The Thai Nguyen Publishing Joint Stock Company (MCK: STH, UpCOM) recently announced its 4Q/2023 financial statement with rather disappointing results.

Specifically, during the period, STH’s net revenue was over VND 6.9 billion, a decrease of 23.3% compared to the same period last year.

Meanwhile, the cost of goods sold increased from nearly VND 4.7 billion in 4Q/2022 to about VND 5.2 billion, resulting in a significant 61.4% decrease in gross profit compared to the same period, at VND 1.7 billion.

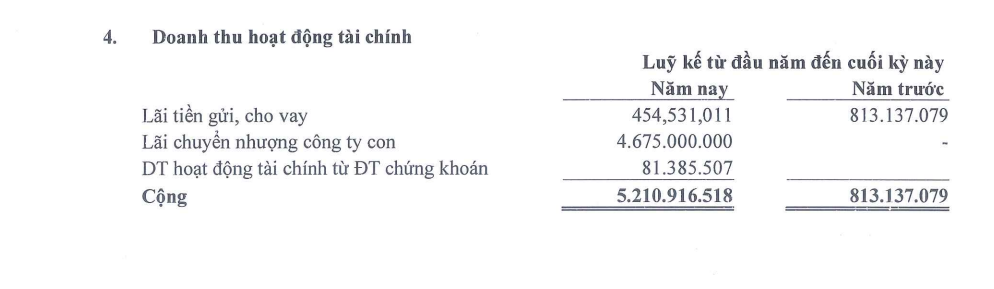

Financial income was over VND 105.7 billion, but financial expenses reached nearly VND 649 million, mostly in interest expenses. Selling and management costs were reduced to VND 1.3 billion and VND 1.4 billion, respectively.

Decreased revenue along with increased cost of goods sold and other expenses resulted in a gross loss of nearly VND 1.5 billion in 4Q/2023.

After deducting taxes and fees, STH reported a post-tax loss of nearly VND 1.5 billion, while in the same period last year, it still had a profit of nearly VND 210 billion.

By the end of 2023, the company, led by entrepreneur Nguyen Quoc Thai as Chairman of the Board of Directors, reported revenue of VND 25.7 billion, a 14.6% decrease compared to 2022.

However, thanks to reduced cost of goods sold, especially interest expenses, Thai Nguyen Publishing still achieved a profit of VND 1.2 billion in 2023, compared to a loss of nearly VND 3.7 billion in the previous year.

As of the end of 2023, the company’s total assets decreased slightly compared to the beginning of the year, at VND 211.8 billion, of which the majority was short-term assets of VND 173.2 billion.

Short-term financial investments increased from VND 6.8 billion to VND 11.6 billion as the company invested capital in securities trading. According to the report, Thai Nguyen Publishing is holding over 1.5 million DHM shares of the Trading and Mineral Exploitation Joint Stock Company Dương Hiếu, with an original price of over VND 13 billion, and a reserve of nearly VND 1.4 billion.

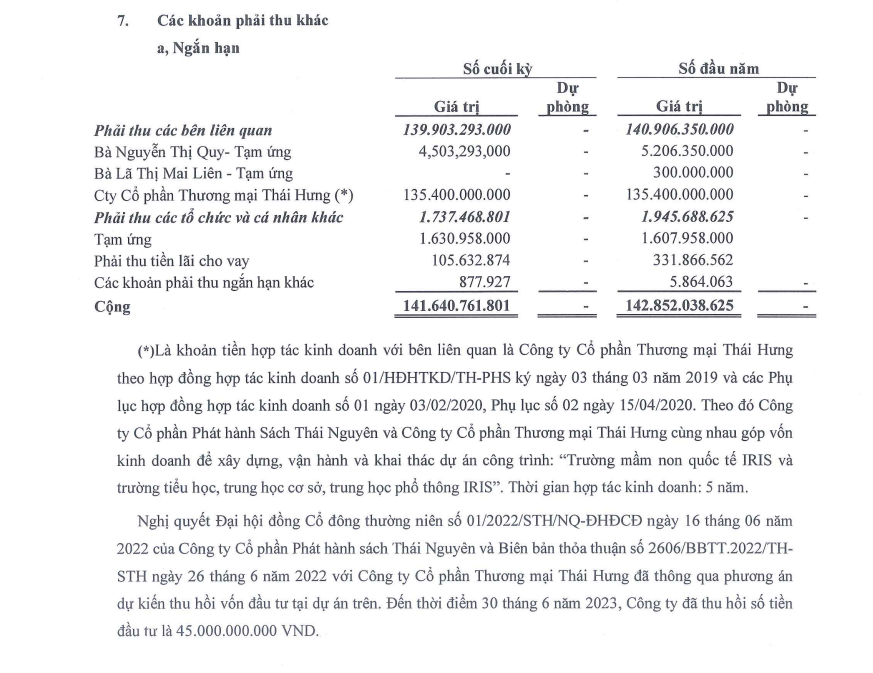

On the other hand, short-term receivables decreased from nearly VND 152 billion at the beginning of the year to about VND 145 billion.

By December 31, 2023, the payable amount was significantly improved from VND 66 billion to VND 14.5 billion.

Also, according to the 4Q/2023 financial statement, Thai Nguyen Publishing had short-term receivables of VND 135.4 billion from Thai Hung Trading Joint Stock Company (Thai Hung).

Source: Thai Nguyen Publishing’s 4Q/2024 financial statement

According to the explanation, this is the cooperation money with the related party, Thai Hung Company, under the business cooperation contract No.01/HDKTKD/TH-PHS signed on March 3, 2019.

