Geopolitical events of the past have not significantly impacted the stock market

VN-Index witnessed a positive session on Monday with a strong gain of nearly 23 points to 1,338.11.

Speaking at the program “Vietnam and the Indices: Financial Prosperity”, Mr. Nguyen Viet Duc, Director of Digital Business at VPBank Securities Joint Stock Company (VPBankS), shared that past geopolitical events have not had a significant impact on the stock market.

In the context of geopolitical tensions over the past 50 years, if conflicts are limited, their impact on the stock market usually lasts only 1-2 sessions. A few months ago, the impact of the Israel-Houthis incident on the market only lasted one session.

Even if the conflict escalates into a war but remains confined to a specific region, the impact is still minimal. According to VPBankS’ expert, this is why the stock market recovered in the first session of the week, as investors believed that the conflict between Israel and Iran would be limited to the Middle East. The impact was mainly on oil prices, without significant global repercussions.

A more severe case is when the United States gets involved in the conflict. In such situations, the market may undergo a prolonged adjustment phase, lasting up to three months, as seen in 2001 after the attack on the twin towers, or in Iraq in 1992. These wars caused the market to adjust by about 10-11% and it took 70 days to find a bottom.

The global market currently believes that the conflict between Israel and Iran is confined to the Middle East and will only impact oil prices, with the US unlikely to intervene. Therefore, the impact of this war on the global market is mainly focused on the energy sector.

At present, oil prices are hovering around $70 per barrel, lower than the 2024 average. As long as oil prices remain within the $70-80 per barrel range, the impact of this conflict is considered over. In a worse-case scenario, if sanctions are imposed, the impact will be more significant.

“In general, despite increasing geopolitical risks, the global stock market will always overcome these adjustments,” Mr. Duc emphasized.

There is a 60-65% chance that the market has bottomed out

According to the expert, investors should refrain from trying to predict the market and instead focus on stock selection, as predicting the market over the medium term does not provide much value.

