The practical plan was conceived in late 2023 when the IVS Board of Directors passed a resolution to approve the principle of offering additional shares in the ratio of 1:1 (shareholders owning 1 share will have 1 right, 1 right to buy 1 additional share issued).

In April 2024, the Company’s Board of Directors continued to issue a resolution to deploy the offering and approve the offering dossier. Two months later, the 2024 Annual General Meeting of Shareholders was held, in which the plan to increase capital was mentioned and approved as an important part of the orientation and solutions to implement the 2024 plan.

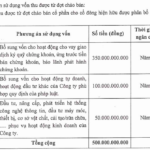

The proceeds from the offering will be used by the Company for three main purposes: supplementing capital for margin lending activities, expanding derivative product development, and supporting investment banking activities.

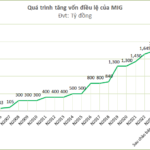

This is the second capital increase since October 2019 – at which time the Company was still known as Vietnam Investment Securities Joint Stock Company – successfully issued 35.35 million shares to strategic shareholders, Guotai Junan International Holding Limited, equivalent to 50.97% of charter capital and became the largest shareholder, officially joining the Vietnamese stock market.

| IVS’s owner’s equity over the years |

“The event of Guotai Junan International Holdings Limited acquiring IVS is of strategic importance to the Group’s internationalization and expansion in the Southeast Asian market, bringing in advanced international management concepts and supporting the strong development of the Vietnamese market. The restructuring process takes place in specific phases, with clear steps, to optimize operations and improve performance”, said Huang Bo, CEO of IVS in August 2024.

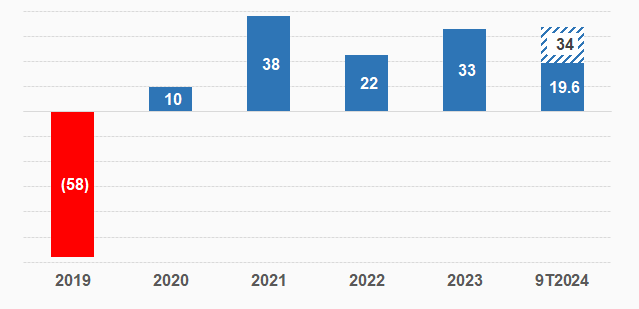

After the restructuring, IVS showed improvements in business performance, turning around from a loss of VND 58 billion in 2019 due to the sale of loss-making investments and provisioning for bad debts, to consecutive profits in subsequent years.

The Company reported a cumulative profit of more than VND 47 billion as of the end of Q3 2024, transforming from a cumulative loss of over VND 57 billion in 2019.

|

IVS continuously made profit before tax after restructuring

Unit: Billion VND

*2024 pre-tax profit plan is VND 34 billion. Source: VietstockFinance

|

“ASEANSC Offers 50 Million Shares to Boost Capital to VND 1,500 Billion”

AseanSc is proud to announce that it is seeking shareholder approval for a proposed sale of 50 million shares. This move is part of our ambitious plans to raise our capital to 1,500 billion VND. We are confident that this decision will drive our company’s growth and open up new avenues for expansion.

HSC Securities Approves Plan to Increase Charter Capital by VND 3.6 Trillion

On December 4, 2024, Ho Chi Minh City Securities Corporation (HSC) successfully held an Extraordinary General Meeting of Shareholders to approve a plan to issue shares to existing shareholders to raise its charter capital by VND 3,600 billion.