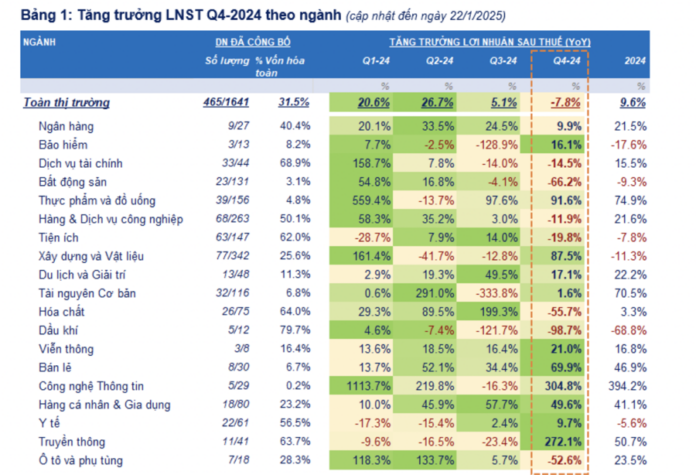

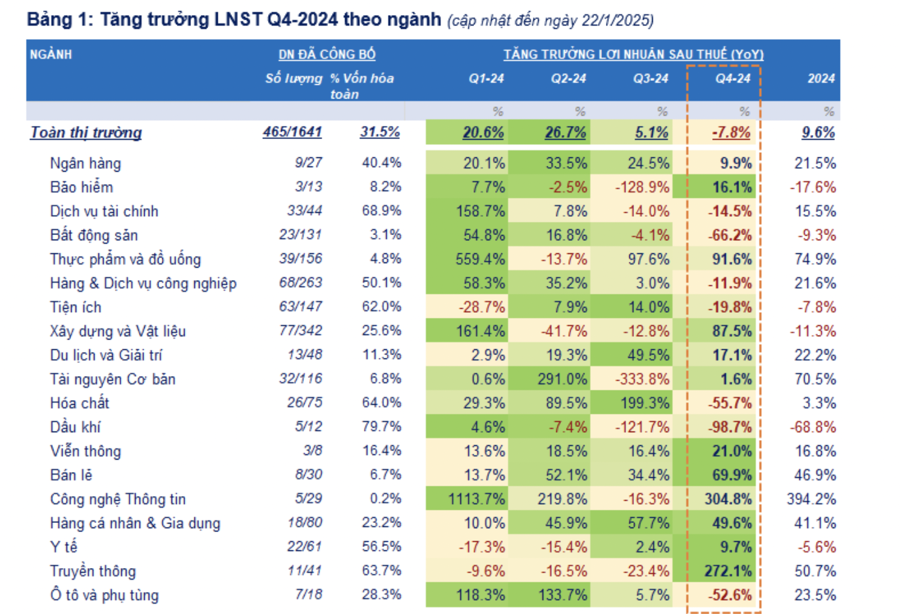

As of January 22, 2025, 465 listed companies, representing 31.5% of the total market capitalization, have announced official or preliminary Q4 2024 financial results. However, the profit picture is less than positive, with nearly half of these companies reporting a decline compared to the same period last year, according to FiinTrade statistics.

The notable decline in profits was seen in the Securities, Oil and Gas, and Chemicals sectors, which is not surprising as these industries are not highly regarded for their short-term profit prospects.

Banks experienced a slowdown in profit growth. Out of the 9 banks that announced their Q4 financial results, BID, STB, and TPB reported high profit growth compared to the previous year. In contrast, TCB’s profit after tax decreased by 23.7% due to a drop in fee income from the LC and UPAS LC segments in the context of high USD interest rates and Banca fee income as TCB transitioned to a new partnership model.

Construction & Materials, led by Viglacera (VGC), saw a turnaround in profits, shifting from a decline to significant growth. Starting as a manufacturer of tiles and ceramics, VGC’s Q4 profit surge of 1226.5% was driven by its industrial park business segment.

The Retail group accelerated profits, with SAS growing by 156.7% and PET by 40.3%. While none of the top three companies in the industry, MWG, FRT, and DGW, have provided Q4 earnings estimates, this sector is expected to achieve high growth in Q4 due to very low year-over-year comparisons and a recovery trend in consumer demand, albeit at a relatively slow pace.

Previously, MBS Securities forecasted a remarkable 25% year-over-year profit growth for the overall market in Q4/2024, the highest since Q2/2022, supported by low-interest rates and a recovering production sector.

Consequently, the full-year 2024 profits are expected to increase by 18% compared to 2023, marking a period of recovery and the beginning of growth. This prediction contrasts the 4% decline recorded in 2023.

Banking industry profits are forecast to grow by 15% year-over-year, leading the market. Notable profit growth sectors include Real Estate (+1005%), Aviation (591%), and Retail (+162%) from a low base. The steel industry is also expected to see decent profit growth.

The Profit Update for Q4 2024: A Market Surge with Real Estate Leading the Charge

In Q4 2024, the market’s after-tax profit rose by 20.9% year-over-year, marking the fourth consecutive quarter of steady growth. Several industries witnessed remarkable growth spurts during this period, notably Real Estate and Retail, which significantly contributed to the overall positive performance.

Petrovietnam’s Make-or-Break Year: 2025

In 2025, the Prime Minister called upon Petrovietnam to be a pioneer in accelerating and breaking through, aiming for double-digit growth.

State-Owned Refinery to Join $2 Billion Capitalized Group, Joining Ranks with Hoa Phat Dung Quat, MB, and Vietinbank

Among the 19 businesses with a charter capital of over $2 billion, there is a diverse mix of ownership structures. This includes 9 state-owned enterprises, showcasing the strong presence of the public sector, alongside 4 foreign-invested companies, and 6 private enterprises, each bringing their unique contributions to the table.

Trump’s Tough Talk Leaves EU in a Bind: “Buy More American Energy or Face Higher Tariffs”

Former US President Donald Trump has threatened to impose tariffs on the European Union if its member states do not increase their purchases of American oil and natural gas. In a characteristic display of his aggressive trade policy approach, Trump is demanding that the EU boost its imports of US energy resources or face economic consequences. This bold ultimatum underscores Trump’s unwavering commitment to protecting and promoting American economic interests on the global stage.