An Giang Mechanical Joint-Stock Company (CKA) plans to pay a 50% dividend for 2023 in October 2024.

September 2024 saw a string of small-scale businesses simultaneously finalizing their shareholder lists and distributing cash dividends at high rates.

A notable example is Green Port Joint Stock Company (VGR on the stock exchange) which has just announced that it will finalize its shareholder list on September 19 to distribute the first round of 2024 dividends. The dividend rate is set at 20%, meaning each share will receive 2,000 VND.

Currently, VGR has a charter capital of over 632 billion VND and has invested in many modern equipment imported from Germany, the Netherlands, and Japan to serve its sea transport business. In Q2 of 2024, VGR achieved a pre-tax profit of nearly 104 billion VND.

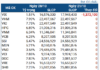

With 63.25 million shares circulating, a market price of 57,500 VND per share, and a small market capitalization of just over 3,600 billion VND, VGR is estimated to spend about 126.5 billion VND on this dividend payment.

Regarding VGR’s shareholder structure, Vietnam Container Shipping Joint Stock Company (VSC), the parent company, holds over 47 million shares and will receive approximately 94 billion VND from this dividend payment. Another major shareholder is Evergreen Marine Corp, which holds 13.7 million shares and is expected to receive 27.5 billion VND in dividends.

Sonadezi Long Thanh Joint Stock Company (SZL on the stock exchange) has also announced that it will finalize its shareholder list on September 21 to distribute the second round of 2023 dividends. The dividend rate is 20%, equivalent to 2,000 VND per share.

With more than 27.3 million shares circulating and a very small market capitalization of only 1,116 billion VND, Sonadezi Long Thanh is expected to spend about 55 billion VND on dividends to its shareholders.

Accordingly, Sonadezi Industrial Park Development Corporation (SNZ on the stock exchange), which owns over 15.35 million SZL shares, will receive nearly 31 billion VND in dividends. Another major shareholder is America LLC, which holds over 4.68 million SZL shares and is expected to receive more than 9.3 billion VND in dividends. Dong Nai Development Investment Fund, with 1.698 million SZL shares, will receive nearly 3.4 billion VND in dividends.

Hanoi Beer Trading Joint Stock Company (Habeco Trading, HAT on the stock exchange) has just announced that it will finalize its shareholder list on September 23 to pay a 2023 dividend in cash at a rate of 30%, equivalent to 3,000 VND per share.

The company expects to spend more than 9.3 billion VND on this dividend payment. Hanoi Beer – Alcohol – Beverage Joint Stock Company (Habeco), which owns 60% of Habeco Trading, is expected to receive nearly 5.6 billion VND in dividends.

Notably, An Giang Mechanical Joint-Stock Company (CKA) announced that it would finalize its shareholder list on September 17 to distribute 2023 dividends at a rate of 50%, equivalent to 5,000 VND per share, with an expected payment date of October 3.

With nearly 3.3 million shares circulating, An Giang Mechanical Joint-Stock Company will spend more than 16 billion VND on this payment. Accordingly, Vietnam Engine and Agricultural Machinery Corporation, which holds 47.41% of CKA’s charter capital, will receive approximately 7.6 billion VND in dividends.

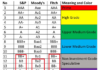

An Giang Mechanical has a history of high dividend payouts, ranging from 20% to 35% in the 2018-2022 period. In 2024, CKA is expected to distribute a 15% dividend.

“The Power of Persuasion: Unlocking Shareholder Value with a Record-Breaking Dividend”

The price-to-earnings ratio (P/E) of this business is an incredibly low 3.5. This indicates a potential bargain for investors, as it’s a metric that showcases the company’s current share price relative to its earnings. A low P/E ratio can often signify an undervalued company, and this particular ratio is far below the industry average, presenting an intriguing opportunity for those seeking to invest.