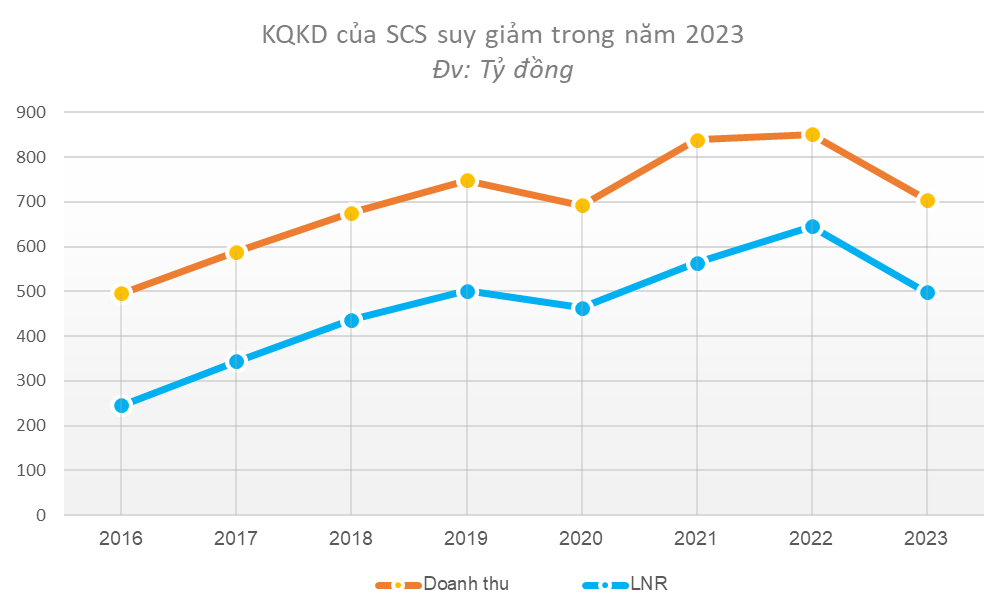

Luxury Car Sales Slump

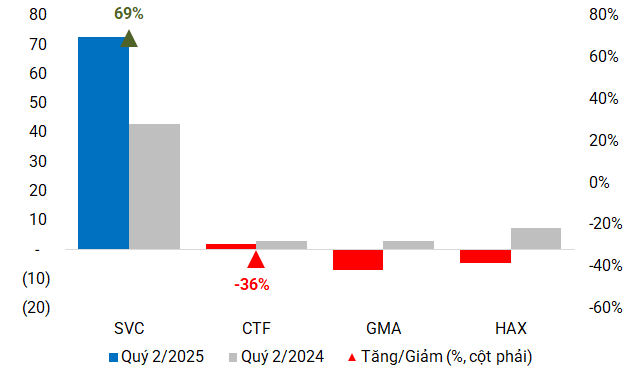

Two companies associated with Mercedes-Benz distribution, GMA and HAX, have reported a drop in profits.

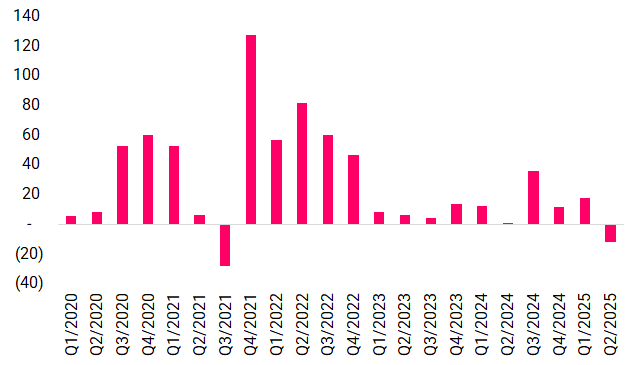

The consolidated revenue of Hang Xanh Automobile Services (Haxaco, HOSE: HAX) exceeded VND 1,000 billion, a decrease of 8.3%. However, the company’s luxury car segment declined by 40%, with the loss offset by sales of MG cars. With nearly VND 25 billion in other income, but operating and interest expenses increased, causing the company to incur a loss of over VND 4.4 billion.

HAX assessed that the premium segment continues to face pressure from the downward trend and intense price competition.

