Illustration. (Source: Vietnam+)

|

Bitcoin is ending 2024 on a slightly sour note, with a near 5% decline in December, even as MicroStrategy continues to buy the dip.

However, as investors look ahead to 2025, historical market data suggests that January could be a bright spot for Bitcoin and the broader digital asset market.

According to data aggregated by Coinglass, Bitcoin has historically performed well in the first quarter. Specifically, Bitcoin prices in January have averaged a 3.35% increase since 2013 and surged nearly 57% in the first quarter of the years within the same period.

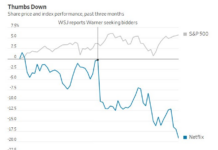

But Bitcoin isn’t the only asset ending the year on a challenging note. The broader market has been weak, with the absence of a “Santa rally” affecting stock markets as well. The Nasdaq 100 index is down about 5% since the last policy meeting of the US Federal Reserve (Fed) in mid-December.

Bitcoin has fared even worse, dropping about 15% during the same period. The “Santa rally” usually occurs during the last five trading days of the year and the first two days of January.

Nevertheless, according to Tom Lee of Fundstrat, a weak stock market at year-end does not necessarily portend a gloomy start to the next year. In fact, the data suggests the opposite.

Specifically, in years when the market has been weak in December, the following January has tended to be a month of recovery.

In the past week, only 18% of stocks on the NYSE rose, the lowest rate for the last three days of the year in 65 years.

Lee also points out that history since 1962 shows that years in which the stock market had few gainers at year-end tended to see the market perform quite well in January, with an average gain of about 5% and a 75% chance of rising.

In this case, the year-end weakness could signal a bright spot for the stock market in the new year. And this may hold true for Bitcoin as well.

This may explain why MicroStrategy continues to “buy the dip.” The company has just announced it purchased an additional $209 million worth of Bitcoin, bringing its total holdings to 446,400 Bitcoins, valued at nearly $42 billion.

Khanh Ly

– 13:19 31/12/2024

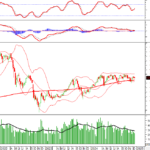

The Cautious Sentiment Rises

The VN-Index witnessed a negative trading session with a decline in trading volume below the 20-day average. This indicates a resurgence of cautious sentiment among investors. However, it’s important to note that the index is currently sitting above the Middle Bollinger Band. If the index manages to hold its ground above this level in the upcoming sessions and the MACD indicator continues to flash a buy signal, the situation may not be as pessimistic as it seems.

Stock Market Week of 12/16/2024 – 12/20/2024: A Prevailing Mood of Caution

The VN-Index edged higher last week, with alternating sessions of gains and losses. While the index inched up, the trading volume fell below the 20-day average, indicating that investors remain cautious. Moreover, foreign investors’ continued net selling streak suggests that the short-term outlook for the market is still not optimistic.

Vietstock Weekly: Navigating Short-Term Risks

The VN-Index ended a rather pessimistic trading week as it continued to lose points and fell below the Middle Bollinger Band. The decline was accompanied by a drop in trading volume below the 20-week average, indicating limited participation of funds in the market. Currently, the MACD indicator is poised to give a sell signal as it narrows its gap with the Signal Line. Should this occur in the coming period, the index’s situation will turn even more negative.