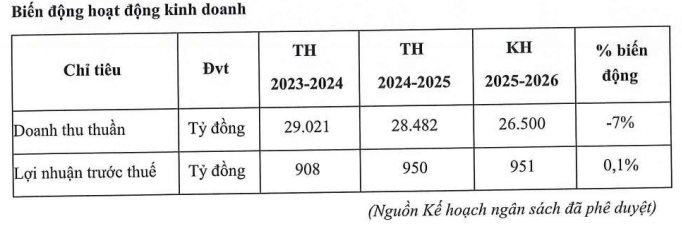

For the fiscal year 2025-2026, SBT has proposed to the Annual General Meeting (AGM) a consolidated revenue target of VND 26,500 billion (a 7% decrease) and pre-tax profit of VND 951 billion, remaining steady compared to the previous year.

These targets are set against a backdrop of anticipated volatility, intensified competition, and challenges in the sugar industry for 2025-2026, with sugar prices expected to enter a downward cycle. SBT aims to maintain its market position in sugar, expand its FBMC product line, control costs, and ensure operational efficiency.

For the fiscal year 2024-2025, SBT proposes a 6% stock dividend. In 2025-2026, the company plans to continue offering stock dividends at a rate of 5-7%.

Targeting a market capitalization of $2.7 billion by 2030

Alongside the 2025-2026 plan, SBT’s Board of Directors has outlined a strategic development roadmap for 2025-2030, focusing on five key areas:

Organizational structure: Implementing a model of 3 Centers, 3 Services, and 1 cross-functional, multinational governance system.

International trade and cooperation: Developing a multi-dimensional international trade network and enhancing global partnerships in trade and investment.

Sustainable development strategy: Strengthening ESG governance and commitments.

Human resources: Building a high-caliber workforce to support international trade and market models.

Market value: Achieving a market capitalization of $2.7 billion by 2030.

To reach the $2.7 billion market cap by 2030, SBT will enhance capital mobilization, particularly attracting international green capital for agriculture, consumer goods, and supporting industries. The company will pursue M&A opportunities with ESG-committed food enterprises to scale operations. Financial strategies include dividend distribution, portfolio optimization, and phased IPOs to boost stock liquidity and appeal. SBT will also elevate the AgriS/SBT brand by developing a sustainable product ecosystem.

Planning to raise VND 1 trillion through convertible bond issuance

For the upcoming fiscal year, SBT has proposed to the AGM the issuance of nearly 10 million convertible bonds, valued at approximately VND 1 trillion. These unsecured bonds, without warrants, are expected to be issued in 2026, pending approval from the State Securities Commission.

The bonds will be offered to common shareholders at a ratio of 855.113:10,000, allowing holders of 85.5 SBT shares to purchase 1 bond. With a 2-year term, the bonds offer a fixed annual interest rate of 9.5%, paid quarterly until maturity.

The principal must be converted into common shares in two phases: 30% after one year and the remainder at maturity. Post-conversion shares will be freely tradable.

The proceeds from the bond issuance, approximately VND 1 trillion, will be used to settle maturing debts with credit institutions and loans from AgriS Gia Lai Joint Stock Company.

– 09:17 17/11/2025

“Billion-Dollar Stocks Vanish from the Market”

Today’s stock market (November 13) paused its two-day recovery streak, with no stocks achieving liquidity in the trillions. The VN-Index fluctuated throughout the session, cooling off toward the close due to pressure from large-cap stocks.

Which Blue-Chip Stocks Are Fueling Positive Market Sentiment?

Amidst recent market turbulence, numerous large-cap stocks have plummeted by 15–25% in just weeks, casting a shadow of caution over investor sentiment. Yet, amidst this volatility, select billion-dollar stocks have demonstrated remarkable resilience, rebounding sooner than the broader market. These stalwarts have emerged as critical pillars of stability, offering a glimmer of hope as markets retreat into sensitive territory.

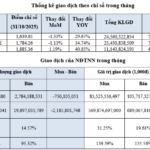

HNX-Index Declines in Both Value and Liquidity in October

In October 2025, the HNX-Index experienced significant volatility. Closing the month at 265.85 points, it marked a nearly 3% decline compared to the previous month. Liquidity also trended downward during this period.

October HOSE Highlights: Listing Activities Shine Amid Market Challenges

Vietnam’s stock market faced continued challenges in October, with the VN-Index declining in both value and liquidity. While the Ho Chi Minh Stock Exchange (HOSE) saw the departure of three companies with market capitalizations exceeding $10 billion, a positive note was struck by the listing and official trading commencement of three new stocks.