I. MARKET ANALYSIS OF THE STOCK MARKET BASED ON JANUARY 23, 2025

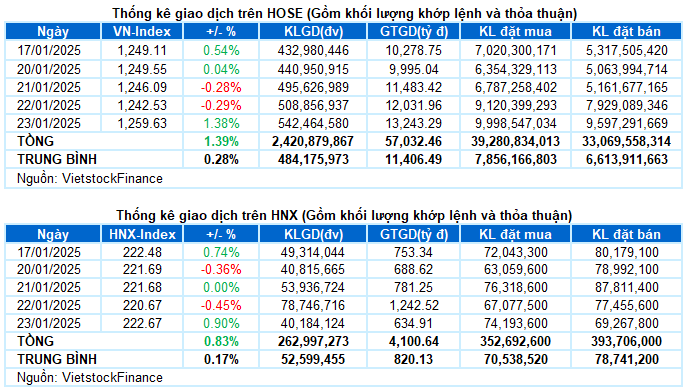

– The main indices surged during the trading session on January 23, with the VN-Index closing 1.38% higher at 1,259.63 points, and the HNX-Index increasing by 0.9% to reach 222.67 points.

– The trading volume on the HOSE exceeded 495 million units, a 23.8% increase compared to the previous session. Meanwhile, the trading volume on the HNX slightly decreased by 3.5%, reaching nearly 38 million units.

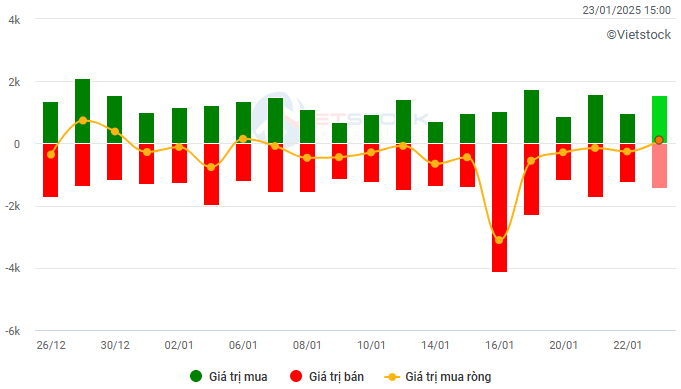

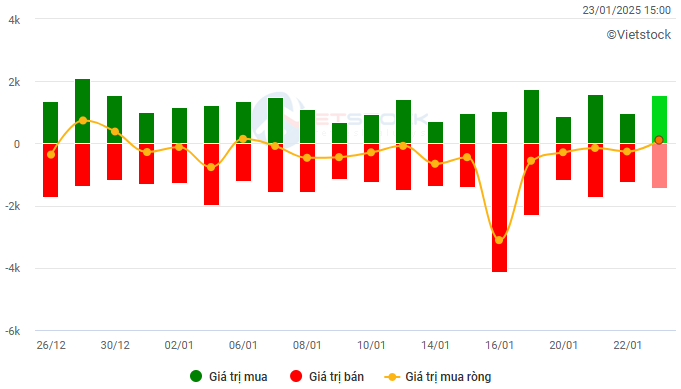

– Foreign investors returned to net buying on the HOSE with a value of nearly VND 86 billion and net bought more than VND 14 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

