Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 475 million shares, equivalent to a value of more than 11.1 trillion dong; HNX-Index reached over 40.5 million shares, equivalent to a value of more than 644 billion dong.

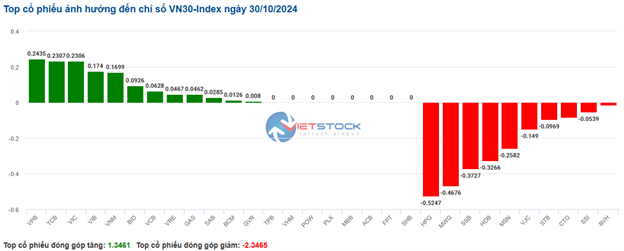

VN-Index opened the afternoon session with a continuation of the tug-of-war between buyers and sellers, with sellers slightly gaining the upper hand, causing the index to plunge into the red despite the return of buying pressure towards the end of the session. In terms of impact, VHM, VCB, VNM, and VIC were the most negative stocks, taking away more than 2.6 points from the index. On the other hand, stocks such as TCB, STB, BID, and HVN had the most positive impact and contributed more than 1.1 points to the index.

| Top 10 stocks with the strongest impact on the VN-Index on October 30, 2024 |

In contrast, the HNX-Index had a rather optimistic performance, with positive influences from stocks such as IDC (+2.79%), HUT (+0.62%), L18 (+5.74%), and DTK (+0.85%)…

|

Source: VietstockFinance

|

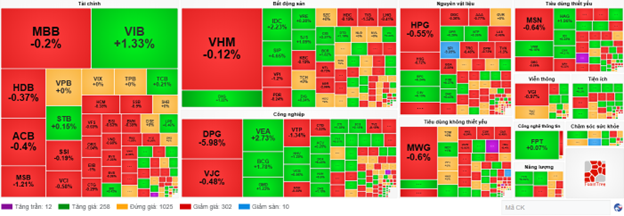

The real estate industry experienced the sharpest decline in the market, falling by -0.73%, mainly due to losses in VHM (-3.74%), VIC (-0.85%), KBC (-0.19%), and NTL (-0.48%). This was followed by the materials sector and the non-essential consumer goods sector, which decreased by 0.46% and 0.42%, respectively. On the other hand, the industrial sector witnessed the strongest recovery in the market, rising by 0.44% with green signals from stocks such as VEA (+3.18%), HAH (+0.69%), GMD (+0.15%), and VTP (+0.89%).

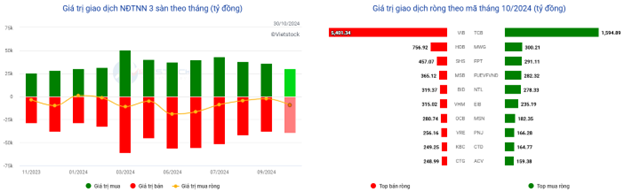

In terms of foreign trading, they continued to net sell more than 214 billion dong on the HOSE exchange, focusing on stocks such as STB (82.3 billion), MSN (79.18 billion), VHM (73.34 billion), and SSI (69.53 billion). On the HNX exchange, foreign investors net sold more than 11 billion dong, mainly offloading IDC (12.71 billion), PVS (7.36 billion), CEO (1.5 billion), and HUT (1.14 billion).

| Foreign Trading Buying and Selling Dynamics |

Morning Session: Pressure on pillar stocks increases, VN-Index turns red

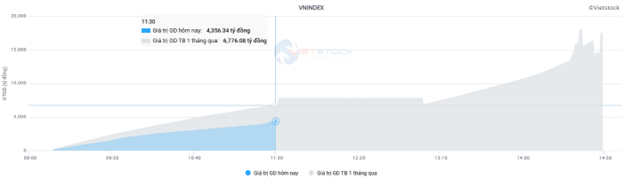

Selling pressure gradually increased towards the end of the morning session amid subdued market liquidity. At the midday break, the VN-Index lost 4.14 points, or 0.33%, to 1,257.64 points; HNX-Index hovered near the reference level, gaining 0.01% to 225.57 points. The number of declining stocks continued to outweigh advancing stocks, with 354 losers and 253 gainers.

Market liquidity remained lackluster, with the VN-Index matching volume reaching just over 191 million units, equivalent to a value of more than 4.3 trillion dong. The HNX-Index recorded a matching volume of over 19 million units, with a value of nearly 275 billion dong.

Market liquidity compared to the 1-month average. Source: VietstockFinance

|

VCB, CTG, VHM, and HPG were the pillar stocks exerting the most pressure on the VN-Index, dragging the index down by nearly 1.5 points. Conversely, BID, SIP, and VIB had the most positive impact but only helped the VN-Index recoup 0.6 points.

The red color gradually dominated the sector performance, although the fluctuations were mild, indicating a certain level of differentiation. After a brief positive momentum at the start of the session, the telecommunications group corrected lower, falling by 0.6% and ranking at the bottom of the sector performance table at the end of the morning session. This was mainly due to the reversal of two large-cap stocks, VGI (-0.97%) and CTR (-1.08%).

Selling pressure also overwhelmed the non-essential consumer goods and materials sectors, as evidenced by the declines in MWG (-1.05%), DGW (-1.26%), PNJ (-0.83%), FRT (-0.99%), TNG (-1.2%); HPG (-0.74%), TVN (-2.6%), DCM (-1.31%), DPM (-1.14%), PTB (-1.29%),…

On the upside, the slight gains in BSR (+0.47%), PVS (+0.26%), and NBC (+0.99%) contributed to the 0.3% increase in the energy group, which temporarily led the market in the morning session.

