The 2025 Sewing Competition at TNG Viet Duc – Son Cam Branch. Illustrative image

|

Tariff “Punch” Becomes a Short-Term Catalyst

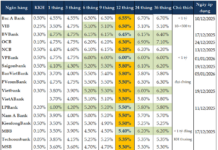

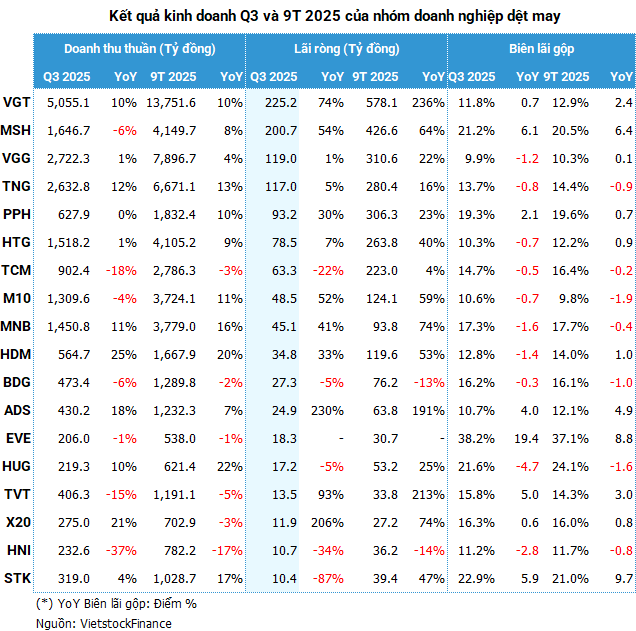

According to VietstockFinance data from 34 listed textile enterprises, total Q3 revenue reached nearly VND 23.8 trillion, up 3% year-on-year, while net profit exceeded VND 1.1 trillion, up 16% thanks to the average gross margin expanding from 13% to 13.5%.

For the first nine months, the growth momentum was even more pronounced, with revenue approaching VND 65.7 trillion, up 8%, and net profit nearing VND 3 trillion, up 56%. Operational efficiency was consolidated sustainably, with the 9-month gross margin surpassing 14%, significantly higher than the 12.7% in the same period in 2024. The 9-month profit scale in 2025 has exceeded the full-year results of 2024 and 2023, and is the second highest in the past decade, just behind the peak of the same period in 2022.

|

This growth was driven by a combination of factors, from the easing of U.S.-China trade tensions to the gradual recovery in consumer demand. However, the decisive short-term driver was customers rushing to place and deliver orders before the U.S. tariff policy took effect, creating a surge in orders that allowed many enterprises to maximize their capacity.

According to data from the Vietnam Textile and Apparel Association (VITAS), the industry’s 9-month export turnover reached $34.75 billion, up 7.7% year-on-year. However, the bright industry-level picture masks deep enterprise-level polarization: in a survey of 34 units, 18 saw profit growth, 8 declined, 2 turned losses into profits, and 6 reported losses.

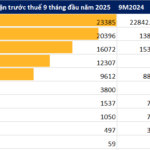

Vinatex Leads, System-Wide Ripple Effect

Vietnam National Textile and Garment Group (Vinatex, VGT) played a leading role, achieving historic results in Q3/2025 with revenue surpassing VND 5 trillion for the first time and net profit exceeding VND 225 billion, up 74% year-on-year, the highest in 12 quarters. For the first nine months, pre-tax profit returned to the VND 1 trillion mark after three years, setting the stage for approaching the 2021 record of VND 1.4 trillion, while net profit surpassed VND 578 billion, soaring 236%.

| Vinatex’s Quarterly Business Results for 2022-2025 |

This upswing rippled widely across the Vinatex system: Phong Phu (PPH), May 10 (M10), May Nha Be (MNB), and Viet Thang (TVT) recorded Q3 profit increases of 30% to 93%. Many units set 9-month records, such as Huegatex (HDM) with net profit nearing VND 120 billion, up 53%, Hoa Tho (HTG) hitting a historic high of VND 264 billion, up 40%, and Viet Tien (VGG) reaching a 7-year peak of VND 311 billion.

| Viet Tien Garment Records Highest 7-Year Profit in 9-Month Cycle |

Large enterprises outside the Vinatex ecosystem also surged. TNG Investment and Trading continued to set new highs in Q3 revenue and net profit, reaching VND 2.633 trillion and VND 117 billion respectively, thanks to controlled selling expenses and hedged exchange rates. May Song Hong (MSH) adopted a different strategy, with Q3 revenue slightly down but record profits of nearly VND 201 billion, up 54%, by screening high-margin orders and shifting strongly to CMT for Chinese partners, fully offsetting the decline in finished products for the U.S. market.

The Dark Side of the Recovery

Competitive pressures, internal issues, and trade dispute impacts have left many units facing declining or even heavy losses.

