According to the Vietnam Association of Seafood Exporters and Producers (VASEP), as of September, the seafood industry continued its growth momentum, driven by recovering demand in key markets and the short-term advantage of the U.S. tariff sprint phase.

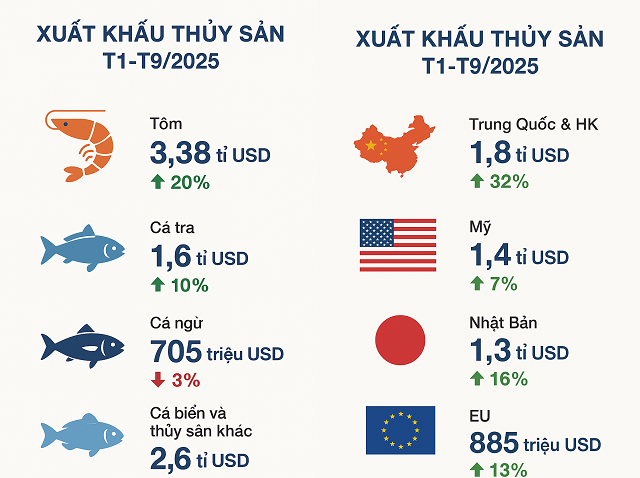

Within the product structure, shrimp remained the leading export, generating over 3.38 billion USD, a 20.3% increase year-on-year. This growth was primarily fueled by stable demand in the U.S., Japan, and the EU, along with rising orders from regional markets. Pangasius also made a notable impact, with exports surpassing 1.6 billion USD, up nearly 10%, thanks to rebounding demand in China, the U.S., and several Middle Eastern countries.

Earlier, market expectations were high that a robust recovery would propel seafood exports to reach the 11 billion USD milestone for the first time since 2022. However, at the Vietnam-EU Trade and Economic Cooperation Forum 2025 on October 17, Ms. Tô Thị Tường Lan, Deputy Secretary-General of VASEP, stated that while growth was positive, achieving this target remained “highly challenging.”

“At the current pace, Vietnam’s seafood exports in 2025 are likely to exceed 10 billion USD. However, reaching the anticipated 11 billion USD is unlikely, as global market pressures are expected to intensify in Q4,” she noted, without specifying short-term causes. The broader context reveals the industry faces significant challenges: slowing demand in major markets, high production and logistics costs, and increasingly stringent technical, environmental, and traceability standards.

Seafood export performance in the first nine months of 2025. Source: VASEP

|

Long-term, experts highlight the EU’s Illegal, Unreported, and Unregulated (IUU) fishing regulations as a major hurdle. Despite Vietnam’s efforts in management and traceability, the prolonged “yellow card” warning, now in its eighth year, costs the industry approximately 100 million USD annually. Ms. Lan expressed hope that the European Commission’s inspection team, expected in December, would pave the way for lifting the warning, boosting seafood exports to Europe.

She emphasized that the EU remains a long-term priority market due to its large consumer base of 450 million and seafood imports exceeding 30 billion euros, second only to China. However, five years after the EVFTA took effect (August 2020), Vietnam’s seafood exports to the EU, though consistently above 1 billion USD annually, have yet to achieve the expected breakthrough.

“Vietnam’s market share in the EU is modest, but the region has provided stability for the industry amid global economic fluctuations,” she observed.

Vietnam currently exports seafood to 26 out of 27 EU countries, with the Netherlands, Germany, Belgium, Spain, and Italy as the top five markets, accounting for 68% of total exports. Ms. Lan sees significant potential in Southern European countries, where consumers increasingly favor sustainably certified and traceable products.

Vietnam has 506 EU-approved processing facilities, demonstrating strong quality control and food safety capabilities. Additionally, Vietnam ranks fourth globally in seafood production and third in trade, after China and Norway, supported by advanced processing and market adaptability.

