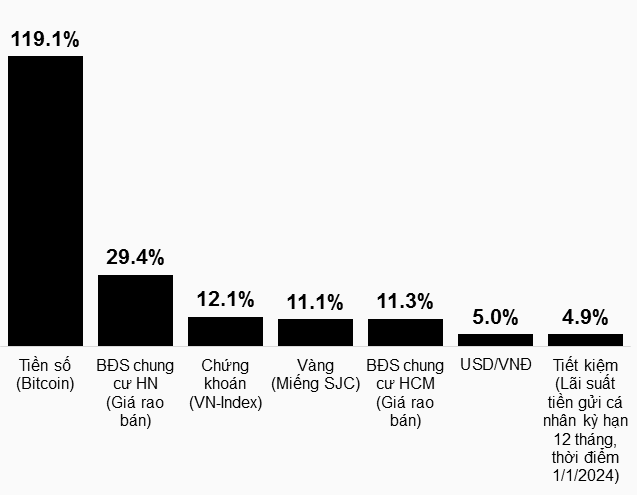

Bitcoin – the largest cryptocurrency by market cap – soared by over 119% in the past year, marking its second consecutive year of strong gains.

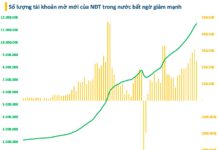

Despite digital assets not being legally recognized, Vietnam ranks second in the world for cryptocurrency ownership, surpassing the US and only behind the UAE.

To put the popularity of digital assets in Vietnam into perspective, by the end of 2023, Vietnamese citizens had opened 21 million cryptocurrency trading accounts, while the number of securities trading accounts was only around 9 million at the end of 2024.

|

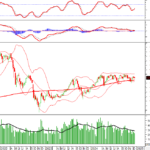

Bitcoin Surges

The currency created by Satoshi Nakamoto surged in 2023-2024, after falling nearly 80% from its peak in 2021-2022 Source: Trading Economics

|

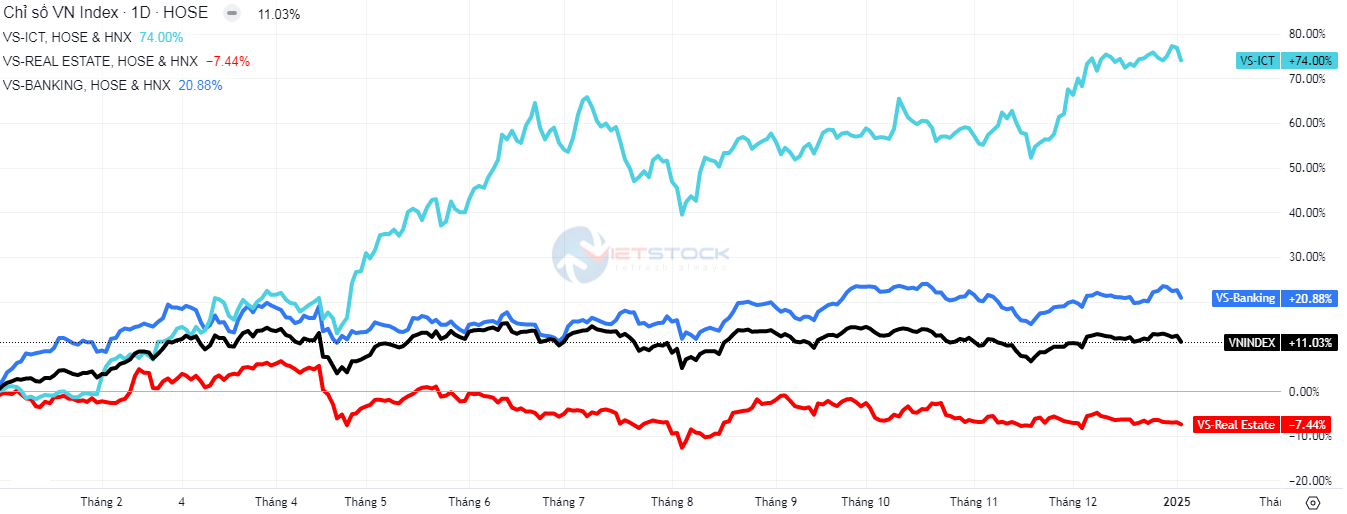

For the stock investment channel, the representative index VN-Index increased by 12.1% in the past year. However, as Vietnam does not have an exchange-traded fund (ETF) that mimics the entire market, investors mainly pour their money into individual stocks or entrust it to funds.