Similarly, G-Automobile (HNX: GMA) reported a loss of over VND 6.9 billion. Revenue decreased by 13% to VND 515 billion, while operating and interest expenses increased. Gross profit margin narrowed from 10% to 8.9%. GMA believes that the automotive market still faces challenges, and the company lacks a strong product strategy.

|

HAX’s luxury car segment profit turns to loss since Q3 2021 (in VND billion)

Source: Author’s compilation

|

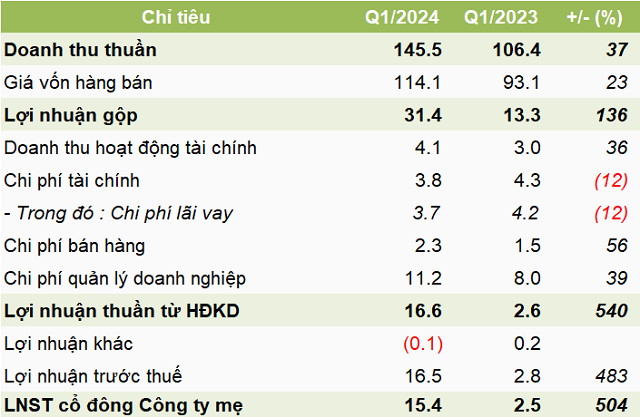

City Auto escapes loss thanks to other income

Long-time Ford distributor City Auto (HOSE: CTF) also had a challenging quarter, with revenue increasing by nearly 15% to over VND 2,000 billion. However, selling expenses surged by almost 50% to over VND 107 billion, causing net profit to decrease by 36%, reaching VND 2 billion.

The company only avoided losses thanks to an additional VND 39 billion in other income from support from its main supplier.

Savico believes the market has improved significantly

Contrary to the cautious assessment of many businesses, Saigon General Service Corporation (Savico, HOSE: SVC) believes that the automotive market in Q2 improved significantly compared to the same period last year. Revenue increased by 23% to VND 6,600 billion, and net profit was nearly VND 73 billion, a 69% increase, mainly from financial activities and other income.

Vietnam Engine and Agricultural Machinery Corporation (UPCoM: VEA) also reported a 17% increase in profit to VND 2,100 billion, mainly due to nearly VND 2,000 billion in revenue from joint venture/associate companies, likely from Honda Vietnam, a motorcycle business.

|

Luxury car distributors still struggled in Q2 2025 (in VND billion)

Source: Author’s compilation

|

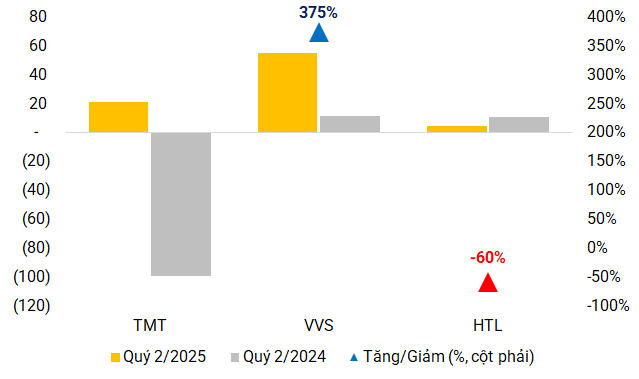

Truck sales rebound

In contrast, the truck segment showed improvement. TMT Automobile (HOSE: TMT) maintained a positive net profit of VND 21 billion after a restructuring process, with a gross profit margin improvement to 12.8%. Revenue decreased by 31% due to a shortage of heavy trucks above 10 tons from the supplier, but most sales were of the competitively priced Euro 5 model.

Benefiting from the disbursement of public investment capital and the increasing demand for freight transportation, Vietnam Machinery Investment and Development (UPCoM: VVS) recorded a doubling of revenue, exceeding VND 2,000 billion, the highest since its listing in 2022. Profit increased by 375% to VND 55 billion.

Meanwhile, Truong Long Technology and Automobile (HOSE: HTL) saw an 11% increase in revenue to VND 159 billion, but the gross profit margin decreased from 13.2% to 10.4%, attributed to delays in obtaining type approval for the Euro 5 model, resulting in a nearly 60% drop in net profit to approximately VND 4.4 billion.

|

Truck distributors performed better (in VND billion)

