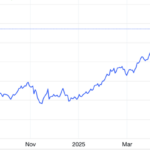

Global gold prices surged during the overnight session on June 12 amid escalating tensions in the Middle East, and continued to rally above the $3,400/oz mark in the morning session of June 13 following news of an Israeli airstrike on Iran. Additionally, statistical data continued to indicate weaker-than-expected inflation in the US, bolstering expectations of a rate cut and supporting the rise in gold prices.

At 8:45 am Vietnam time, gold spot prices in the Asian market surged by over $40/oz compared to the previous close in the US, equivalent to a rise of more than 1.2%, trading at $3,426.1/oz according to Kitco data. Converted at Vietcombank’s selling exchange rate, this price is equivalent to approximately VND 108.2 million/troy ounce, an increase of VND 1.6 million/troy ounce from the previous day.

At the same time, Vietcombank quoted the USD at VND 25,820 (buying) and VND 26,210 (selling).

In the New York session on Thursday, gold spot prices settled at $3,386.1/oz, up $30.5/oz or 0.9% from the previous close. On COMEX, gold futures rose 2% to close at $3,410.7/oz.

Risk aversion is on the rise as geopolitical tensions flare up in the Middle East. Israel conducted an airstrike on Iran in the early hours of Friday local time, and Israel’s Minister of Defense, Katz, declared a special state of emergency across the nation.

“Following Israel’s preemptive strike on Iran, a retaliatory attack on Israel using missiles and drones is likely imminent,” Katz said, as quoted by the Associated Press.

Previously, tensions in the Middle East had fueled safe-haven demand for gold during the sessions on Wednesday and Thursday, as US President Donald Trump expressed his diminishing faith in the possibility of a nuclear deal with Iran.

On Thursday, Trump stated that the US was moving some personnel out of the Middle East as it “could be a very dangerous place.” Iran’s Defense Minister, Aziz Nasirzadeh, warned on Wednesday that if targeted, Iran would retaliate by targeting US bases in the region.

Moreover, gold prices were bolstered by expectations of an early interest rate cut by the US Federal Reserve (Fed).

The report released by the US Department of Labor on Thursday showed that the Producer Price Index (PPI) for May rose 0.1% from the previous month, following a 0.2% decline in April. In a previous Dow Jones survey, economists had forecast a 0.2% increase in PPI for May. On Wednesday, another inflation indicator, the Consumer Price Index (CPI), also showed a smaller-than-expected increase. These data suggest that tariffs have not yet pushed up inflation in the US, and the case for a Fed rate cut has strengthened.

In the interest rate futures market, traders are betting on an 80% chance of a Fed rate cut in the September meeting, with a second cut expected in October instead of December as previously forecasted before the PPI report.

“Gold prices continue to surge amid heightened geopolitical risks. Once above the $3,400/oz level, gold prices may encounter minor resistance at $3,417 and $3,431/oz, but are poised for a strong breakout to new record highs,” said Peter Grant, strategist at Zaner Metals, in a Reuters report.

The US dollar weakened significantly during the Thursday session, with the Dollar Index settling at 97.92, down 0.6% from the previous close of 98.5, according to MarketWatch data.

After two consecutive sessions of net selling, the world’s largest gold ETF, SPDR Gold Trust, resumed net buying on Thursday. The fund purchased 3.7 tons of gold, increasing its holdings to 937.5 tons.

The Ultimate Guide to Investing: Oil Surges to 2-Month High, Gold Shines, Sugar Plunges to Near 4-Year Low

As of the market close on June 11, 2025, oil prices surged over 4% to a two-month high amid escalating Middle East tensions. Gold prices maintained their upward trajectory, buoyed by lower-than-expected US inflation data and expectations of an early Fed rate cut. Copper prices, however, took a hit due to concerns over Chinese demand and protracted trade tensions. Raw sugar plunged to a near four-year low, while coffee prices also witnessed a decline.

Gold Surges as US CPI Falls Short of Expectations

The demand for gold as a safe-haven asset remains strong, according to analysts. This is due to the unpredictable nature of US trade policies and the escalating geopolitical tensions in the Middle East. Gold has traditionally been seen as a hedge against economic and political uncertainty, and it appears that investors are still seeking this precious metal as a means of protecting their wealth. With the potential for further volatility in the global markets, it seems that gold’s allure as a safe investment is here to stay.

“Markets on June 10th: Oil Surges to Multi-Week Highs, Gold Slightly Up”

As of the market close on June 9th, 2025, oil prices surged to their highest levels in weeks, while gold and copper prices also rose, buoyed by hopes of a potential US-China trade deal.

The Energy Market on June 7: Oil Prices Continue to Surge, Gold Plunges Over 1%

The energy complex continued its upward trajectory on June 6th, with oil prices extending gains. Silver shone brightly, surging to a 13-year high, while platinum reached a 3-year peak. However, gold suffered a sharp decline, dropping over 1%. Raw sugar prices remained subdued, languishing at a 4-year low.