According to preliminary data from the Customs Department, in August 2025, Vietnam imported over 584,000 tons of fertilizers valued at more than $222 million, marking a 2.2% decrease in volume and an 8.4% decline in value compared to July 2024. Cumulatively, in the first eight months of the year, the country spent over $1.51 billion on imports, corresponding to nearly 4.34 million tons, reflecting a 24.1% increase in volume and a 33.1% rise in value compared to the same period in 2024.

The average import price stood at $380 per ton, a 6.3% decrease year-over-year.

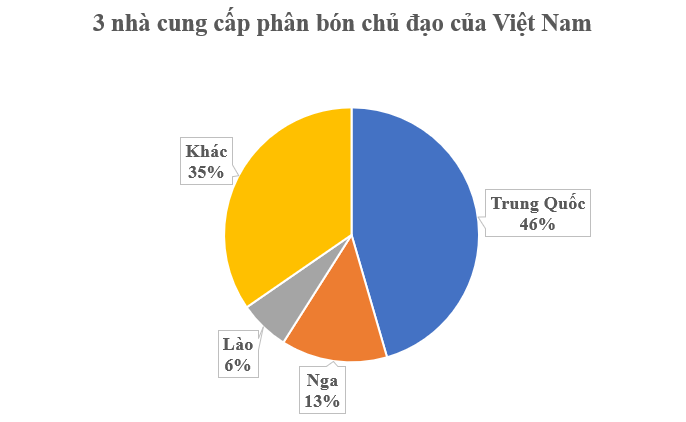

China remains the largest supplier of fertilizers to Vietnam, accounting for over 46% of both volume and value in the country’s total fertilizer imports. Vietnam imported 1.97 million tons from China, worth $679.98 million, representing a 38% increase in volume and a 55% surge in value compared to the previous year.

The average price from China was $344 per ton, up 12% year-over-year.

Russia ranked second, contributing 13.5% in volume and 17.7% in value, with imports exceeding 585,000 tons valued at over $266 million, marking a 35% increase in volume and a 42% rise in value compared to the first eight months of 2025.

The average price from Russia was $455.6 per ton, a 5.3% increase year-over-year.

Laos followed, accounting for 6.4% in volume and 5.4% in value, with imports surpassing 277,000 tons valued at over $80.66 million, reflecting a 15.2% increase in volume and a 29.8% rise in value. The average price from Laos was $291 per ton, up 13% year-over-year.

According to the International Fertilizer Association (IFA), from 2024 to 2028, the demand growth rate for key fertilizers such as urea, phosphate, potash, and NPK is expected to lag behind supply growth, exacerbating the oversupply situation.

Global urea capacity in 2024 is estimated at 165.9 million tons and is projected to increase by over 7% to 177.8 million tons by 2028. Meanwhile, consumption demand is expected to rise by only 6% during the same period. Consequently, the urea oversupply is anticipated to grow from 3.6 million tons in 2024 to 5.1 million tons in 2028.

The Vietnam Fertilizer Association (FAV) notes that China has historically been Vietnam’s largest fertilizer supplier, which is unsurprising given China’s status as a major global producer and exporter. However, Vietnam maintains a degree of self-sufficiency, particularly in fertilizers like urea, superphosphate, and NPK, not only meeting domestic demand but also exporting surplus.

Currently, Vietnam imports fertilizers that are in short supply or not produced domestically. For instance, Vietnam produces only 400,000–500,000 tons of DAP annually but requires nearly 1 million tons, necessitating imports. Similarly, the country imports 900,000–1 million tons of ammonium sulfate (SA) annually.

Potash (MOP) is entirely imported, with volumes fluctuating around 1 million tons per year. For NPK fertilizers, Vietnam imports high-nutrient varieties while exporting lower-nutrient types to neighboring markets.

Unleashing Khánh Hòa’s Potential: A Coastal Growth Hub Seeks Major Investors and Skilled Talent

Nestled in a prime strategic location, Khánh Hòa boasts Vietnam’s longest coastline, the Spratly Islands, deep-water bays, and abundant natural resources, creating “vast space for grand aspirations,” as aptly stated by Assoc. Prof. Dr. Nguyễn Chu Hồi, a member of the 15th National Assembly and Vice Chairman of the Vietnam Association of Seafood Exporters and Producers.

Cà Mau Fertilizer enters the markets of Australia and New Zealand

In the final days of the year, the leadership team and employees of Cà Mau Fertilizer and Petroleum Joint Stock Company (PVCFC, Hose: DCM) are delighted and busy preparing a high-quality batch of products to officially penetrate the demanding fertilizer markets of Australia and New Zealand. This is an encouraging signal and a testament to the export-import efforts of the Cà Mau Fertilizer brand.