As of December 31, 2024: A minimum of 35% of the specific additional provision amount must be allocated.

|

The classification of assets, the level of risk provisions, the method of provisioning, and the use of provisions to address risks associated with customer debts affected by Typhoon No. 3, as well as the resulting floods, landslides, and post-typhoon damage (hereinafter referred to as Typhoon No. 3), are decided as follows:

Asset Classification

Credit institutions and foreign bank branches are allowed to maintain the original debt group classification for debts that have had their principal and interest payment deadlines restructured according to the State Bank’s regulations on credit institutions (TCTD) and foreign bank branches restructuring payment deadlines for customers affected by Typhoon No. 3. This classification will be based on the group assigned according to the State Bank’s regulations on asset classification in the operations of TCTD as of September 7, 2024, during the restructured payment period.

The TCTD is not required to adjust or reclassify the debt group that has been maintained as current during the restructured period into a higher-risk group according to the State Bank’s regulations on asset classification in the operations of TCTD.

For debts that have been maintained as overdue during the restructured period and are not subject to further restructuring of payment deadlines or no longer have a restructured debt balance according to the State Bank’s regulations on TCTD restructuring payment deadlines for customers affected by Typhoon No. 3, the TCTD must classify the debts according to the regulations of the State Bank on asset classification in the operations of TCTD.

Level and Method of Risk Provisions

TCTDs shall make specific provisions for customers with debts that have been maintained in the original debt group as follows:

Based on the Government’s regulations on the level, method of provisioning, and the use of provisions to address risks in the operations of TCTDs, TCTDs shall make specific provisions for the total outstanding debt of customers based on the results of debt classification for debts that have been maintained in the original debt group and the results of debt classification for the remaining outstanding debt of customers according to the regulations of the State Bank on asset classification in the operations of TCTD.

Based on the Government’s regulations on the level, method of provisioning, and the use of provisions to address risks in the operations of TCTDs, TCTDs shall determine the specific amount of provisions to be made for the total outstanding debt of customers based on the results of debt classification according to the regulations of the State Bank on asset classification in the operations of TCTD, without applying the maintenance of the original debt group.

TCTDs shall determine the additional specific provision amount to be made by subtracting the specific provision amount already made from the specific provision amount to be made.

In the event that the additional specific provision amount to be made is determined to be positive, TCTDs shall make additional specific provisions as follows: By December 31, 2024: A minimum of 35% of the additional specific provision amount to be made.

By December 31, 2025: Additional provisioning to reach a minimum of 70% of the additional specific provision amount to be made.

For debts that have been restructured according to the regulations of the State Bank on TCTD restructuring payment deadlines for customers affected by Typhoon No. 3 before January 1, 2025, TCTDs shall make provisions in 2025 of at least the minimum ratio of 35%.

By December 31, 2026: Additional provisioning to reach 100% of the additional specific provision amount to be made.

For debts that have been restructured according to the regulations of the State Bank on TCTD restructuring payment deadlines for customers affected by Typhoon No. 3 before January 1, 2026, TCTDs shall make provisions in 2026 of at least the minimum ratio of 70%.

Based on the Government’s regulations on the level, method of provisioning, and the use of provisions to address risks in the operations of TCTDs, TCTDs shall make general provisions for the total outstanding debt of customers based on the results of debt classification determined according to the regulations of the State Bank on asset classification in the operations of TCTD, without applying the maintenance of the original debt group.

The decision also states: Regarding the use of provisions to address risks and the contents related to asset classification, the level of risk provisions, the method of provisioning, and the treatment of debts of customers affected by Typhoon No. 3 that are not mentioned in this Decision, TCTDs shall comply with the Government’s regulations on the level, method of provisioning, and the use of provisions to address risks in the operations of TCTDs and the regulations of the State Bank on asset classification in the operations of TCTD.

The Central Bank’s New Directive to Commercial Banks: Stabilize Deposit Rates, Lower Lending Rates

The State Bank (SBV) has requested that credit institutions maintain a stable and reasonable deposit interest rate, one that aligns with their capital balancing capabilities, healthy credit expansion, and risk management competencies. This move aims to contribute to the stability of the monetary market and interest rate environment.

The Art of Financial Flexibility: Central Bank’s Credit Extension

This adjustment was made amidst well-controlled inflation, falling below the target set by the Government and the National Assembly. The move was in line with the directives of the Government and the Prime Minister to manage the monetary policy flexibly, effectively, and promptly to meet the capital needs of the economy and support production and business development.

Which Banks Have Recently Been Granted Credit Limit Relaxation by the State Bank of Vietnam?

The State Bank has not disclosed the list of institutions that have been granted a relaxation in the foreign ownership limit. However, several banks had previously expressed their desire for an increase in this limit, hoping to attract more foreign investment.

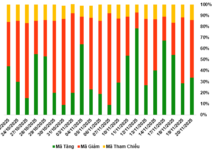

The Dark Cloud of Bad Debt

As per the latest data from the State Bank of Vietnam, the on-balance sheet bad debt ratio stood at 4.55% as of the end of Q3 2024, almost on par with the level at the end of 2023. In its recently updated report on the banking sector outlook, SSI Research noted that the bad debt ratios at state-owned and joint-stock commercial banks rose to 1.49% and 2.59%, respectively, in Q3 2024.