Among key products, pangasius shows the most promise in the EU due to its closed production chain, full traceability, and compliance with U.S. food safety standards. It is the only product recognized by the USDA for equivalent supply chain management and is among the top seven sustainable aquaculture species globally, according to FAO and the World Bank. As of September 2025, Vietnam leads Asia with 121 ASC-certified pangasius farms, far surpassing other regional nations.

For shrimp, Vietnam holds the third position in the EU, after Ecuador and India. Value-added products account for 50-55% of exports, while high-tech farming models that increase productivity and reduce environmental impact are rapidly expanding.

Tuna, despite being among the top seven EU exporters, continues to face significant IUU “yellow card” barriers. However, businesses and regulators are enhancing compliance with international standards, aiming to lift the warning and restore growth.

Ms. Tô Thị Tường Lan forecasts seafood exports unlikely to reach 11 billion USD this year – Photo: Tử Kính

|

Broadly, VASEP’s Deputy Secretary-General identifies three major challenges: complex climate change impacts, including diseases, salinization, and rising production costs; shifting global consumer preferences toward “green” products, with many Vietnamese firms lagging in sustainability standards; and increasing competition and trade barriers as Indonesia and India emerge strongly, while Vietnam’s seafood brand recognition in the EU remains limited.

To address these, VASEP proposes four key strategies: sustainable development linked to resource conservation and emissions reduction; quality enhancement and premium product expansion; export market diversification; and ensuring transparent production and financial chains. Ms. Lan stresses the need to shift from raw to value-added exports, leveraging unique products like shrimp-rice-mangrove ecosystems for long-term advantage.

At the forum, Mr. Lasse Pedersen Hjortshoj, Chargé d’Affaires of the Danish Embassy in Vietnam, praised Vietnam’s green transition and sustainability efforts, noting that ESG compliance and carbon reduction are both mandatory and opportunities to elevate Vietnam’s seafood brand globally.

Meanwhile, Mr. Ngô Chung Khanh, Deputy Director of the Multilateral Trade Policy Department (Ministry of Industry and Trade), noted that while EVFTA opened a “golden door,” seafood market share has stagnated over five years. As the EU prepares trade deals with Indonesia and India, Vietnam’s tariff advantages will shrink, urging businesses to “leverage the remaining time to enhance product quality and expand market share.”

|

Government intensifies efforts to combat illegal fishing Prime Minister Phạm Minh Chính issued Directive 198/CĐ-TTg, calling on ministries, agencies, and coastal provinces to launch a “peak month against illegal fishing,” aiming to lift the EC’s “yellow card” this year. The directive underscores that combating IUU fishing is not only an immediate priority but also vital for the industry’s sustainable development. The government mandates stricter vessel control, electronic traceability (eCDT), severe penalties for violations, and public reporting for deterrence. Progress has been made, with reduced boundary violations and improved law enforcement. Vietnam aims to complete its vessel monitoring and reporting system by November 2025, supporting “yellow card” removal and enhancing its seafood reputation in Europe. |

Expert: Vietnam underutilizing EVFTA’s “golden period”

– 15:52 20/10/2025

Vietnamese Export Item Sees Record Triple-Digit Growth as U.S. Demand Surges

In the first 8 months of the year, Vietnam’s exports of this commodity have surpassed the total export value of the past 5 years.

Navigating U.S. Tax Challenges: A Critical Test for Businesses

The U.S.’s 20% retaliatory tax on imports from Vietnam presents a significant challenge, yet it also serves as a critical test for businesses to restructure their market strategies and enhance competitiveness. With thorough preparation and support from local authorities, companies can not only retain their market share but also explore opportunities for expansion.

U.S. Tax Challenges: A Critical Litmus Test for Businesses

The 20% reciprocal tax imposed by the U.S. on imports from Vietnam presents a significant challenge, yet it also serves as a critical test for businesses to restructure their market strategies and enhance competitiveness. With thorough preparation and support from local authorities, companies can not only retain their market share but also explore opportunities for expansion.