VnDirect Securities has released its outlook on Vietnam’s macroeconomic and commodity market outlook for 2025. The firm expresses optimism for gold, while anticipating challenges for oil and iron ore in the coming year.

Gold witnessed a strong rally in 2024, and VnDirect expects this momentum to continue into 2025. Goldman Sachs predicts gold prices to reach $3,000 per ounce by the end of the year, driven by anticipated Fed rate cuts, uncertainty surrounding Trump’s policies, and increased central bank demand, with China significantly increasing its gold reserves since 2022, according to the IMF.

Interestingly, while gold prices have historically had an inverse correlation with the DXY, both gold and the DXY surged simultaneously in 2024.

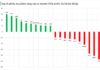

For Brent crude oil, the World Bank forecasts a moderate price of $79 per barrel in 2025 due to the partial removal of OPEC+ production cuts and increasing output from non-OPEC+ countries. VnDirect anticipates Brent crude oil prices to range between $70 and $75 per barrel in 2025, lower than the average of ~$80 per barrel in 2023 and 2024. This is mainly due to expectations that the US administration will pursue policies encouraging increased oil and gas production in the US, potentially putting downward pressure on global oil prices.

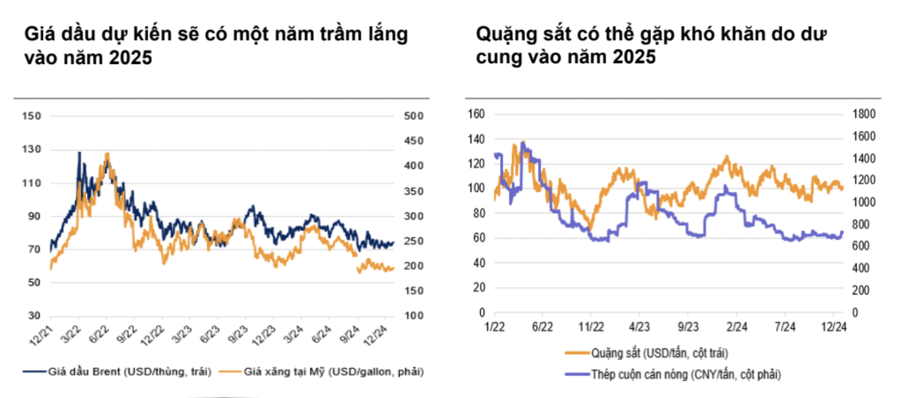

Iron ore prices, on the other hand, plummeted by 25% in 2024, making it one of the worst-performing commodities. Goldman Sachs predicts iron ore prices to fall below $100 per ton in 2025 due to increased supply from Rio Tinto’s $34 billion African project, exacerbating the current oversupply situation; weakening steel demand due to US tariffs; and rising inventory levels at Chinese ports.

On the economic front, VnDirect has upgraded its GDP growth forecast for Vietnam to 7.3% from 6.6% previously, citing increased optimism about public investment and reduced concerns over the impact of US tariffs on Vietnamese exports.

Vietnam has set ambitious economic growth targets for 2025, including a National Assembly target of 6.5%-7.0% and a more aspirational target of 7.0%-7.5%. For the 2026-2030 period, the government aims for a GDP growth rate of 7.5%-8.5% per year.

VnDirect expects the Vietnamese economy to maintain its high growth trajectory in 2025 and has upgraded its GDP growth forecast to 7.3%. Other factors supporting this growth include gradually improving domestic consumption as inflationary pressures ease and the labor market improves; and a recovery in the real estate market and private investment due to the implementation of the amended Land Law and improved business environment through government reforms.

Regarding the three main pillars of the economy, VnDirect anticipates stable growth in the industry and construction sector of 8.3% in 2025, driven by export growth and increased public investment. Meanwhile, the remaining two pillars may exhibit stronger expansion, with the services sector growing by 7.8% in 2025 and the agriculture, forestry, and fishery sector increasing by 3.6%.

Vietnam is gradually moving towards achieving an investment-grade sovereign credit rating. Currently, Vietnam is rated one notch below investment grade by two agencies (Fitch Ratings and S&P) and two notches below by Moody’s.

The Vietnamese government aims to attain investment-grade status by 2030, and VnDirect believes this milestone could be achieved sooner. This is crucial for realizing the country’s ambitious transportation and energy infrastructure plans in the next decade, including major projects such as the North-South high-speed railway, a high-speed railway connecting with China, the North-South West Highway, and metro systems in Hanoi and Ho Chi Minh City.

Achieving investment-grade status will enable the Vietnamese government and businesses to access international capital more easily and at lower costs. It is estimated that this could reduce international borrowing costs by 2.0-2.5 percentage points.

To attain an investment-grade rating, Vietnam needs to continue improving transparency, corporate governance, and further strengthen its banking sector. “Achieving investment-grade status will enable Vietnam to materialize its ambitious investment plans for economic infrastructure, including highways, railways, and energy infrastructure, in the coming decades,” VnDirect emphasized.