The Ministry of Finance has recently approved the project titled “Transforming Tax Management Models and Methods for Household Businesses Upon the Abolition of Presumptive Taxation” via Decision No. 3389/QĐ-BTC. This marks a significant step in implementing the policy to transition all household businesses to self-declaration and self-payment of taxes, a fundamental shift in tax administration for this vital economic sector.

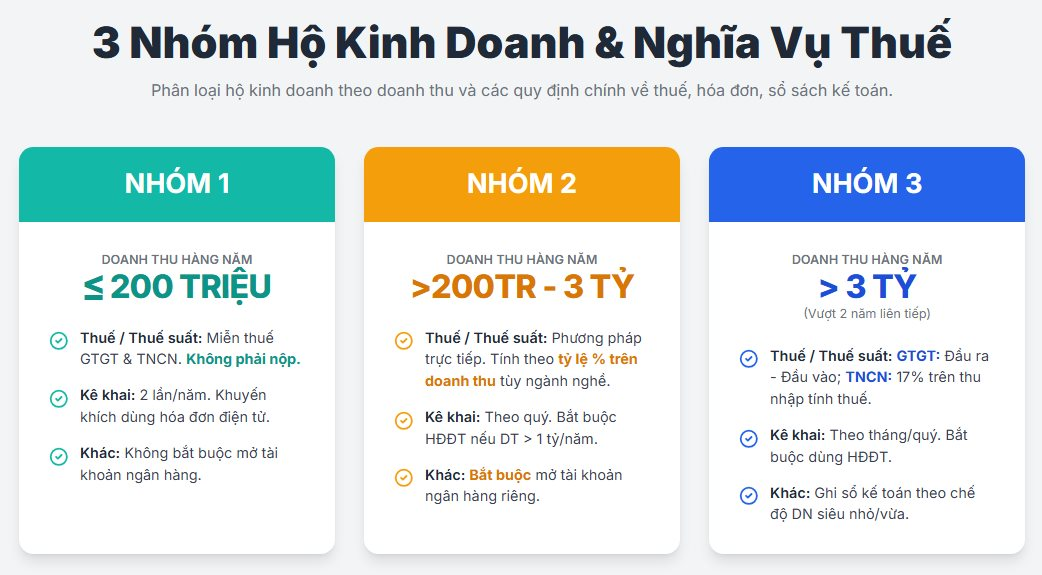

According to the project, starting from 2026, household businesses will be categorized into three main groups based on annual revenue, with corresponding tax calculation methods and declaration obligations.

The first group comprises household businesses with annual revenue below 200 million VND.

These businesses are exempt from Value-Added Tax (VAT) and Personal Income Tax (PIT). While they are not required to maintain complex accounting books, they must submit periodic declarations twice a year to keep tax authorities informed of their operations.

The second group includes businesses with annual revenue ranging from 200 million to under 3 billion VND.

For this group, tax is calculated directly on revenue, similar to the current method, with rates varying by industry: 1% for goods distribution; 5% for services and construction without material procurement; 3% for production and transportation; and 2% for other business activities.

Businesses in this group must declare taxes quarterly (four times a year) and maintain simple accounting records using prescribed forms. Notably, those with annual revenue exceeding 1 billion VND in retail or consumer services must use electronic invoices from cash registers connected to tax authorities.

The third group, the largest, consists of businesses with annual revenue above 3 billion VND.

These businesses must adopt the VAT credit method, where payable tax is calculated as output tax minus deductible input tax. For PIT, a 17% rate applies to profits (revenue minus reasonable expenses).

Their obligations closely resemble those of corporations, including maintaining separate bank accounts for business activities and using electronic invoices with codes or cash register invoices. Declaration frequency is monthly for businesses with annual revenue over 50 billion VND and quarterly for others.

As of late 2024, Vietnam has approximately 3.6 million household and individual businesses, with about 2.2 million operating steadily. Around 1.3 million businesses have revenue above the taxable threshold (over 100 million VND/year under the old regulations). In 2024, this sector contributed roughly 26 trillion VND to the state budget.

The transition to this new management model is seen as a crucial step toward enhancing transparency and reducing compliance disparities between household businesses and corporations, fostering a more level playing field. However, significant institutional work remains for authorities to bring these regulations to life.

According to the project’s roadmap, key legislative documents such as the amended Tax Administration Law and Personal Income Tax Law are expected to be submitted to the National Assembly in October 2025 during its 10th session. The Law on Fees and Charges must also be revised before 2026.

In 2026, other documents like the Law on Supporting Small and Medium Enterprises, along with circulars guiding accounting regimes for household businesses and micro-enterprises, will be reviewed and adjusted. This process requires close coordination to ensure a synchronized legal framework, laying a solid foundation for nationwide implementation of the new tax management model.

Attention Business Owners: New Tax Rates Effective January 1, 2026

The Ministry of Finance has officially approved the plan titled “Transforming Tax Management Models and Methods for Household Businesses Upon the Abolition of Presumptive Tax,” set to take effect on January 1, 2026.

Finance Ministry Withdraws Proposal for Immediate Taxation on Stock Dividends

The Ministry of Finance has opted to maintain the existing tax payment method for dividends and bonuses in the form of securities, requiring payment at the time of transfer rather than upon receipt, as previously suggested. Immediate taxation upon stock distribution is deemed impractical, as investors lack the actual cash flow to pay taxes, while businesses, if required to withhold taxes, would face additional financial strain, potentially impacting their production and business operations.

Navigating the Transition: How Small Businesses Can Adopt E-Invoicing Under Decree 70

As of June 1, 2025, under Decree 70, businesses with annual revenue of 1 billion VND or more will be required to use electronic invoices connected to tax authorities. This regulation also applies to those using cash registers or subject to tax declaration methods. It marks a significant step toward transparent business operations but presents considerable challenges, particularly for small and individual business owners.