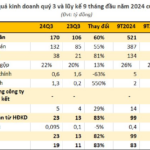

G.C Food, a leading producer of aloe vera and coconut jelly products in Vietnam, has released its financial report for Q3 2024, showing impressive growth. The report highlights a 31% year-over-year increase in revenue, reaching VND 173 billion. The slower rise in cost of goods sold resulted in a significant improvement in gross profit margin, climbing from 27% to 38%. This led to a remarkable 83% surge in gross profit, totaling VND 65 billion.

During this quarter, financial activity revenue witnessed a sharp decline to just VND 130 million. Conversely, selling and management expenses rose by 21% and 122%, respectively, amounting to VND 9 billion and VND 21 billion.

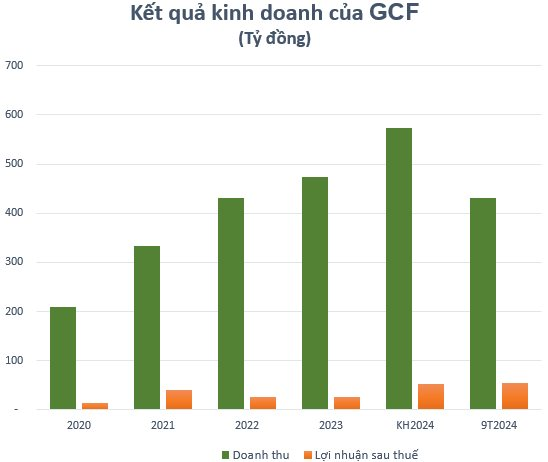

As a result, the company recorded a pre-tax profit of VND 32 billion, doubling that of the previous year. Net profit also increased by 85%, reaching VND 23 billion. For the first nine months of 2024, G.C Food achieved VND 432 billion in revenue and nearly VND 55 billion in net profit, representing an 18% and 138% year-over-year growth, respectively. These figures mark the company’s highest profit to date.

For the full year 2024, G.C Food aims to achieve VND 573 billion in revenue and over VND 52 billion in net profit, representing a 21% increase and nearly a doubling from the previous year, respectively. With these Q3 results, the company has already accomplished 76% of its revenue target and surpassed its annual profit goal.

G.C Food, a veteran in the aloe vera and coconut jelly industry with over a decade of experience, leads the Vietnamese market with an annual production of more than 20,000 tons. Their products are available in 19 countries worldwide, earning them the title of “Aloe Vera King.”

The company owns and operates two state-of-the-art factories: Vietfarm in Ninh Thuan, specializing in aloe vera processing with a capacity of 35,000 tons of fresh leaves per year, producing 15,000 tons of finished products; and Vinacoco in Dong Nai, dedicated to coconut jelly production with an annual capacity of approximately 12,000 tons.

G.C Food is the sole Vietnamese supplier to prominent international brands such as OKF, the world’s leading aloe vera drink manufacturer; Lotte, the fifth-largest producer of aloe vera drinks globally; and Morinaga, Japan’s second-largest dairy company.

Looking ahead, G.C Food envisions becoming a high-tech company by 2026, aiming for 100% control over its supply chain, from raw materials to production. They target a compound annual growth rate of 30% until 2028 and plan to expand their aloe vera cultivation area to 500 hectares.

GCF’s stock performance on the market has been positive, with a nearly 65% increase in share price since the beginning of the year, hovering around its historical high of VND 22,600 per share.

The Chairman of TTC AgriS: Working in the Interests of 91% of Shareholders and Investors

In her capacity as Chairman of the Board of Directors of TTC Agri-Biotech Joint Stock Company (TTC AgriS) (HOSE: SBT), Ms. Dang Huynh Uc My has asserted the company’s commitment to ensuring fairness and transparency for its shareholders, investors, and stakeholders. As TTC AgriS attracts the participation of international investors and prominent financial institutions, Ms. My has emphasized the importance of equitable treatment and transparent disclosure for all involved parties.