President Donald Trump Announces New Tariffs at the White House on April 2nd (Photo: AFP)

On April 2nd, President Trump announced a 10% tariff on all imports from all countries, effective April 5th, 2025. In addition, the US will impose reciprocal taxes, effective April 9th, on goods from countries with which the US has a significant trade deficit, excluding certain products vital to US economic and national security. Vietnam is among the group of countries facing the highest tariffs, at 46%.

According to Vietcombank Securities (VCBS), the new tax rates (including the 10% tariff for all countries and the reciprocal taxes for individual countries) are higher than market expectations and the predictions of most market participants. When the executive order was announced, the market reacted quite strongly and negatively to the news. However, these tax rates are expected to change after the upcoming negotiations. VCBS believes that Vietnam’s proven flexible diplomacy will lead to positive developments in the negotiations.

Regarding the impact of US tariff policies on Vietnam’s inflation, VCBS maintains the view that inflation remains within the government’s targets and control. This provides a basis and flexibility for the State Bank to harmoniously utilize its management tools.

The analysis group argues that while domestic consumer demand is recovering well, it is not strong enough to put pressure on inflation. Moreover, Vietnam has always been self-sufficient in food, and the supply of essential goods and services is guaranteed. The government also has tools and has demonstrated its determination to stabilize prices, such as ensuring a roadmap for price adjustments for some public goods and essential services. If there is inflationary pressure, it may be recorded at the end of the year and the beginning of next year due to the low base effect of the previous year.

On exchange rates, VCBS states that in the context of uncertainties and pending final decisions on tariff policies, exchange rates will fluctuate more in the short term. Concerns about tariff risks could slow down foreign investment registration and disbursement. In addition, export activities, especially to the US market, may slow down and even suffer losses. Meanwhile, Vietnam’s foreign exchange reserves are currently quite limited.

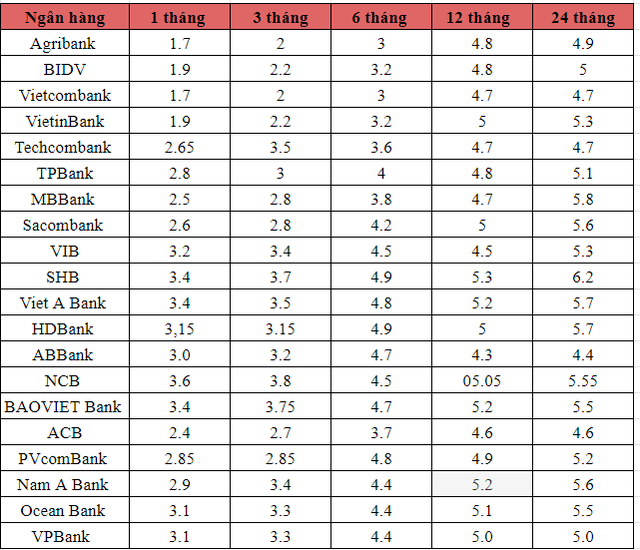

Given the pressure on exchange rates and the absence of a final decision on tariffs on Vietnamese goods, the operating interest rates are expected to continue to facilitate growth support. Specifically, deposit interest rates are guaranteed to be stable, and lending interest rates are maintained at low levels to support businesses. However, lending rates still vary among industries, enterprises, and risk appetites among commercial banks. Furthermore, VCBS also expects monetary policy to be conducted in a direction that facilitates the achievement of growth targets and the development of domestic factors.

In the short term, especially during the wait for information on final tariff decisions, VCBS draws particular attention to the potential pressure on exchange rates. Nevertheless, the analysis group remains optimistic about the possibility of conducting monetary policy in a direction that facilitates business support and sustainable growth objectives.

Additionally, VCBS also highlights Vietnam’s internal factors. Alongside the ongoing negotiations and discussions, the Vietnamese government will continue to focus on strengthening the country’s internal growth drivers, including boosting public investment and promoting consumer demand and services, all aimed at achieving sustainable growth in the upcoming period.

Specifically for the banking sector, VCBS believes that banks will be indirectly affected as the income of related businesses decreases, impacting debt repayment capacity and credit demand. However, the impact is not significant, as export loans account for only over 5% of the total system’s outstanding loans, and FDI loans account for about 2%.

Consequently, state-owned banks with large outstanding export and FDI loans, such as Vietcombank, VietinBank, and BIDV, will be impacted. Some banks focusing on approaching FDI businesses, like VPBank, Techcombank, and MB, may also face short-term challenges in expanding credit in this segment.

Title: UOB: SBV May Cut Policy Rates to COVID-19 Lows if Economic Conditions Deteriorate, USD/VND Forecast to Rise to 27,200

According to UOB, the risk trend is tilting towards the SBV cutting interest rates, due to the downward pressure on business and exports, with the potential shock of the 46% tax from the US on the Vietnamese economy.

The Stock Market Wrestler: How Mai Phương Thúy Turned a Tidy Profit of 1.5 Billion VND Overnight by Grappling with Billionaire Trần Đình Long’s Shares.

Yesterday, former Miss Vietnam Mai Phương Thúy took to Facebook to share her recent investment move. In her post, she revealed that she had purchased one million shares of Hoa Phat Group (HPG) at the floor price. Her exact words were: “Struggled all day just to buy one million HPG shares at the floor price.”

The Masan Consumer Chairman’s Open Letter: Unveiling US Revenue and Strategies to Navigate Potential Tariff Scenarios

According to Mr. Quang, the proposed US tariffs will have a negligible impact on Masan’s business operations and prospects.