Following closely was the industrial and healthcare sectors, which posted modest gains amid a differentiated performance. Buying interest concentrated on stocks such as VEA (+2.05%), BCG (+1.45%), PHP (+2.11%), MVN (+1.25%), SCS (+1.36%); TNH (+2.3%) and DVN (+2.78%). Meanwhile, sellers remained in control of VTP (-1.56%), CTD (-1.33%), TMS (-2.79%); DTP (-3.23%), DBT (-1.63%), and AMV, which hit the daily limit down (-10%).

Foreign investors continued to net sell over 225 billion dong on the HOSE exchange in the morning session. VHM faced the strongest net selling pressure, with a net sell value of 71.22 billion dong. On the HNX exchange, foreign investors net sold 5.5 billion dong, focusing their sales on MBS and PVS.

10:35 am: Foreign net selling persists, market struggles to break higher

Selling pressure gradually resurfaced, eroding the early gains. Currently, the main indices are trading in a tug-of-war manner around the reference levels. As of 10:30 am, the VN-Index dipped 0.64 points to hover around 1,261 points. The HNX-Index added 0.06 points to trade around 225 points.

Stocks in the VN30 basket are trading in a relatively balanced manner, with a mix of green and red signals. Specifically, HPG, MWG, SSB, and HDB respectively took away 0.52 points, 0.47 points, 0.37 points, and 0.33 points from the overall index. Conversely, VPB, TCB, VIC, and VIB maintained relatively strong buying interest, but their positive impact on the index was not significant.

Source: VietstockFinance

|

The industrial sector led the market recovery with a modest gain of 0.63%, thanks to a somewhat differentiated performance. Within the sector, BCG rose 2.1%, GMD climbed 0.46%, HHV advanced 1.29%, VCG gained 0.56%… On the flip side, selling pressure persisted in some stocks, including DPG, which fell 6.15%, VJC down 0.67%, VTP losing 1.67%, and HAH slipping 0.23%…

From a technical perspective, VEA witnessed a surge in buying interest during the morning session, with volume surpassing the 20-day average, indicating heightened trading activity. Currently, VEA‘s price has rebounded after testing the Fibonacci Projection 23.6% level (corresponding to the 42,900-44,300 range) amid positive signals from the MACD and Stochastic Oscillator, reinforcing the ongoing recovery trend.

Source: https://stockchart.vietstock.vn/

|

Following closely, the energy sector also posted a solid gain, driven by buying interest in the three largest oil and gas stocks: PVS rose 0.53%, PVD climbed 0.19%, and BSR advanced 0.47%. Meanwhile, the remaining stocks in the sector mostly traded sideways or dipped into the red, including PVC, which fell 0.81%, PSB down 1.61%, and TMB losing 0.61%.

Compared to the opening, buyers and sellers were engaged in a tight tug-of-war, with over 1,000 stocks trading sideways and sellers slightly gaining the upper hand. There were 302 declining stocks (including 10 at the lower limit) and 258 advancing stocks (including 12 at the upper limit).

Source: VietstockFinance

|

Additionally, as of 10:30 am on October 30, 2024, foreign investors continued to net sell, with a net selling value of over 9.413 trillion dong in October. Notably, VIB faced the strongest net selling pressure, with a net sell value of over 5,400 billion dong (accounting for more than 57% of the total net selling value of foreign investors in the market). Conversely, TCB was the most net bought stock, with a net buy value of over 1,594 billion dong.

Source: VietstockFinance

|

9:40 am: Maintaining a slight gain – Telecommunications services sector continues its growth trajectory

In the early trading session on October 30, as of 9:40 am, the VN-Index posted a solid gain, climbing to 1,263.69 points. The HNX-Index edged higher, reaching 226.19 points.

On Wall Street, the Nasdaq Composite Index reached a new record high on Tuesday (October 29), closing 0.78% higher at a record high of 18,712.75 points. The S&P 500 index advanced 0.16% to 5,832.92 points. In contrast, the Dow Jones index lost 154.42 points (or 0.36%) to finish at 42,233.05 points.

Meanwhile, oil prices continued their downward trend on October 29, with WTI crude oil futures falling 17 cents (or 0.25%) to $67.21 per barrel. Brent crude futures declined by 30 cents (or 0.42%) to $71.12 per barrel.

As of 9:40 am, the telecommunications services sector was among the top-performing sectors, with notable gains in stocks such as

The Momentum of Declines Persists

The VN-Index ended the week on a bearish note, forming a Black Marubozu candlestick pattern while slicing through the middle Bollinger Band. This reinforces the increasingly pessimistic outlook. Moreover, trading volume remaining below the 20-day average underscores the growing investor caution. The MACD indicator continues its downward trajectory, reinforcing the sell signal. This suggests that the risk of short-term corrections persists.

The Wolf of Wall Street: Brokers’ Prop Trading Losses Mount in Market Rout

The proprietary trading arms of securities companies recorded net selling with a value of VND 94 billion across the entire market.

The Beat of the Market on 10/28: Indecision Looms, Telecom Services Shine Brightly

At the end of the trading session, the VN-Index rose 2.05 points (+0.16%) to 1,254.77, while the HNX-Index dipped 0.03 points (-0.01%) to 224.59. The market breadth tilted towards gainers with 389 advancers and 283 decliners. The large-cap stocks also witnessed a sea of green, as reflected in the VN30-Index, with 15 gainers, 9 losers, and 6 stocks holding steady.