How Does Binh Minh Plastic Operate?

Binh Minh Plastic Joint Stock Company (BMP) was formerly known as Binh Minh Plastic Joint Venture Company, established in 1977. After several name changes and privatization, the company got its current name in 2004. Two years later, the company’s shares were officially traded on the HOSE with the stock code BMP.

Binh Minh Plastic is known as the first company in Vietnam to successfully produce HDPE pipes with a diameter of 1,200mm at its Binh Minh Long An factory.

Binh Minh Plastic (BMP) is a leading enterprise in plastic pipe production, with a dominant market share in the domestic market (27% at the end of 2023), mainly in the Southern region. BMP has four factories with a total capacity of 150,000 tons/year. The company solely trades in plastic pipes.

According to the financial report for the first six months, the company recorded a revenue of VND 2,156 billion, a 22% decrease compared to the same period last year. This decrease is attributed to a 24% drop in consumption volume year-on-year. However, consumption volume in the second quarter of 2024 increased by 23%. The company’s management shared that the average selling price in the second quarter of 2024 remained relatively stable compared to the first quarter.

BMP’s after-tax profit for the first six months reached VND 470 billion, an 18% decrease, due to an estimated 24% decrease in consumption volume compared to the same period last year. This equates to an average daily profit of approximately VND 2.6 billion.

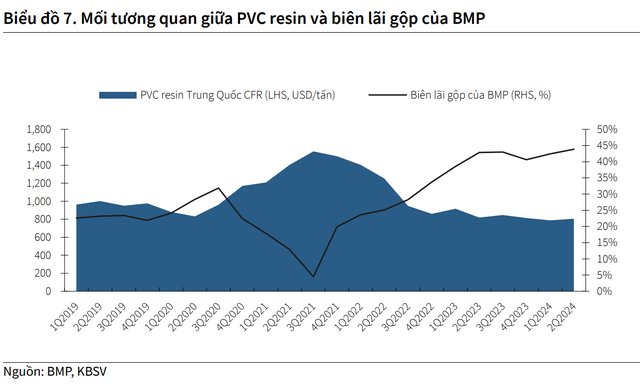

The PVC resin price is forecasted to remain at its bottom level for the next 6-9 months due to low consumption in the Chinese market, influenced by the stagnant real estate sector. This presents an opportunity for BMP to maintain high gross profit margins in the coming period. According to the assessment of KB Vietnam Securities Co (KBSV), BMP’s gross profit margin for 2024/2025 is expected to reach 42.5%/40%.

What Are the Development Prospects?

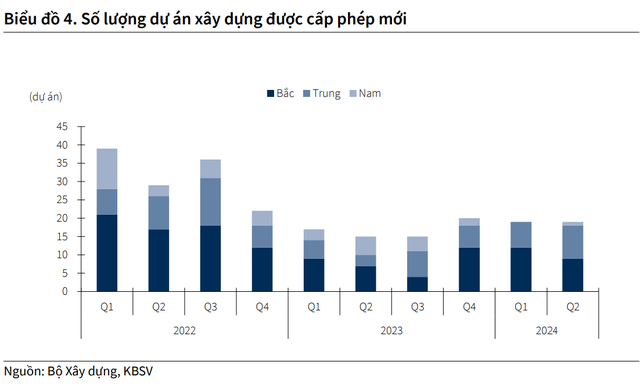

Regarding the company’s prospects for the second half of 2024, KBSV expects that the consumption of construction plastics in general and plastic pipes, in particular, will improve from the second half of 2024 onwards, driven by the recovery of the real estate and construction industries.

The number of new real estate projects licensed for construction and those resuming construction in the second half of 2024 is expected to improve compared to the first half. The early application of the amended Land Law and the amended Law on Real Estate Business will help shorten the time for completing the legal procedures for projects, improving supply and contributing to the sustainable development of the real estate market.

“In the long term, we estimate the CAGR of the plastic pipe market at 6%/year in the period of 2025 – 2029,” KBSV stated.

Furthermore, according to this securities company’s assessment, the consumption volume of plastic pipes in the first six months of the year is estimated at 157,000 tons, a 4% decrease compared to the same period, due to difficulties in the domestic real estate market, which has been recovering slowly.

However, according to KBSV’s observations, the consumption of construction materials in the domestic market has improved compared to the same period, with consumption of construction steel and steel pipes in the first seven months of 2024 increasing by 7% year-on-year.

“We believe that the faster recovery pace of domestic construction material demand is a leading indicator of plastic pipe consumption in the coming period, indicating that BMP’s revenue has bottomed out recently. KBSV estimates BMP’s consumption volume in the second half of 2024 to reach 44,625 tons, a 25% increase compared to the first half of 2024,” KBSV said.

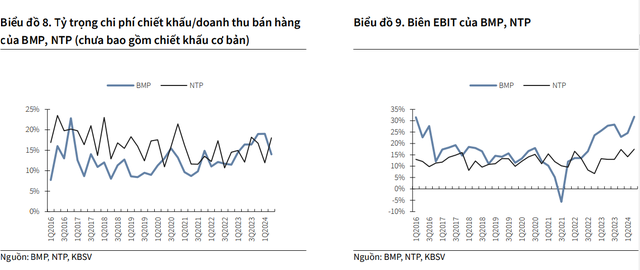

Additionally, compared to its competitors, BMP’s business strategy focuses on maintaining the profitability of its operations in the context of a saturated domestic plastic pipe industry, where other competitors maintain their competitiveness by offering substantial basic discounts to agents. Historically, BMP’s discount rate for distribution channels tends to be lower than that of its industry peers, optimizing profitability.

KBSV projects BMP’s EBIT margin to reach 28%/24% in 2024/2025, with a decline due to a decrease in gross profit margin caused by the recovery of PVC resin prices and increased selling expenses as BMP enhances its sales programs with agents to boost revenue when consumption demand returns.

BMP holds a significant position in the industry, with a capital occupancy rate of over 1.5x and a cash turnover cycle of less than 60 days since the beginning of 2023. Moreover, BMP is not dependent on loans to maintain its business operations, as its loan balance accounts for only about 2% of the company’s equity.

Therefore, the securities company expects BMP to maintain a high dividend payout ratio in the coming period. In the last five years, BMP has consistently maintained a cash dividend payout ratio of 97-99%, with a high cash dividend yield (9.5%/11.3% in 2022/2023). KBSV expects BMP’s dividend policy to continue at an average of 97% in the future, with an estimated cash dividend yield of 11.6%/11.2% for 2024/2025.

SSI Research predicts BMP could replace MWG in VNDiamond

SSI Research has made predictions about changes in the VNDiamond index basket for the first quarter of 2024. It is worth noting that MWG stocks are still considered to have a P/E ratio that does not meet the requirements and may be excluded from the basket, while BMP stocks may be added.