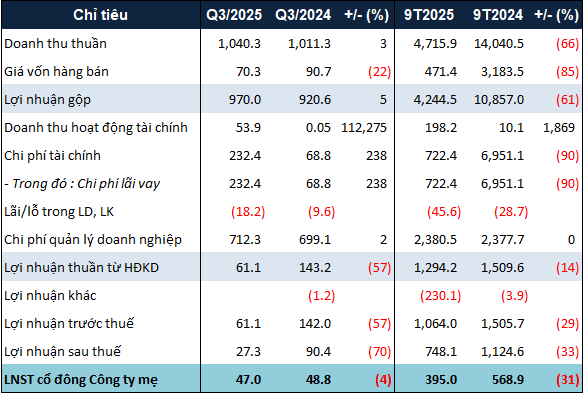

In Q3/2025, VRC recorded a net revenue of over 1 billion VND, a 3% increase compared to the same period last year. All revenue was generated from service provision, while real estate business activities continued to yield no revenue.

Financial activity revenue reached approximately 54 million VND, a significant rise from the mere 50 thousand VND recorded in the same period last year. This difference is attributed to over 7 million VND in loan interest and nearly 43 million VND in late payment interest from a related-party customer.

Regarding expenses, financial costs surged 3.4 times to over 232 million VND, entirely comprising loan interest expenses. Management expenses also saw a slight 2% increase to over 712 million VND due to higher external service costs.

After deducting expenses, VRC posted a net profit of 47 million VND, a 4% decline. In the first nine months of the year, the company’s net profit totaled 395 million VND, down 31% year-on-year.

|

VRC‘s 9-month business results for 2025. Unit: Million VND

Source: VietstockFinance

|

However, the 9-month after-tax profit equates to just over 7% of the 10.1 billion VND target set for 2025.

Notably, according to self-prepared financial statements, VRC‘s net profit for the first half of the year was nearly 11 billion VND. Post-audit, this figure plummeted to just over 363 million VND. The company attributed this discrepancy to retrospective adjustments made to year-beginning balance sheet figures.

Specifically, VRC had previously recognized other income from a nearly 14.7 billion VND compensation payment received from the state for the repossession of a 962.6m² plot in Vung Tau’s Hang Dieu road project.

However, on December 26, 2024, the company informed the Ba Ria – Vung Tau Provincial Inspectorate of its refusal to accept the compensation due to disagreements over the land valuation, which was based on a 2020 provincial decision despite the land being repossessed in 2023. On December 30, 2024, the Inspectorate transferred VRC‘s compensation to the State Treasury to offset outstanding land rent payments as per Inspectorate Conclusion No. 261.

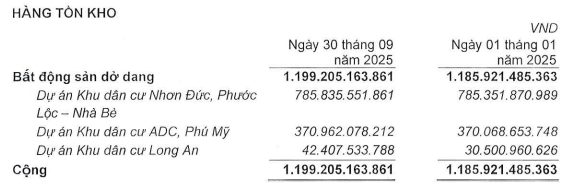

Returning to the Q3 consolidated financial statements, VRC‘s total assets as of September 30, 2025, stood at over 1.7 trillion VND, unchanged from the beginning of the year. The largest asset, inventory, remained at nearly 1.2 trillion VND, entirely comprising work-in-progress real estate.

|

VRC‘s inventory as of September 30, 2025

Source: Q3/2025 Consolidated Financial Statements

|

Liabilities remained relatively stable at over 473 billion VND. Outstanding debt increased 3% to over 336 billion VND, including a 333 billion VND loan from new CEO Tran Thi Van.

Largest Shareholder Becomes VRC’s CEO?

Despite Q3’s earnings decline, major shareholder Bui Minh Luc purchased nearly 3 million VRC shares on October 31, equivalent to the total volume traded that day via negotiated transactions, valued at over 40.4 billion VND. This acquisition increased Luc’s ownership stake from 14.359% to 20.347%.

– 15:28 05/11/2025

New Proposed Fines for Real Estate Business Violations

In the latest draft of the Decree on Administrative Penalties for Construction Violations, the Ministry of Construction has proposed new regulations to penalize violations related to real estate business activities.

Hydropower Sector Booms: Ha Do Group’s Q3 Net Profit Doubles Year-on-Year

According to the consolidated financial report, Ha Do Group Corporation (HOSE: HDG) recorded a net revenue of nearly VND 713 billion in Q3/2025, a 26% increase compared to the same period last year. Despite this growth, the cost of goods sold decreased by 6%, resulting in a 47% surge in gross profit.

How Far Has Real Estate Titan Hoàng Quân Come in Delivering on Its Promise of 50,000 Affordable Homes?

In a bold commitment to addressing the nation’s housing needs, Hoang Quan Real Estate has pledged to develop 50,000 social housing units across Vietnam between 2022 and 2030. This ambitious initiative underscores the company’s dedication to creating affordable, quality homes for communities nationwide.

Proposed Increase in Penalties for Real Estate Business Violations

The Ministry of Construction has proposed hefty fines for real estate businesses failing to meet regulatory requirements, with penalties reaching up to 200 million VND. Additionally, companies engaged in unqualified housing sales could face fines of up to 1 billion VND.

Unveiling Vingroup’s $43 Billion Empire: $5.3B in Under-Construction Real Estate, $760M in VinFast Projects, and $147M Invested in VinEnergo & VinSpeed

Vingroup (VIC) has achieved a monumental milestone, surpassing the 1 quadrillion VND asset threshold as revealed in its Q3/2025 financial report. The conglomerate is strategically channeling its substantial capital into key sectors, including real estate, the VinFast ecosystem, and emerging industrial pillars.