Bao Minh Securities JSC (BMSC, stock code: BMS) has recently reported the sale of its entire 2.81 million shares in Binh Dinh Pharmaceutical and Medical Equipment JSC (Bidiphar, stock code: DBD) during the trading session on December 3, 2025, via a negotiated transaction.

At the close of the December 3 session, DBD shares remained at the reference price of VND 50,400 per share. This transaction is estimated to yield BMSC approximately VND 141.8 billion, effectively ending its status as a Bidiphar shareholder.

Notably, Mr. Phan Tan Thu, CEO of BMSC, also serves as a Board Member of Bidiphar. Mr. Thu personally holds 975 DBD shares.

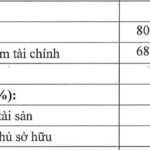

As of September 30, 2025, BMSC’s total assets stood at VND 1,893 billion, reflecting an increase of VND 130 billion since the beginning of the year.

The FVTPL (Fair Value Through Profit or Loss) asset portfolio was valued at VND 785 billion, up VND 107 billion year-to-date. This includes 23.4 million listed shares with a book value of VND 391 billion and a market value of VND 508.5 billion. Additionally, the portfolio comprises 9.4 million unlisted shares worth nearly VND 158 billion and 8.8 million fund certificates valued at VND 118 billion.

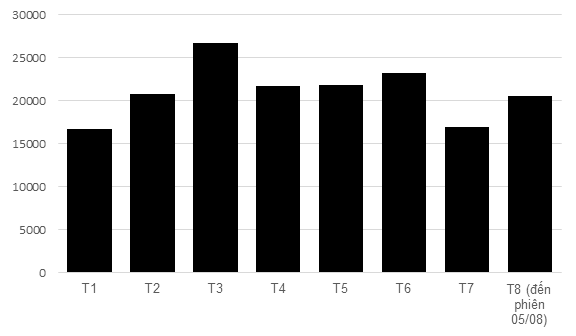

In terms of business performance, Bao Minh Securities recorded operating revenue of VND 366 billion in the first nine months of 2025, a 68.6% increase year-on-year. Consequently, pre-tax profit reached VND 108 billion, marking a 30% growth compared to the same period last year.

Recently, Bao Minh Securities announced that it will finalize the shareholder list on December 8 to convene an Extraordinary General Meeting (EGM) for 2025. The meeting’s time and venue are yet to be disclosed. The agenda includes the resignation of one Board Member and two Supervisory Board Members, followed by the election of their replacements.

Earlier, Bao Minh Securities received resignation letters from three senior executives. Mr. Do Van Ha stepped down as an Independent Board Member due to work commitments. Mr. Ha was appointed to this role in April 2023.

Additionally, two Supervisory Board Members, Ms. Moc Thi Lan Uyen and Ms. Truong Thi Bich Ngan, also tendered their resignations. Ms. Uyen was elected in April 2022, while Ms. Ngan joined in April 2023. Both hold Bachelor’s degrees in Accounting and Auditing.

Quốc Cường Gia Lai to Issue Over 27 Million Shares as 2021 Dividend Payment

Revised Introduction:

Quốc Cường Gia Lai is set to issue over 27.5 million QCG shares as dividends for 2021, offering a 10:1 ratio to shareholders. The execution is slated for Q1 2026.

Phú Mỹ Tops Urea Market Share, Aims for Billion-Dollar Revenue

PetroVietnam Fertilizer and Chemicals Corporation (PVFCCO – Phu My, HOSE: DPM) is entering a strategic acceleration phase. Building on its leadership in the domestic urea market, the company aims to expand into the chemicals and petrochemicals value chain, with a focus on green products such as clean ammonia and hydrogen.

G Kitchen Chain Owner Reports 2.5x Surge in Half-Year Profits

According to its periodic financial report submitted to the Hanoi Stock Exchange (HNX), Greenfeed Vietnam JSC recorded a significant surge in profits during the first half of 2025. However, the company’s total liabilities also saw a notable increase during the same period.