Specifically, Thai Nguyen Publishing and Thai Hung jointly contribute capital to build, operate, and exploit the project: “IRIS International Kindergarten and Elementary, Middle, and High School”. The business cooperation period is 5 years.

However, Resolution No.01/2022/STH/NQ-DHDCD dated June 16, 2022, passed by Thai Nguyen Publishing’s General Meeting of Shareholders and Minutes of Agreement No.2606/BBTT.2022/TH-STJ dated June 26, 2022, with Thai Hung Company, approved the anticipated plan to recover investment capital in the above project. As of June 30, 2023, STH had recovered the investment capital of VND 45 billion.

Prior to that, in 2022, STH’s Board of Directors also approved Resolution No. 12 regarding investment in the project Thai Hung Complex Tower, a commercial financial service complex and hotel, invested by Thai Hung Company.

In addition, STH also had a long-term financial investment of over VND 20 billion in the Vietnam Public Joint Stock Commercial Bank (PVcomBank).

According to the report, in 2022, the company successfully received the transfer of over 2 million shares of PVcomBank from Thai Hung Company, with a transfer price of over VND 20 billion.

Notably, in 2023, Thai Nguyen Publishing had generated financial income of nearly VND 4.7 billion from stock trading. However, it incurred over VND 3.5 billion in stock sales losses, while this was not recorded in 2022.

Prior to this, Thai Nguyen Publishing was known as a state-owned company, after which it implemented equitization in 2003.

As a book publishing business, the profit margin is not high, but Thai Nguyen Publishing has the advantage of owning many prime land plots in Thai Nguyen province, including land plot No. 65 Hoang Van Thu, Thai Nguyen City.

In May 2019, STH underwent a strong capital increase from VND 2 billion to VND 65 billion, at which point the role of Thai Hung and related individuals became evident.

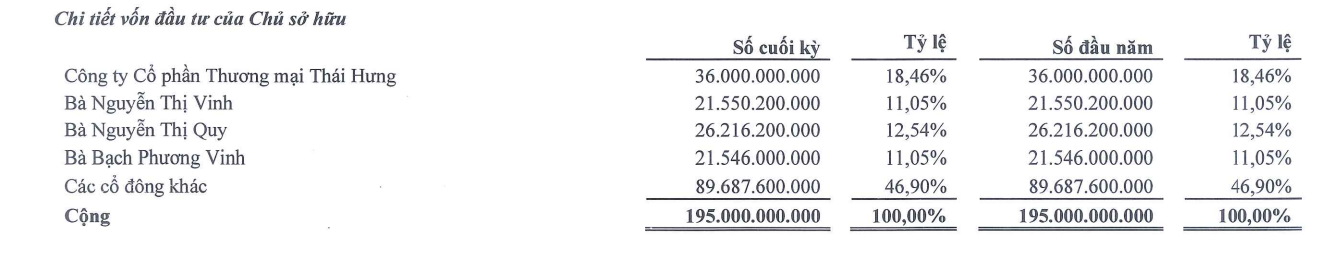

As of the end of 2023, Thai Hung directly owned 18.64% of the capital in Thai Nguyen Publishing. In addition, individuals related to Chairman Nguyen Quoc Thai and Thai Hung Company also held a large amount of shares and held key positions in the company.

Specifically, Mr. Thai’s two daughters, Ms. Nguyen Thi Vinh and Nguyen Thi Quy, respectively owned 11.05% and 13.44% of STH’s capital, and Bach Phuong Vinh (Mr. Nguyen Quoc Thai’s daughter-in-law) held 11.05%.

Currently, Ms. Quy is a member of the Board of Directors and the CEO of Thai Nguyen Publishing, while Ms. Vinh is a member of the Board of Directors. The Chairman of the Audit Committee of STH, Ms. Nguyen Thi Lan Huong, is also related to Thai Hung Company.

As for Thai Hung, the company originated as a private steel service business named Thai Hung Metal Trading Service since 1993, established by Mr. and Mrs. Nguyen Quoc Thai- Nguyen Thi Cai.

According to the amendment registration in February 2022, Thai Hung’s charter capital was adjusted from VND 1,000 billion to VND 1,500 billion, and the shareholder structure was not disclosed at that time.

From a steel manufacturing and trading enterprise, in recent years, Thai Hung has gradually shifted its focus to real estate business. A notable project is Thai Hung Eco City (Crown Villas), located in a prime location on Cach Mang Thang 8 Street, right at the “gateway” to Thai Nguyen City.

The aforementioned prime land plot originally belonged to Gia Sang Steel Refining Joint Stock Company.

In July 2016, Thai Hung Company participated in the auction of assets of Gia Sang Steel Refining Joint Stock Company and won the auction with a bid of nearly VND 57 billion, including the Gia Sang Steel Refining Plant.

Initially, Thai Hung committed to re-operate the Gia Sang steel plant. However, after a few months of operation, at the end of 2016, Thai Hung stopped operations due to small scale, outdated technology, high equipment loss, and demolished the steel plant. At the same time, Thai Hung Company proposed to the Provincial People’s Committee of Thai Nguyen to issue a permit to implement real estate projects on the prime land plot of Gia Sang Steel.

In October 2018, the Provincial People’s Committee of Thai Nguyen officially permitted Thai Hung Company to change the intended use of nearly 21.4 hectares of land of the Gia Sang Steel Refining Plant for the construction of the new Thai Hung Eco City (Crown Villas), formerly known as Crown Villas.