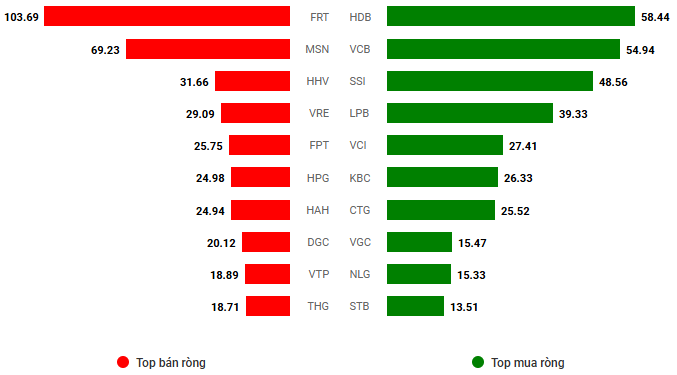

Net trading value by stock code. Unit: VND billion

– The trading session on January 23 unexpectedly witnessed a strong breakthrough in the market after a series of lackluster trading days. The VN-Index soared from the beginning of the session, thanks to the strong pull from the group of pillar stocks, and the green color spread across all sectors. Notably, the uptrend was accompanied by improved liquidity and foreign investors also stopped net selling, indicating a clear consolidation of market psychology. The VN-Index ended the session with more than 17 points increase, advancing to the 1,259.63-point threshold.

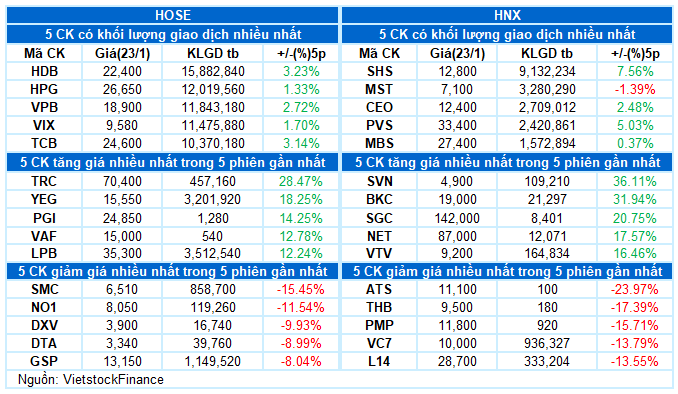

– In terms of impact, the top 10 stocks that contributed the most to the VN-Index‘s gain were VCB (1.7 points), FPT (1.6 points), and LPB (1.4 points). Meanwhile, there were no notable names on the opposite side, indicating a complete dominance of buyers.

– The pillar group led the breakthrough today, with the VN30-Index increasing by nearly 23 points compared to the previous session, reaching 1,332.54 points. The breadth was entirely in favor of buyers, with 26 codes increasing and 4 codes being referenced, and no codes decreased in price. More than half of the stocks rose by more than 1%. FPT, MWG, SSI, and VPB stood out the most with an increase of 3% or more.

All sectors closed with vibrant green colors, except for the telecommunications group, which adjusted after a positive previous increase, typically VGI (-0.98%), CTR (-0.3%), YEG (-3.72%), FOX (-2.06%), and FOC (-2.43%).

Meanwhile, the standout performance of FPT (+3.07%) and CMG (+2.37%) helped the information technology group increase by 3%, leading the market in today’s explosive session. Next was the financial group, which contributed the most to the general index due to its large capitalization. Stocks that surged with high liquidity included VPB, TCB, HDB, LPB, MBB, VIB, CTG, SSI, VCI, SHS, VND, etc. In addition, three other sectors also recorded an increase of more than 1%, including materials, non-essential consumer goods, and industry.