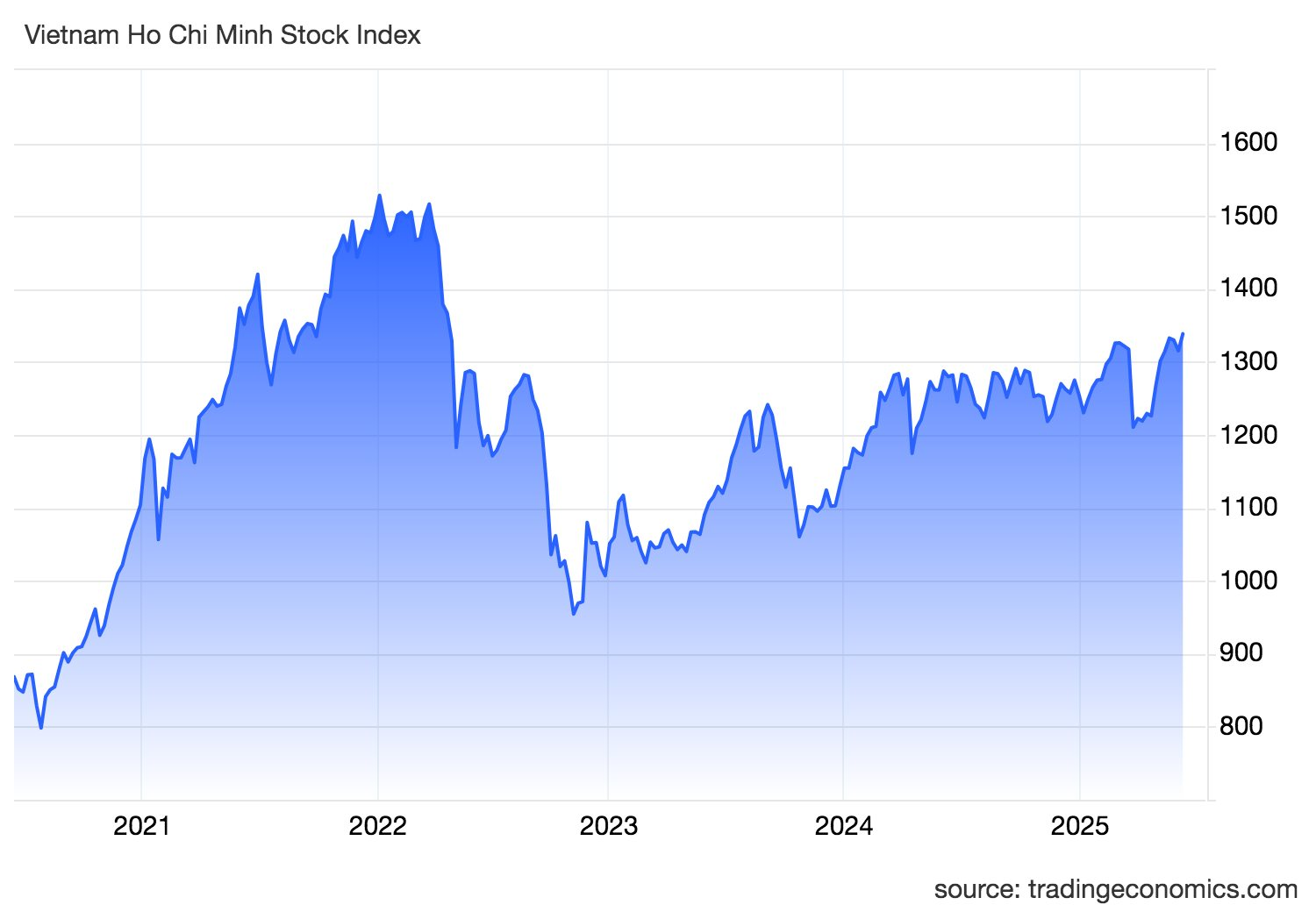

In the short term, the VN-Index underwent an adjustment last week, falling from 1,350 to 1,300 points. According to Elliott, each adjustment wave consists of waves A, B, and C. Currently, it can be affirmed that wave A has ended at 1,310 points. If the market recovers and surpasses 1,340 points, the adjustment wave will end, and a new uptrend may begin. Otherwise, the market will adjust again, with the next support level at 1,280 points.

Essentially, it is challenging to determine whether the market will go up or down. Mr. Duc predicts two pivotal points at 1,310 and 1,280 points. Regarding investment strategy, the expert advises investors to allocate funds to buy during declining sessions and avoid chasing strong rallies. Instead, they should consider buying before significant increases or after adjustments. If investors missed the opportunity to buy on Friday last week, they should wait for the market to rise and test the 1,330-point region.

At present, the expert forecasts a 60-65% probability that the market has bottomed out. In the remaining 35% of cases, if the market declines further, investors will still have the opportunity to sell. If they are holding stocks and are concerned about a market decline, they can rest assured that there will be recovery sessions to exit their positions.

Therefore, when surfing, if investors cannot sell before a sharp decline, they can wait for the recovery wave. With the current situation, if worried, investors can sell 30% of their stocks in the 1,330-1,340 range and maintain 70% of their portfolio. Only when the market turns truly bearish, falling below the MA50 and MA200, should investors consider reducing their equity holdings below 70%.

Technical Analysis for June 19: The Tug-of-War Continues

The VN-Index and HNX-Index opened lower, with a slight dip in trading volume, indicating investor uncertainty at resistance levels.

Market Beat: VN-Index Falls Flat, Failing to Breach Reference Level

The VN-Index, after reaching a high of 1,350 points, corrected sharply to 1,344 points and remained range-bound at this level. At the end of the morning session, the VN-Index closed 2.77 points lower at 1,344.06, while the HNX-Index and UPCoM-Index also witnessed declines, falling 1.25 points and 0.47 points to 226.95 and 98.84, respectively.