As such, there is always a significant performance differentiation when market participants choose different sectors and stocks. In 2024, while real estate stocks were stagnant and held back the VN-Index, banking stocks recorded quite attractive returns, and the technology stocks group led by FPT saw impressive price increases.

The FPT ticker surged by up to 84%, contributing 27 points out of nearly 137 additional points of the VN-Index in 2024. The technology company founded by Mr. Truong Gia Binh has thus become the largest private company in Vietnam by market capitalization, with a value of approximately VND 224 trillion, ranking only behind the state-owned group including Vietcombank, ACV, BIDV.

|

Tech Stocks Boom

– VN-Index double-digit increase still largely driven by the banking sector – The tech sector accounts for a relatively low proportion of the total market capitalization of stocks Data from 01/01/2024-04/01/2025 – Source: VietstockFinance

|

Unlike the gloom in real estate stocks, apartment prices in Hanoi surged in the first half of 2024. The short-term price change is attributed to scarce supply due to the lack of new projects, as well as the launch of some luxury apartment projects that have pushed the psychology of accepting higher price levels for existing projects. In addition, at some points, there were suspicions of price manipulation by teams, causing the market to become even “hotter.”

Experts believe that apartment prices in major cities like Hanoi and Ho Chi Minh City will continue to rise due to the ongoing trend of migration to these economic centers. However, prices are unlikely to surge as they did before.

|

2024: The Year of Digital Assets

– Bitcoin surges as cryptocurrencies gain wider acceptance globally, especially after Donald Trump’s election as US President – In the domestic context, real estate is the most effective traditional investment channel (using the reference measure of advertised apartment prices in the two major cities) 2024 Data. Source: VietstockFinance, CoinMarketCap, Batdongsan.com.vn, Investing.com, SJC* (buy price of gold bars on 01/01 – sell price on 31/12)

|

According to the author’s statistics, savings deposits are the lowest-yielding form, due to the stable and safe nature of this channel. The interest rate level has also been oriented by the management agency to decrease and maintain at a low level to support the economy over the past two years.

Meanwhile, although USD strengthened in the global market in 2024, holding the greenback did not bring different financial effectiveness compared to depositing VND in banks. This is mainly due to the State Bank’s policy of stabilizing the USD/VND exchange rate.

While it is difficult to build wealth based on bank interest rates, savings deposits remain a suitable choice for those who are not capable of making complex investment decisions and do not want to entrust their asset management to a third party.

At the very least, savings deposits help preserve the value of money compared to inflation, avoid the risks associated with participating in highly volatile markets, and require certain knowledge and skills to generate profits.

Note that in Vietnam, most individuals participating in the stock market lose money in the long run.

Similarly, in the digital asset channel, the joy is not shared by all, even though Bitcoin – accounting for about 56% of the total market capitalization of crypto – has surged. A report from Coin68 (surveying about 2,750 people) reveals that nearly 44% of crypto traders lost money in 2024, right in the context of Bitcoin’s 119% rise.

– 08:42 09/01/2025

The Cautious Sentiment Rises

The VN-Index witnessed a negative trading session with a decline in trading volume below the 20-day average. This indicates a resurgence of cautious sentiment among investors. However, it’s important to note that the index is currently sitting above the Middle Bollinger Band. If the index manages to hold its ground above this level in the upcoming sessions and the MACD indicator continues to flash a buy signal, the situation may not be as pessimistic as it seems.

Stock Market Week of 12/16/2024 – 12/20/2024: A Prevailing Mood of Caution

The VN-Index edged higher last week, with alternating sessions of gains and losses. While the index inched up, the trading volume fell below the 20-day average, indicating that investors remain cautious. Moreover, foreign investors’ continued net selling streak suggests that the short-term outlook for the market is still not optimistic.

Vietstock Weekly: Navigating Short-Term Risks

The VN-Index ended a rather pessimistic trading week as it continued to lose points and fell below the Middle Bollinger Band. The decline was accompanied by a drop in trading volume below the 20-week average, indicating limited participation of funds in the market. Currently, the MACD indicator is poised to give a sell signal as it narrows its gap with the Signal Line. Should this occur in the coming period, the index’s situation will turn even more negative.