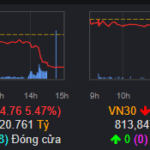

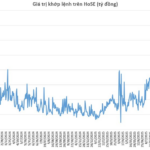

Vietnam’s stock market kicked off the new week with significant volatility. Selling pressure dominated for most of the session, intensifying towards the close. The VN-Index ended the day down nearly 95 points (-5.47%), settling at 1,636.43. In absolute terms, this marks the largest single-day decline in the 25-year history of Vietnam’s stock market.

Market breadth was overwhelmingly negative across all three exchanges, with over 650 decliners, including more than a hundred stocks hitting their lower limits. Notably, all 30 constituents of the VN30 Index closed in the red, with 13 hitting their downside limits. The VN30 Index itself recorded its first-ever triple-digit decline, dropping over 100 points to close at 1,870.

The VN-Index has now shed a combined 130 points over two consecutive sessions, erasing all gains made since early October. Short-term profit-taking likely contributed to the sharp decline, compounded by foreign investors’ net selling of approximately VND 2 trillion, further pressuring the market.

Speaking at a recent Investor Day event, Mr. Le Anh Tuan, CEO of Dragon Capital, emphasized that short-term fluctuations—whether upward or downward—are entirely normal, akin to “bumps in the road” on the market’s long-term journey.

“Volatility within an uptrend is inevitable. A 5-10% market swing is perfectly normal. Don’t be surprised, confused, or fearful during such corrections. When understood correctly, these adjustments present opportunities,” Mr. Tuan remarked.

According to Dragon Capital’s leadership, the critical factor is the market’s strengthening long-term fundamentals. Vietnam is poised for potential upgrades to MSCI Emerging Markets and FTSE Advanced Emerging status within 3-5 years—a development that could usher in a new growth cycle.

J.P. Morgan similarly anticipates that such an upgrade would attract substantial passive capital inflows into Vietnam. The firm estimates global index funds could allocate approximately $1.3 billion to Vietnamese equities, equivalent to a 0.34% weighting in the FTSE Emerging Market All Cap Index. Based on current market capitalization, roughly 22 Vietnamese stocks could be included in this index.

Building on this, J.P. Morgan has raised its 12-month VN-Index target to 2,000 points under the base case and 2,200 points under an optimistic scenario, implying 20-30% upside from current levels. Robust macroeconomic fundamentals and corporate earnings growth are cited as key drivers of this positive outlook.

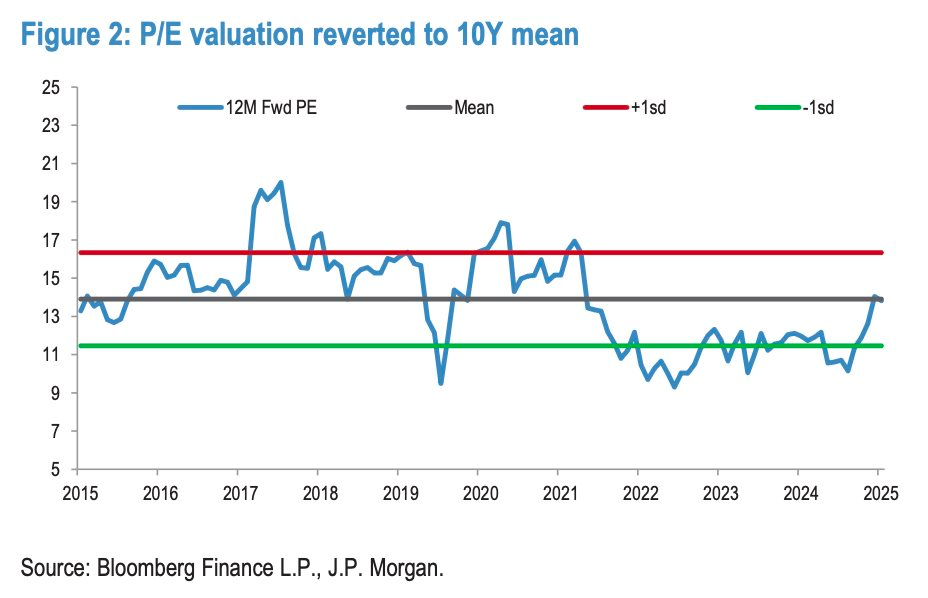

J.P. Morgan views the VN-Index’s current valuation as reasonable, projecting a forward P/E of 15-16.5x over the next 12 months. While higher than the ASEAN average, this remains below historical peaks seen in 2018 and 2021, reflecting long-term growth expectations and improving corporate profitability in Vietnam.

“If the MSCI reclassification proceeds smoothly, the market could see an additional 10% upside from P/E multiple re-rating,” J.P. Morgan’s report concluded.

Nearly 150 Stocks Hit Lower Limit, Vietnam’s Market Cap Plunges by $18.5 Billion in October 20 Session

Vietnam’s stock market plunged nearly 5.5% on the first trading day of the week, making it one of the world’s worst-performing markets.