Source: Author’s compilation

|

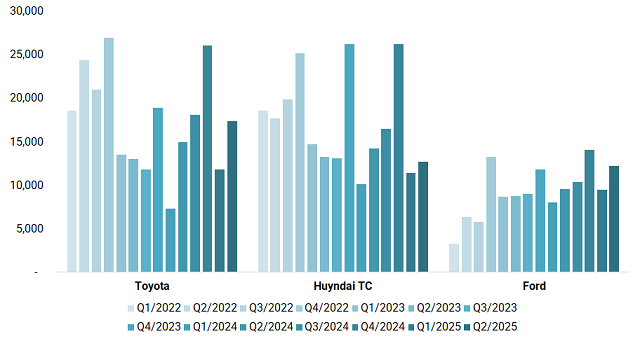

Toyota makes a strong comeback, leading in Q2 sales

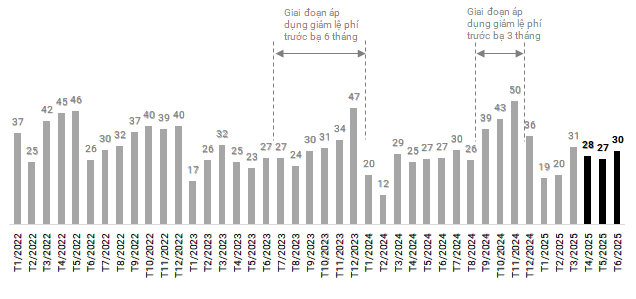

According to data from the Vietnam Automobile Manufacturers’ Association (VAMA, excluding VinFast) and TC Group, the market sold 84,367 units in Q2 2025, a slight increase of 6.7% year-on-year, but still significantly lower than the 117,389 units sold in Q2 2022. Compared to Q1, sales volume increased by 19.8%, with a gradual improvement each month.

|

Total sales volume improved from Q1 (in thousands of units)

Source: Author’s compilation

|

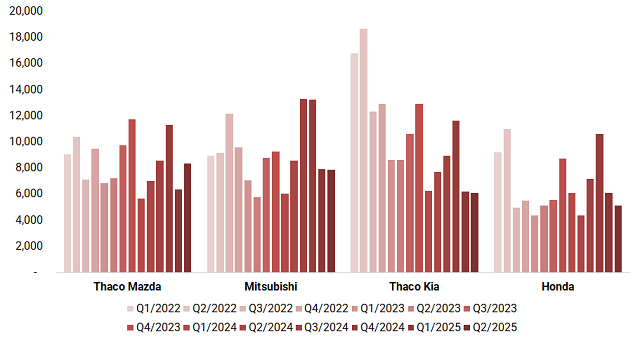

In terms of ranking, Toyota took the lead with 17,444 units, up 16% from Q2 2024 and a significant 48% increase from Q1 2025. Hyundai (TC Group) ranked second with 12,730 units, an 11% decrease year-on-year but an 11% increase quarter-on-quarter. Ford followed with 12,218 units, a 27% increase year-on-year and a 29% increase from the previous quarter.

Among the other high-volume brands, Mazda (Thaco) sold 8,344 units, up 19% year-on-year and 31.6% quarter-on-quarter. Mitsubishi sold 7,873 units, a decrease of 8% year-on-year but a slight increase of 4% from the previous quarter. Kia (Thaco) sold 6,093 units, down 21% year-on-year and 1.7% lower quarter-on-quarter. Honda sold 5,149 units, an 18% increase year-on-year but a 15% decrease from the previous quarter.

In Q2, Thaco sold a total of 22,834 units, a roughly 9.4% increase year-on-year. The internal structure showed that Mazda and trucks recorded strong growth, compensating for the slowdown in Kia sales.

After a sharp decline in Q1 due to the expiration of preferential registration fees for domestically assembled cars, Toyota, Ford, and Thaco Mazda were the brands that saw the most significant increases in sales in Q2.

|

Toyota’s sales recovered strongly in Q2 (in units)

Source: Author’s compilation

|

|

Among the trailing group, only Mazda (Thaco) saw a rebound in sales (in units)

Source: Author’s compilation

|

– 10:00 27/08/2025

The Automotive Industry in Q2: Luxury Cars Lose Steam, While Trucks Make a Comeback

The automotive industry’s total revenue on the stock exchange in Q2 2025 reached an impressive figure of over VND 14.1 trillion, marking an 18% increase compared to the same period last year. Even more remarkable was the net profit, which exceeded VND 2.2 trillion, reflecting a 27% surge. However, a distinct polarization emerged, with luxury vehicles continuing to struggle while commercial vehicles, particularly trucks, and several mass-market brands witnessed significant improvements.

Mastering the Extreme: An Arctic Adventure with Mercedes-AMG

This September and October, Mercedes-Benz Vietnam is offering an exclusive opportunity for its customers to embark on an exhilarating AMG journey – the “AMG On Ice” experience.

The Ultimate Wordsmith: Crafting Captivating Copy and Capturing Online Visibility

“A Peerless Pair: The World’s Most Expensive Car Worth $143 Million Parks Outside Mr. Dang Le Nguyen Vu’s Residence”

The iconic Mercedes-Benz 300 SL has been spotted in Ho Chi Minh City, Vietnam. This classic car is a true automotive legend and its presence in the vibrant city of Ho Chi Minh is a thrilling surprise for car enthusiasts and aficionados alike.