Thanh Cong Textile (TCM), a prime example of this divergence, saw Q3 net profit drop 22% to over VND 63 billion, with gross margin hitting a 2-year low. The only bright spot was financial activities, which acted as a “lifeline” to keep 9-month profit up slightly by 4%.

| TCM’s Quarterly Business Results for 2023-2025 |

Once an export giant, Binh Thanh Import-Export and Production (Gilimex, GIL) suffered its deepest loss since inception due to prolonged disputes with Amazon, with a Q3 loss of over VND 32 billion and a 9-month cumulative loss exceeding VND 100 billion. The fallout extended to its CMT partner, Garmex Saigon (GMC), which halted garment production in May 2023, continued to lose, and raised cumulative losses to nearly VND 125 billion.

| Garmex Profited Only in Q2/2022 and Q1/2024, Otherwise Losing in 2022-2025 |

The core business collapse was starkly illustrated by Garmex’s 9-month revenue of just VND 1.4 billion, over half from pickleball court rentals, generating VND 795 million, or nearly VND 3 million/day.

The gloom was further highlighted by other cases. Fortex (FTM) lost over VND 119 billion in 9 months, pushing cumulative losses to a peak of VND 1.463 trillion and owner’s equity negative by VND 954 billion. Garment 7 (DM7) had its worst quarter ever, with net profit evaporating by 97%. Huu Nghi Garment (HNI) reported a 34% profit drop, with gross margin hitting a 2-year low due to export disruptions to the U.S.

|

Upstream Pressure Points

This polarization is also evident in specialized segments like fiber production, where enterprises face unique challenges.

The Century Fiber (STK), despite a record gross margin of nearly 23%, saw Q3 net profit plunge 87% to just over VND 10 billion due to low sales volume, delayed Unitex plant projects, and large exchange losses. Financial pressure on STK is severe, with 9-month financial costs soaring 211% to VND 121 billion, including VND 87 billion in exchange losses; debt at the end of September 2025 neared VND 1.9 trillion, exceeding owner’s equity, raising concerns about capital costs and financial resilience.

| The Century Fiber’s Quarterly Business Results for 2023-2025 |

Other fiber enterprises like Hanoisimex (HSM) and Vu Dang Fiber (SVD) also saw profits halve in Q3. However, the segment had bright spots: Phu Bai Fiber (SPB) achieved record Q3 profit of nearly VND 9 billion, up 795%, officially exiting cumulative losses; Damsan (ADS) saw triple-digit profit growth, mainly from real estate.

The Party’s Over, Challenges Begin

Despite positive 9-month figures, industry leaders are sounding alarms about the future. The short-term order “party” is over, but real challenges are just beginning.

Vinatex CEO Cao Huu Hieu

|

Vinatex CEO Cao Huu Hieu warned that the impact of U.S. tariff policies is deeply affecting enterprises. Order volumes are significantly shrinking. While this is typically the peak period for finalizing next year’s orders, current orders are mostly month-to-month, with many enterprises lacking orders even for November 2025.

According to Vinatex leadership, the industry faces three structural challenges: complying with rules of origin to leverage FTAs while avoiding punitive tariffs; upgrading value chain positions from manufacturing to design, branding, and distribution; and cost pressures as cheap labor advantages diminish, threatening order shifts to lower-cost markets.

Vinatex Chairman Le Tien Truong emphasized that the final quarter of 2025 and 2026 will bring many policy risks, regional disparities, and rapid changes, making long-term forecasting models less suitable. Enterprises must continuously update market signals for timely decision-making.

Enterprise Adaptation Strategies

Enterprises are proactively implementing solutions to stabilize production and sustain growth. Hoa Tho is pursuing a multi-pronged strategy, from closely monitoring tariff policies and diversifying markets to Canada, Japan, the EU, and South Korea, to technological innovation and ensuring traceability. Viet Tien is focusing on alternative supply sources to avoid business disruptions. Viet Thang is prioritizing operational optimization by reorganizing production, reducing inventory, and boosting exports through finished fabric sales and origin certificates.

In summary, the first nine months of 2025 painted a picture of stark contrasts for Vietnam’s textile industry. On one hand, the industry achieved new records in revenue and profit, showcasing resilience and opportunity seizing. On the other, deep polarization and structural challenges are increasingly evident. The favorable period of advanced orders may be over, and the road ahead is expected to be difficult. In this context, adaptability, continuous innovation, and proactive competitiveness will be key to the success of Vietnamese textile enterprises in this challenging phase.

– 12:00 13/11/2025

Dong Nai Must Disburse Nearly VND 9,000 Billion in Public Investment Capital in the Last Two Months of 2025

To achieve 100% of the allocated capital plan for 2025, Dong Nai province must disburse 8,826 billion VND in the remaining months of the year.

Latest Q3 Earnings Update: 11 Banks, Including ACB, Techcombank, and SHB, Reveal 9-Month Profits as of October 22nd

By October 22, 11 banks had announced their 9-month profit results, all reporting positive year-on-year growth.

Top Stocks to Watch at the Start of the Week: October 20th

Discover the most volatile stocks in recent trading sessions with Vietstock’s comprehensive list of top gainers and losers. Stay ahead of market trends and make informed investment decisions by exploring the stocks that have experienced the most significant price movements. This curated selection highlights the market’s most dynamic performers, providing valuable insights for both seasoned investors and newcomers alike.