supporting its improved risk absorption capacity.

Amid a volatile domestic and international market environment, Vietnam’s banking sector faces significant challenges. Moody’s ratings indicate that OCB remains stable and resilient in the face of potential risks.

In May, OCB also received an A+ rating from VIS Rating, a collaboration between Moody’s and other organizations, initiated by the Vietnam Bond Market Association (VBMA). This rating reflects OCB’s strong profitability, risk management capabilities, and asset quality.

VIS Rating assessed OCB’s standalone strength as “Strong,” underpinned by higher lending yields and net interest margins (NIM) compared to peers. OCB’s strategic focus on the individual and small and medium-sized enterprise (SME) segments has maintained an average return on assets (ROA) of 2.2% (2019-2023), outperforming the industry average of 1.3%.