The VN-Index edged up 0.67%, or over 8 points, on November 29, 2024, with more gainers than losers. Notably, insurance stocks witnessed a sharp surge and emerged as the best-performing sector, rallying 5.11%.

|

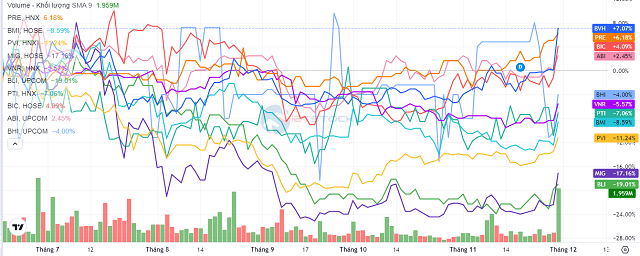

Insurance Stock Price Movement on November 29, 2024

Source: VietstockFinance

|

With the exception of PGI, which closed unchanged, all other insurance stocks painted the town green, including PVI (+2.7%), PTI (+4.29%), and BIC (+5.29%). The rally was further accentuated by the strong performance of BVH (+6.98%) and MIG (+6.78%), which added a purple hue to the sector’s bullish picture.

|

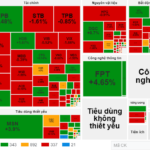

Insurance Stock Price Movement from July to November 2024

Source: VietstockFinance

|

Today’s performance in the insurance sector mirrored a similar rally witnessed in late August 2024, when the State Bank of Vietnam (SBV) decided to relax credit growth limits for credit institutions.

Right from the start of 2024, the SBV had allocated a 15% credit growth target for credit institutions, as outlined in Directive No. 01/CT-NHNN dated January 15, 2024. On August 28, 2024, the SBV proactively issued a document announcing adjustments to the 2024 credit growth target for these institutions. As of November 22, 2024, system-wide credit growth stood at 11.12% compared to the end of 2023.

The SBV stated that given the inflation was well-controlled below the target set by the National Assembly and the Government, and following the Government and Prime Minister’s directives on flexible and effective credit growth management, the SBV, on November 28, 2024, once again announced an increase in the 2024 credit growth target for credit institutions, ensuring transparency and fairness. This additional limit is a proactive move by the SBV, and credit institutions need not request it.

In theory, when credit growth is accelerated, lending rates tend to remain stable or increase slightly to maintain profit margins. This could exert pressure on deposit rates, potentially leading to adjustments to attract more deposits and balance capital sources, ensuring liquidity for banks during the peak business season.

Given the unique nature of the insurance industry, with short-term insurance policies, the investment portfolios of non-life insurance companies are predominantly focused on deposits and bonds, accounting for over 80%; the remaining comprises stocks and real estate.

Consequently, apart from their core insurance business, the financial performance of these companies can be significantly influenced by their financial investments, particularly as they hold substantial amounts of deposits. Thus, the insurance sector is considered sensitive to commercial bank deposit rate decisions.

This sensitivity likely explains why the news of the central bank’s decision to relax credit limits for banks triggered a wave of bullish sentiment for insurance stocks in today’s trading session.

Market Beat: Telecoms Rebound, VN-Index Surges Over 8 Points

The market ended the session on a positive note, with the VN-Index climbing 8.35 points (0.67%) to reach 1,250.46, while the HNX-Index gained 1.07 points (0.48%), closing at 224.64. The market breadth tilted in favor of buyers, with 402 tickers advancing against 279 declining ticks. The VN30 basket painted a similar picture, as bulls dominated with 21 gainers, 6 losers, and 3 unchanged stocks, ending the day in the green.

Market Beat October 10th: Fading Momentum, VN-Index Climbs but Leaves Investors Wanting More

The VN-Index experienced an eventful trading session, starting on a positive note and even flirting with the 1,295-point mark. However, it gradually lost momentum during the afternoon session, unable to sustain the early gains. Despite the intraday volatility, the VN-Index continued its recovery trend, building on the positive movement seen in recent days.

The Market Beat: Where Does the Money Flow?

Today’s trading session ended with the VN-Index climbing over 1 point to 1,245.76, while the HNX-Index gained 0.4 points to reach 224.86. The market remains in an accumulation phase with low liquidity. The total trading value across the market barely surpassed 12 trillion dong, with more than 3 trillion dong coming from negotiated trades.

The Power of Foreign Capital: VN-Index Soars to 1250

The morning shake-up was quickly resolved as buying pressure forced prices higher and sellers jumped on board. The market didn’t correct, but instead continued its upward trajectory with extremely low liquidity. The VN-Index closed at a staggering 1250 points, with strong net buying of nearly VND 334 billion by foreign investors. FPT excelled, reaching a new historic peak, also fueled by foreign capital support.