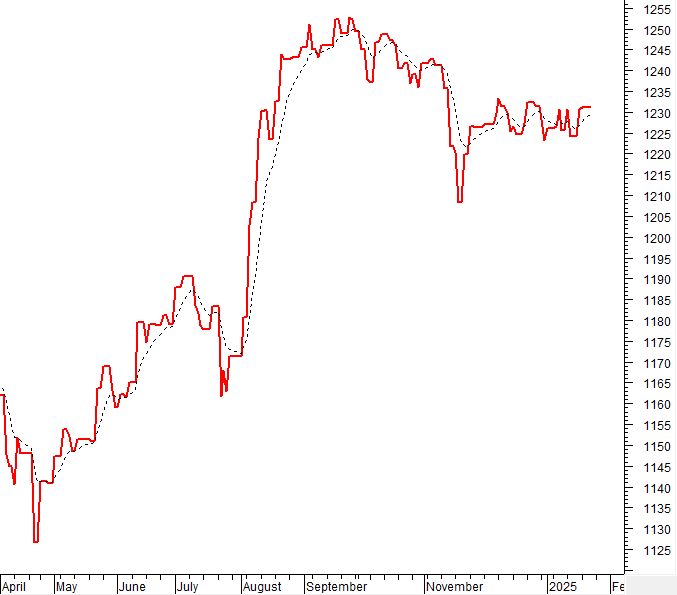

VN-Index surged with more than 17 points and simultaneously surpassed the SMA 200-day threshold. Moreover, the trading volume was above the 20-day average, indicating the return of active capital participation. Currently, the Stochastic Oscillator indicator is giving a buying signal, and MACD also appears to be similar after cutting above the Signal Line. If this state is maintained in the coming time, the situation will become even more optimistic.

II. TREND AND PRICE FLUCTUATION ANALYSIS

VN-Index – Surpassing the SMA 200-day threshold

VN-Index surged with more than 17 points and simultaneously surpassed the SMA 200-day threshold. Moreover, the trading volume was above the 20-day average, indicating the return of active capital participation.

At the moment, the Stochastic Oscillator indicator is giving a buying signal, and MACD also appears to be similar after cutting above the Signal Line. If this state is maintained in the coming time, the situation will become even more optimistic.

HNX-Index – MACD indicator gives a buying signal again

HNX-Index increased well and halted the consecutive downward trend. However, the trading volume needs to surpass the 20-day average to maintain optimism.

Currently, the Stochastic Oscillator indicator gives a buying signal, accompanied by MACD, which has just appeared with a similar signal. If this state is maintained, the short-term optimistic outlook will be sustained.

Analysis of Capital Flows

Fluctuation of Smart Money Flows: The Negative Volume Index indicator of VN-Index cut above the EMA 20-day line. If this state continues in the next session, the risk of an unexpected decline (thrust down) will be limited.

Fluctuation of Capital Flows from Foreign Investors: Foreign investors returned to net buying in the trading session on January 23, 2025. If foreign investors maintain this action in the coming sessions, the situation will become more optimistic.

III. MARKET STATISTICS ON JANUARY 23, 2025

Department of Economic Analysis & Market Strategy, Vietstock Consulting

– 17:09 23/01/2025

The Ultimate Headline:

“Vietstock Daily: Halting the Uptrend”

The VN-Index stalled its upward trajectory with a sharp decline, dipping below the 200-day SMA. If, in upcoming sessions, the index falls below the Middle Band of the Bollinger Bands, the outlook turns decidedly bearish. However, the Stochastic Oscillator remains in bullish territory, and the MACD mirrors this sentiment, even hinting at a potential rise above the zero threshold. Should this materialize, it would alleviate the short-term downside risk.

The Market Beat: Foreigners Buy for Two Straight Sessions, VN-Index Responds Positively

The market ended the session on a positive note, with the VN-Index climbing 5.42 points (+0.43%) to reach 1,265.05, while the HNX-Index gained 0.34 points (+0.15%), closing at 223.01. The market breadth tilted in favor of advancers, with 432 tickers in the green and 301 in the red. The large-cap sector mirrored the broader market’s sentiment, as evidenced by the VN30 basket, which saw 20 constituents advance, 5 decline, and 5 remain unchanged, resulting in a sea of green.

The Power of Positive Thinking

The VN-Index surged after a period of consolidation around the 200-day SMA. Accompanied by a solid trading volume above the 20-day average, this indicates a positive shift in market sentiment. The Stochastic Oscillator and MACD are both generating buy signals, with the latter crossing above zero, suggesting a further boost to the already optimistic short-term outlook.

The Ultimate Trader’s Journal: Aiming for the December 2024 Peak

The VN-Index extended its upward momentum from the previous session, with trading volume surpassing the 20-day average. A more robust participation of funds in the upcoming sessions could propel the index towards its old peak of December 2024 (1,270-1,280 points). The Stochastic Oscillator and MACD indicators remain bullish, suggesting continued optimism in the short term.