. Trading was more vibrant in the afternoon session, and it got even more intense towards the end. The effect of running out of sell-side liquidity from the morning session created a rather rapid price increase. When buying momentum picked up, sellers became imbalanced, leading to a dominant wave of rising prices. The trading volume on the HoSE in the afternoon surged by 130% compared to the morning session.

¶ The significant increase in liquidity, coupled with the upward price trend, is a positive combination. This afternoon, a large volume of stocks hit rock bottom in terms of account value, but it was evident that there weren’t many swing trades. Investors tended to hold on to their stocks, so despite the surge in liquidity compared to the morning session, the overall trading volume remained moderate. Specifically, HoSE added 7,347 billion VND in matching value, a slight decrease of 2% from yesterday’s afternoon session.

¶ The upward momentum intensified significantly from 2:15 PM onwards, marking the start of the final settlement price calculation for the VN30 Index futures contracts. However, even before that, trading activities had already become more lively. By the end of the morning session, the VN-Index had 166 gainers and 153 losers, but around 1:30 PM, the numbers shifted to 200 gainers and 139 losers. At the HoSE closing, there were 278 gainers and 94 losers.

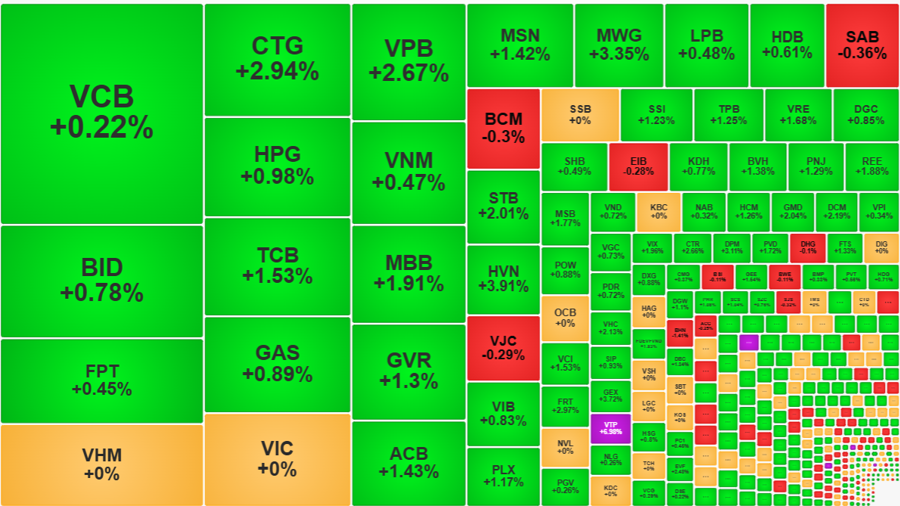

¶ Bank stocks usually play a crucial role in the settlement sessions of derivatives as they hold a significant weight in the VN30-Index. CTG started to accelerate from around 2 PM, closing with a 2.94% increase compared to the reference price. Thus, in the afternoon session alone, CTG rose nearly 3.25% from the morning session. VPB was the earliest to surge, as it started climbing right at the beginning of the afternoon session. This stock ended the morning session with a meager gain of 0.27% but closed with a substantial increase of 2.67%. MBB, ACB, STB, and TCB were other bank stocks that witnessed an increase of more than 1% compared to the morning session. Overall, out of the banking group, only 3 out of 27 codes closed in the red: NVB, PGB, and EIB, which are relatively insignificant stocks.

¶ In addition to banks, other mid-cap stocks in the VN30-Index also contributed to the rally, such as MWG, which rose by 3.35%, VRE by 1.68%, BVH by 1.38%, MSN by 1.42%, GVR by 1.3%, PLX by 1.17%, and SSI by 1.23%. The VN-Index underperformed the VN30-Index partly due to the lackluster performance of the largest cap stocks. VCB and FPT posted modest gains, while VHM and VIC remained unchanged. Nonetheless, today, liquidity was evidently concentrated in the blue-chip stock group, as the trading volume of the VN30 basket accounted for 59.6% of the entire HoSE, while the average for last week was only about 47% each day.

¶ The price increase spillover effect in the afternoon session was remarkable. Firstly, it was evident in the overwhelming breadth of advancing stocks. Additionally, the overall price level witnessed a significant boost. By the end of the morning session, the VN-Index had only 44 stocks rising by more than 1%, but in the afternoon, this number jumped to 113. This group contributed 50.9% of the total trading value on the HoSE. Clearly, the upward momentum was not solely reliant on a few large-cap stocks but was effectively driven by liquidity.

¶ Apart from bank stocks and blue-chip stocks in the VN30 basket, several other stocks traded actively, such as HCM, which rose by 1.26%, GEX by 3.72%, FRT by 2.97%, VTP by 6.98%, VIX by 1.96%, DPM by 3.11%, HVN by 3.91%, and TCM by 1.43%… These stocks all achieved a trading volume of over 100 billion VND, placing them among the most actively traded stocks in the market.

¶ Foreign investors this afternoon did not reduce their selling intensity but instead increased their buying. Specifically, they injected an additional 1,039.1 billion VND on the HoSE, a 2.4-fold increase from the morning session. The selling value was 1,234.1 billion, a rise of about 13%. The corresponding net selling value was 195 billion VND, significantly lower than the morning session’s figure of -663 billion. The stocks that witnessed intense selling pressure today were VHM (-586.9 billion), SSI (-129.6 billion), HPG (-118.3 billion), MWG (-104.9 billion), and KBC (-98.4 billion). On the buying side, CTG (+66.6 billion), TCB (+52.2 billion), VPB (+43.1 billion), FPT (+28.7 billion), KDH (+26.5 billion), and VNM (+25.6 billion) stood out.

¶ With an additional 11.79 points today, the VN-Index has witnessed a strong two-day recovery from the 1200-point bottom. This pace is helping the index widen the gap with the psychological support level. On the one hand, this provides some consolation to investors who are holding on to their losing positions. On the other hand, it also means that short-term profit-taking pressure will likely intensify in the coming sessions as those who bought at the bottom would be eager to lock in quick gains.