|

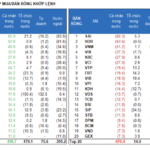

Supply Slows Down in October and November (Unit: VND billion)

Source: Author’s Compilation

|

Banks continue to be the most attractive sector, attracting a total of approximately VND 25 trillion, accounting for 70% of the total market value.

November witnessed the return of Vietcombank (HOSE: VCB) with a rare green bond offering in the market, valued at VND 2 trillion with a fixed interest rate of 4.9%/year. The bonds are of the three-non type (non-convertible, non-warrant, and unsecured) with a term extending to November 2026.

Techcombank (HOSE: TCB) also received an additional VND 3.7 trillion at an interest rate of 5%/year, unchanged for several months, thus further solidifying its top position in terms of issuance value with over VND 35 trillion.

Other significant issuers in November included ACB and HDB, raising VND 4.3 trillion and VND 4.6 trillion, respectively. ACB offered interest rates of 5-6%/year for tenors ranging from 2 to 5 years, while HDB provided a rate of 7.47%/year for 8-year bonds. Over the past 11 months, each of these banks has raised no less than VND 24 trillion.

The non-bank financial group remained consistent with the previous months’ participants, including F88 Business and MB Shinsei (Mcredit), raising VND 100 billion and VND 450 billion, respectively. Despite sharing a similar consumer lending model, F88 Business bore a higher interest rate of 10.5%/year for its bonds compared to MB Shinsei’s rate of 6.7%/year.

20-Year Bonds

November also witnessed notable bond offerings from water companies guaranteed by foreign organizations. For instance, Biwase – Long An Water’s VND 700 billion bonds, with a 10-year tenor and a fixed interest rate of 5.5%/year, were guaranteed by CGIF (Credit Guarantee and Investment Facility), a trust fund of the Asian Development Bank (ADB), with Maybank Securities Company Limited as the advisor.

Even more impressive was the offering from Hoa Binh – Xuan Mai Clean Water of Shark Lien, with a value of VND 875 billion and a tenor extending to 20 years. The fixed interest rate of 5.75%/year was made possible by the guarantee of GuarantCo, a multinational guarantee service company based in the African tax haven of Mauritius.

The Trend of Issuing Bonds to Refinance Debt

The year 2024 witnessed multiple bond issuances aimed at restructuring old debts. This move is not unusual for Investment Group I.P.A (HNX: IPA) as it continues to issue VND 600 billion to settle two loans from three years ago, which are now approaching their maturity dates.

Nam Long Investment (HOSE: NLG) raised an additional VND 1 trillion, intending to repurchase two bond lots from 2022 before their maturity. TTC Hospitality (TTC, HOSE: VNG) issued VND 500 billion to refinance old debt from two years ago.

Hoang Truc My, a real estate company founded by a 19-year-old individual to develop the Truc My Complex project in Binh Duong, attracted an additional VND 880 billion in bonds. Since the beginning of the year, this enterprise has raised VND 1,080 billion, with a consistent 5-year tenor and an interest rate of 12%/year.

|

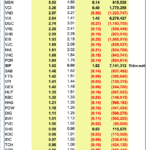

Corporate Bond Issuance Portfolio in November

|

Source: Author’s Compilation

|

SIP into VNM ETF, Adding Over 2.2 Million New Shares

In the Q4 2024 review, released in the early hours of December 14, 2024, MarketVector Indexes added just one stock, SIP, to the MarketVector Vietnam Local Index – the benchmark for the hundred-million-dollar VanEck Vectors Vietnam ETF (VNM ETF). Notably, no stocks were removed.

Is Investing in Gold, Real Estate or Stocks the Most Profitable?

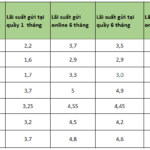

The year 2025 is set to be a period of significant change, but also a time of opportunity for investors to reap success. While real estate, stocks, bonds, and savings accounts remain the dominant investment avenues, a strategic capital allocation is key. Notably, gold is expected to be the least attractive investment option among these traditional avenues.

The Perils of Corporate Bonds Relying on Real Estate and Banking

The corporate bond market is heavily reliant on banking and real estate. Experts advocate for encouraging greater participation from foreign investors and financial institutions to diversify this market.