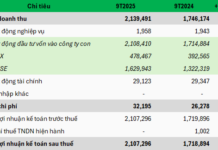

Masan Consumer, the leading consumer goods company in Vietnam, recently announced the results of a vote regarding additional dividend payments for 2023. Impressively, 97.3% of the company’s shares agreed to the proposal of a 168% supplementary cash dividend.

Notably, Bill & Melinda Gates Foundation Trust was among the shareholders who participated in this decision. The organization currently holds over 1 million MCH shares, valuing approximately 212 billion VND in the market.

Prior to this, Masan Consumer had already distributed 100% dividends in cash for the year 2023. With this additional payout of 16,800 VND per share, the Bill & Melinda Gates Foundation Trust is expected to receive nearly 28 billion VND in dividends from Masan Consumer this year.

So far this year, MCH shares have more than doubled in value, currently trading above 200,000 VND per share. This translates to a market capitalization of 147,600 billion VND (approximately 5.9 billion USD).

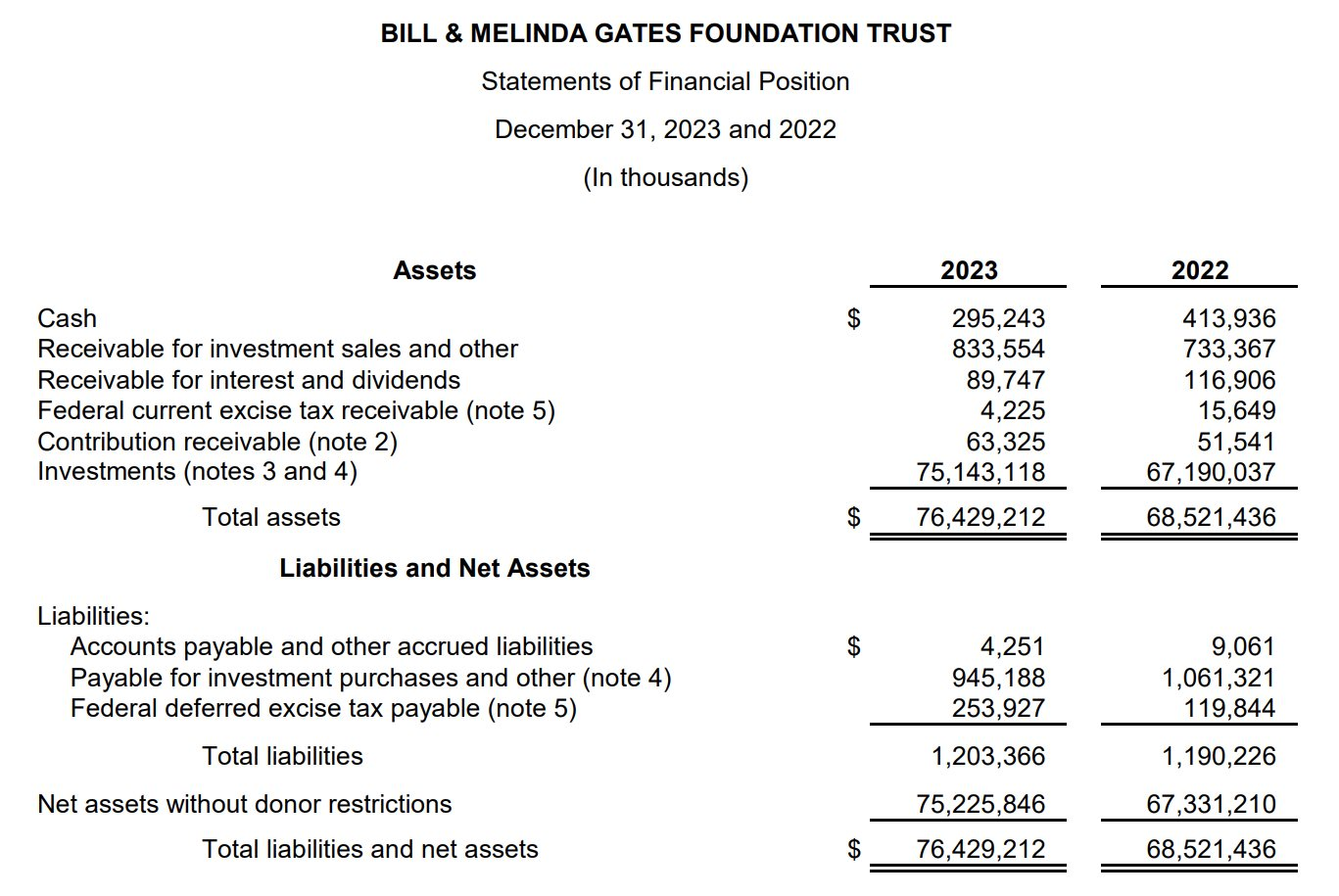

Managing over 75 billion USD in assets

Bill & Melinda Gates Foundation Trust is responsible for managing the finances of the Bill & Melinda Gates Foundation (BMGF), a charitable organization founded by Bill Gates, co-founder of Microsoft, and his former wife, Melinda Gates.

As of the end of 2023, the net asset value of BMGF Trust exceeded 75 billion USD, primarily consisting of financial investments.

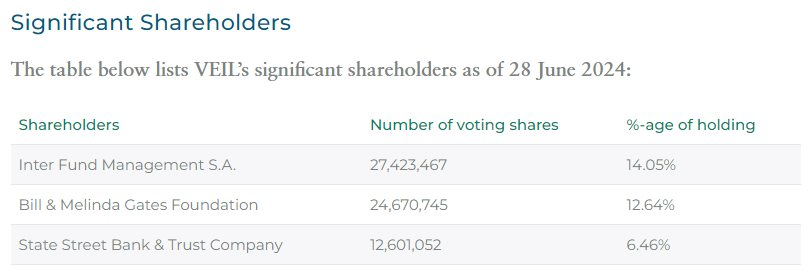

BMGF Trust has been indirectly investing in Vietnam for quite some time, particularly in the stock market through the Vietnam Enterprise Investments Limited (VEIL) fund, the largest investment fund in Vietnam managed by Dragon Capital.

BMGF Trust is currently the second largest shareholder of VEIL, holding nearly 24.7 million fund certificates. These certificates are valued at over 183 million USD based on VEIL’s market price on the London Stock Exchange.

It is worth noting that BMGF Trust has not traded VEIL for a considerable period.

While the fund has actively invested in the Vietnamese stock market, it sold a range of stocks of global tech giants in the fourth quarter of 2023. According to Dataroma, the Bill & Melinda Gates Foundation Trust offloaded its entire holdings in tech companies such as Apple, Meta (Facebook’s parent company), Alphabet (Google’s parent company), Amazon, and Nvidia.

