Hoang Anh Gia Lai Joint Stock Company (HAGL, stock code: HAG) has announced the trading of its insider shares by Ms. Vo Thi My Hanh and Ms. Ho Thi Kim Chi, both members of the Board of Directors and Vice Presidents of HAGL.

Accordingly, Vo Thi My Hanh and Ho Thi Kim Chi registered to purchase 1 million HAG shares through matched orders and floor trading from June 23 to July 22.

Upon completion of the transaction, Ms. Hanh is expected to increase her ownership in the company from 300,001 shares, or 0.03% to 130 million shares, representing 0.12% of the charter capital.

Meanwhile, Ms. Chi is expected to raise her stake from 595,159 shares, or 0.06% to 1.5 million shares, equivalent to a 0.15% ownership interest.

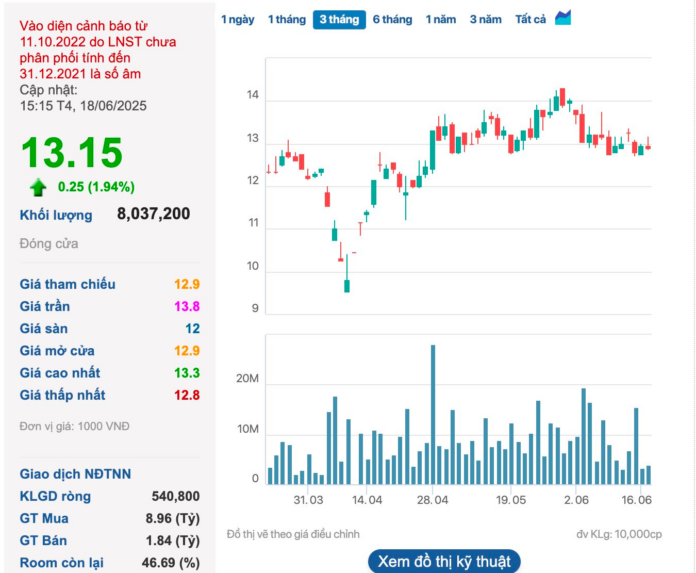

In the stock market, HAG shares of HAGL closed at VND 13,150/share on June 18.

At this price, Ms. Hanh and Ms. Chi are expected to spend approximately VND 13.1 billion each to complete the transaction.

Earlier, on June 11, HAGL’s Chairman, Mr. Doan Nguyen Duc, also known as “Bầu Đức,” registered to purchase 10 million HAG shares from June 16 to June 30, 2025, to increase his ownership.

At the above price, Bau Duc is expected to spend VND 131 billion to complete the transaction. If successful, the HAGL chairman will hold 330 million HAG shares, increasing his stake from 30.26% to 31.2% of the capital.

In terms of financial results for Q1 2025, HAGL recorded net revenue of nearly VND 1,379 billion, up 11.2% compared to the same period last year. After deducting taxes and expenses, the company reported a net profit of over VND 360.4 billion, a 59.2% increase compared to Q1 2024.

HAGL is also expanding its investments in new areas, including cultivating 2,000 hectares of mulberry for silkworm farming to produce export silk and 2,000 hectares of Arabica coffee. In parallel, a pilot project for sturgeon farming is underway in Laos with 700,000 fingerlings, expected to yield the first harvest in September-October this year.

“Vietstock Daily: Anticipating a Liquidity Rebound”

The VN-Index surged, successfully surpassing the 1,350-point resistance level. For this upward trend to solidify, confirmation from trading volume is necessary. The Stochastic Oscillator is pointing upwards and has already given a buy signal, while the MACD is narrowing its gap with the signal line, potentially providing a similar indication. These signals bode well for the index’s short-term positive outlook.

“America LLC Reduces Ownership Stake in ILB to Below 13%”

America LLC currently holds nearly 4.9 million shares of Joint Stock Company ICD Tan Cang – Long Binh (HOSE: ILB), equivalent to 12.81% of its charter capital.