The revised Personal Income Tax Law, adopted by the National Assembly on December 10, introduces significant changes to the personal income tax brackets compared to the current regulations.

New Personal Income Tax Brackets, Effective from July 1, 2026

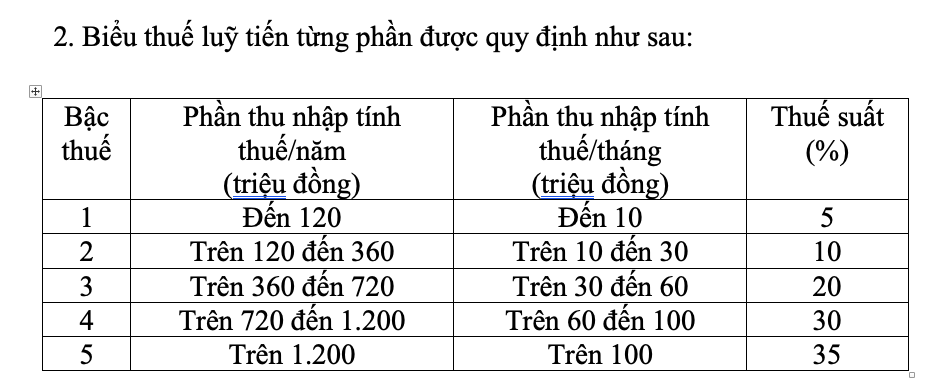

Under the new law, effective from July 1, 2026, the progressive tax brackets have been reduced from 7 to 5. The law has widened the gaps between brackets and adjusted two intermediate tax rates. Specifically, the 15% rate in bracket 2 has been lowered to 10%, and the 25% rate in bracket 3 has been reduced to 20%.

With the new tax brackets, the government states that all individuals currently paying taxes under the existing brackets will see a reduction in their tax obligations. Additionally, the new brackets address sudden increases at certain levels, ensuring a more reasonable tax structure.

Regarding the highest tax rate of 35% in bracket 5 for income from salaries and wages, this is considered a reasonable proposal. It is an average rate, neither too high nor too low compared to other countries globally and within the ASEAN region.

According to the government, several ASEAN countries, including Thailand, Indonesia, and the Philippines, also have a top tax rate of 35%, while China’s highest rate is 45%. Reducing the 35% rate to 30% would be perceived as a tax cut favoring the wealthy.

Regarding family deductions, the revised Personal Income Tax Law defines family deductions as amounts subtracted from taxable income before calculating tax on income from salaries and wages for resident taxpayers.

Family deductions include: a deduction of 15.5 million VND/month (186 million VND/year) for the taxpayer, and a deduction of 6.2 million VND/month for each dependent.

The law also stipulates that, based on price and income fluctuations, the government will propose appropriate family deductions to the National Assembly’s Standing Committee, reflecting the economic and social conditions of each period. Each dependent can only be claimed once by a single taxpayer.

According to the government, revising and supplementing family deduction provisions is essential to align with current realities. Family deductions are a critical aspect of the law, attracting significant public and media attention.

Moreover, family deductions directly impact taxpayers’ obligations. Therefore, to ensure compliance and reflect practical implementation, the law should explicitly specify family deductions for taxpayers and dependents, as in the current Personal Income Tax Law.

Thus, the law explicitly sets family deductions for taxpayers and dependents. It also grants the government the authority to propose adjustments to the National Assembly’s Standing Committee when necessary, ensuring clarity and transparency in implementation.

Personal Income Tax: Government Aims to Retain Top Bracket at 35%

Under the latest proposal, income exceeding 100 million VND per month, after deductions for dependents, will be subject to the highest tax rate of 35%. The government argues that reducing this rate from 35% to 30% would be perceived as a policy of ‘tax cuts for the wealthy.’

Latest Updates on Taxation of Gold Bullion Transfers

The Ministry of Finance has proposed a 0.1% tax rate on the transfer price of each gold bar transaction. The government will specify the threshold value of gold bars subject to tax, exempting individuals who buy or sell gold for savings or storage purposes (not for business), in line with traditional accumulation practices.