Golden Gate Joint Stock Group has just announced the agenda for its upcoming 2025 Annual General Meeting of Shareholders, which includes several important matters.

The meeting is scheduled to take place at 9:30 am on June 30, 2025, at the company’s representative office (6th Floor, 315 Truong Chinh, Khuong Mai Ward, Thanh Xuan District, Hanoi City).

The Board of Directors of Golden Gate will present to the shareholders the 2024 business results and the 2025 business plan, the report on the activities of the Board of Directors for 2024, the company’s separate and consolidated audited financial statements for 2024, and the proposal to appoint an independent audit firm for the 2025 financial year. Shareholders will also have the opportunity to ask questions and discuss other relevant matters.

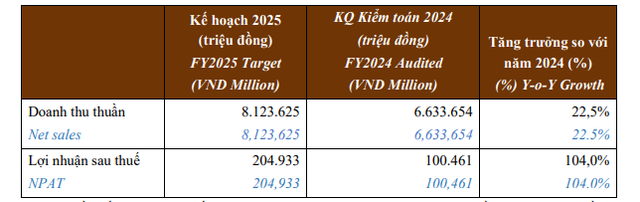

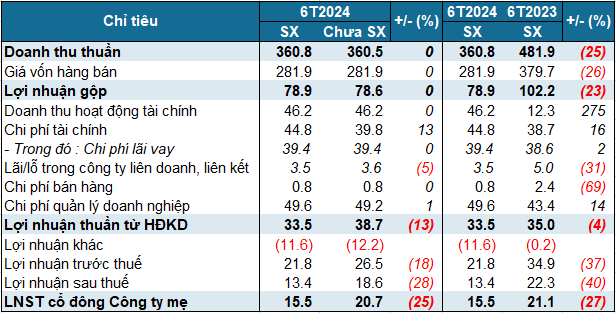

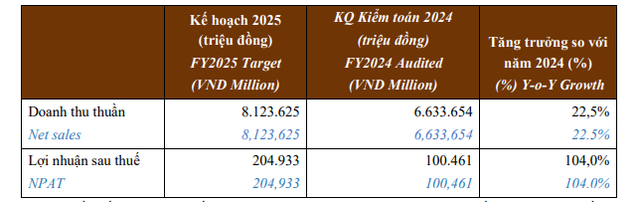

According to the documents, in 2024, the company achieved total net revenue of VND 6,634 billion, a 5.5% increase compared to the previous year. However, net profit decreased from VND 139 billion to VND 100 billion, a 27.7% drop. These results fell short of the targets set by the Annual General Meeting of Shareholders, achieving only 93.9% and 62% of the revenue and profit plans, respectively.

The Board of Directors has proposed a business plan for 2025, aiming for VND 8,124 billion in net revenue and VND 205 billion in after-tax profit. This plan will be presented to the shareholders for approval during the meeting.

Source: Golden Gate

Notably, in 2025, the company plans to focus on the core operations of its restaurants to lay a solid foundation for its future breakthrough growth. To ensure optimal resources, capital concentration is crucial. Therefore, the Board of Directors proposes to the shareholders to approve the decision to not distribute cash dividends for the year 2025.

In another development, on January 8, 2025, Golden Gate completed the acquisition of 99.98% of the shares of Vietnam Tea and Coffee Trading Services Joint Stock Company (the entity operating the The Coffee House chain) for a temporary fee of VND 270 billion, according to Golden Gate’s 2024 consolidated financial statements.

As a result, Vietnam Tea and Coffee Trading Services Joint Stock Company has become a subsidiary of Golden Gate, meaning that The Coffee House has joined the Golden Gate family, alongside brands such as Gogi, Kichi-Kichi, Ashima, Hutong, and Isushi.

Following this acquisition, there was a change in leadership at the company operating the The Coffee House chain.

As of January 9, 2025, Mr. Tran Viet Trung (DOB: 1963) took over as General Director and legal representative of the company, replacing Mr. Ngo Nguyen Kha.

Mr. Tran Viet Trung is known as the Chairman of the Board of Directors and one of the founders of Golden Gate Group.

Additionally, the 2024 Governance Report of Mobile World Investment Corporation (Stock Code: MWG) noted that Mr. Dao The Vinh – Independent Member of MWG’s Board of Directors and General Director of Golden Gate – also assumed the role of Chairman of the Board of Directors of Vietnam Tea and Coffee Trading Services Joint Stock Company.

According to our research, Golden Gate was established in 2005 by its founders: Mr. Tran Viet Trung, Mr. Dao The Vinh, and Mr. Nguyen Xuan Tuong – Member of the Board of Directors and Deputy General Director.

As per Golden Gate’s 2024 Governance Report, as of the end of the reporting period, the largest shareholder of Golden Gate was Golden Gate Partners Joint Stock Company, holding 29.51% of the capital. Chairman Tran Viet Trung owned 4.97%, while General Director Dao The Vinh directly held 5.65%, and Mr. Nguyen Xuan Tuong owned 10.9% of Golden Gate’s capital as of December 31, 2024.

All three founders, Mr. Tran Viet Trung, Mr. Dao The Vinh, and Mr. Nguyen Xuan Tuong, are members of the Board of Directors of Golden Gate Partners Joint Stock Company.

The Nest-Egg Nest: Stock Market Darling Dishes Out Divine Dividends

“With a hefty sum of $42 billion, the company is set to reward its shareholders with a generous dividend payout. This substantial allocation of funds showcases the company’s commitment to recognizing and valuing the investment of its shareholders.”

“Shareholder Meeting of Tôn Đông Á: Steel Trade Flows are in Turmoil, with a Focus on the Domestic Market Aiming for a 75% Share.”

With a steadfast determination to ascend in the industry, Ton Dong A envisions a strategic shift to the Ho Chi Minh Stock Exchange (HoSE). This move is accompanied by ambitious plans to invest in a new plant, dubbed ‘Plant 4,’ with a formidable capacity of 1.2 million tons per annum. This decisive step propels the company deeper into the value chain of the prestigious coated steel industry.

“PVT Announces Stock Dividend: A Generous 32% Payout to Shareholders”

“PetroVietnam Transportation Corporation (HOSE: PVT) has announced a dividend payout of 32% for the year 2024. Shareholders owning 100 shares will be entitled to receive an additional 32 shares. The record date for this dividend issuance has been set as June 19, 2024, with the ex-rights trading date being the day before, June 18.”