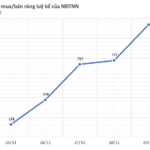

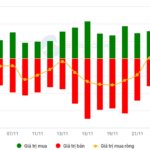

The recent rally in the stock market came to a mild halt as the VN-Index witnessed a slight dip on November 27th. However, it’s worth noting that the index didn’t plummet, indicating a positive sign of capital inflow as investors seized the opportunity to buy stocks at lower prices following the market correction.

When it comes to investing for success, you may have heard about the value investing theory, which entails buying stocks of solid companies at attractive prices. However, the gap between theory and practice can be vast. When stock prices are low, it often reflects a relatively pessimistic market sentiment.

Stock prices, which seem cheap, can always get cheaper, and market bottoms are only identifiable in hindsight. These factors, coupled with the finite capital that most investors have at their disposal during bottom-fishing campaigns, present a challenging scenario. Thus, according to experts, to successfully time the market, one needs to pinpoint the Method, Timing, and Objective.

According to experts, successful bottom-fishing requires a well-defined method, precise timing, and a clear investment objective. Illustrative image.

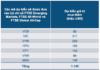

Just as “location, location, location” is paramount in real estate investing, “timing, timing, timing” is the crux of stock market investing. So, is now the right time to invest when prices seem alluring? Many experts rely on the P/E ratio for valuation, suggesting that a P/E of around 12-13 times, as seen currently, indicates a bargain.

While timing the market correctly and identifying the right stocks are crucial, a long-term investment objective is essential for achieving financial prosperity. In today’s environment, with an ever-growing number of new investors opening brokerage accounts, the prevalence of stock market scams is a cause for concern. Be vigilant against fraudulent social media pages impersonating the Stock Exchange, brokerage firms, and financial experts, enticing investors to join training sessions or exclusive investment communities.

VNX warns that such claims are entirely false, and investors should refrain from divulging personal information or sending money to these imposter communities. Stay alert and protect yourself from such deceptive practices.

The Online Investment Scam: How to Spot and Avoid It

Although these schemes are not new, their sophistication often traps unsuspecting social media users.

Unlocking the Power of Words: Reigniting Interest in the VN-Index’s Journey to 1,260 Points While Navigating the Ever-Present Risk of Reversal

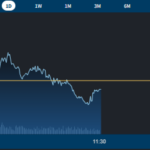

Looking ahead to the next trading session, most securities companies anticipate a continuation of the market’s upward trajectory. However, they also caution against potential reversals as the market approaches resistance levels.

Vietstock Daily Recap: Can We Expect a Resurgence in Liquidity?

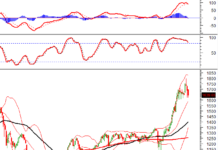

The VN-Index witnessed a modest gain while staying afloat on the Middle Line of the Bollinger Bands. If, in the upcoming sessions, the index persists above this threshold, coupled with trading volumes surpassing the 20-day average, the upward trajectory will be fortified. Notably, the MACD indicator has already flashed a buy signal by crossing above the Signal Line. In tandem, the Stochastic Oscillator is echoing a similar signal. Should this momentum be sustained in the forthcoming sessions, the short-term outlook will brighten with optimism.