The fund also exited positions in several other well-known companies, including Walt Disney, Morgan Stanley, Johnson & Johnson, Unilever, Goldman Sachs, Exxon Mobil, Lockheed Martin, and PepsiCo. Additionally, it reduced its holdings in two of the largest stocks in its portfolio, Microsoft and Berkshire Hathaway.

According to Forbes, Bill Gates is currently the seventh richest person in the world, with an estimated net worth of 138.6 billion USD. The billionaire also owns 111,288 hectares of land, ranking as the 42nd largest landowner in the United States. He is also the largest owner of agricultural land in the country, according to Land Report magazine.

A significant portion of Gates’ income is dedicated to charitable causes through the Bill & Melinda Gates Foundation. In 2023, the foundation committed to spending 8.3 billion USD to fight poverty, disease, and inequality, a 15% increase from 2022. The foundation aims to further increase its spending to 9 billion USD by 2026.

The Retail Giant: Generating $170 Million in Annual Tax Revenue

Masan Group is proud to be one of the largest taxpayers in the provinces where its factories operate, but its contribution to the community goes beyond that. The company provides employment opportunities for thousands of people, improving their livelihoods and positively impacting their lives. Additionally, Masan Group is committed to community development, allocating a portion of its profits to initiatives that make a lasting difference in the areas it serves.

“Double-Digit Growth, Double-Digit Dividends: Masan Consumer’s Impressive Performance Streak”

Masan Consumer Holdings (MCH), a leading consumer goods company, has announced plans to propose a generous dividend payout to shareholders. The proposal, which will be presented at the upcoming Annual General Meeting, includes a cash dividend of 168% or VND 16,800 per share for the fiscal year 2023. This significant dividend payout reflects MCH’s strong financial performance and commitment to returning value to its shareholders.