MARKET ANALYSIS FOR THE WEEK OF OCTOBER 20-24, 2025

During the week of October 20-24, 2025, the VN-Index extended its correction into the second consecutive week, with trading volumes falling below the 20-session average. Despite narrowing losses, a cautious sentiment prevailed as buying interest remained exploratory and lacked the breadth needed for a sustainable rebound.

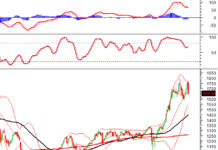

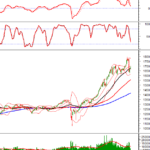

With the Stochastic Oscillator signaling a sell and the MACD narrowing its gap with the Signal Line, further volatility is likely in the near term.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Re-testing the 50-Day SMA

On October 24, 2025, the VN-Index experienced a slight decline, re-testing the 50-day SMA. A Doji candlestick pattern emerged alongside trading volumes remaining below the 20-session average, reflecting investor caution.

Additionally, the ADX indicator is moving within the neutral zone (20 < ADX < 25). Meanwhile, the Stochastic Oscillator and MACD continue to weaken after issuing sell signals, indicating no short-term improvement.

HNX-Index – Doji Candlestick Formation

On October 24, 2025, the HNX-Index saw a slight gain, accompanied by a Doji candlestick pattern and trading volumes exceeding the 20-session average, indicating investor indecision.

The MACD indicator is forming lower highs and lower lows, while the HNX-Index remains below the Bollinger Bands’ Middle Line. This suggests a bearish short-term outlook.

Money Flow Analysis

Smart Money Movement: The Negative Volume Index for the VN-Index is above the 20-day EMA. If this continues in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

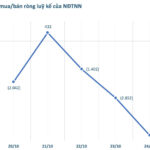

Foreign Investor Flow: Foreign investors continued net selling on October 24, 2025. If this trend persists in upcoming sessions, the outlook will become more pessimistic.

Technical Analysis Team, Vietstock Advisory Department

– 16:58 October 26, 2025

Technical Analysis Afternoon Session 24/10: Struggling to Break Above Bollinger Bands’ Middle Line

The VN-Index experienced intense volatility, retracing after nearing the Bollinger Bands’ Middle Line. Meanwhile, the HNX-Index extended its decline, forming a candle pattern resembling a Spinning Top.

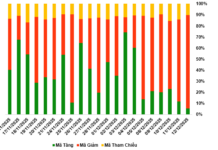

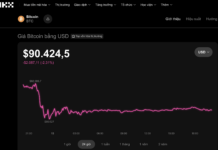

Market Pulse 24/10: Foreign Investors Net Sell Financial Stocks, VN-Index Closes in the Red

At the close of trading, the VN-Index dipped 3.88 points (-0.23%), settling at 1,683.18 points, while the HNX-Index edged up 0.5 points (+0.19%) to 267.28 points. Market breadth favored decliners, with 416 stocks closing lower compared to 291 gainers. Similarly, the VN30 basket saw red dominate, with 15 decliners, 12 advancers, and 3 unchanged stocks.

Stock Market Week 20-24/10/2025: Challenges Persist

The VN-Index paused its recovery in the final session of the week, failing to offset the sharp decline earlier and closing the week 48 points lower than the previous one. With liquidity yet to show significant improvement and foreign investors maintaining their net selling trend, downward pressure on the index is likely to persist in the near term.