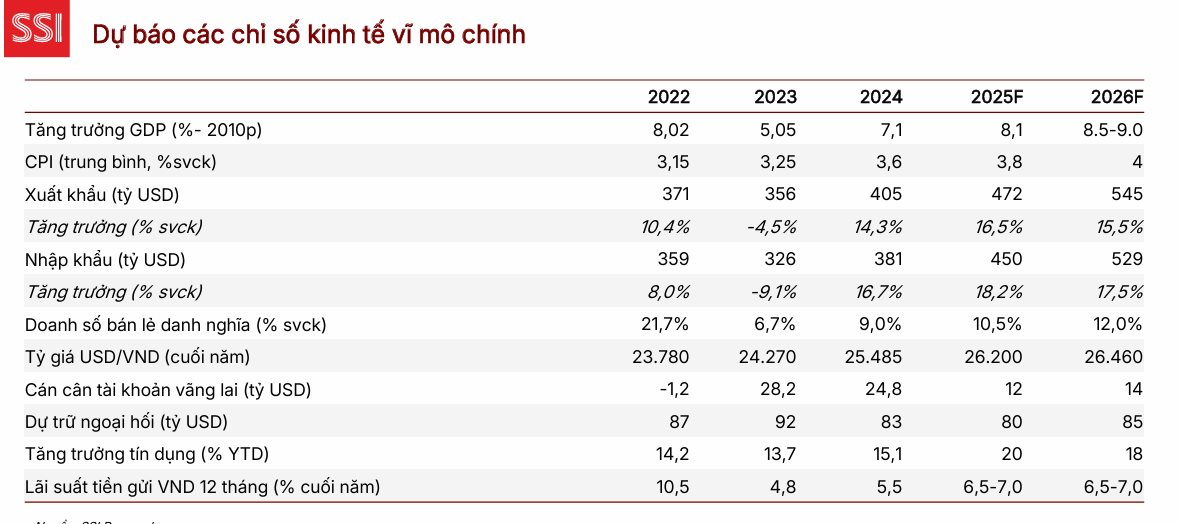

Vietnam’s economic landscape is concluding 2025 on a high note. SSI Research forecasts a GDP growth of 8.2% in Q4/2025 compared to the same period last year, bringing the annual growth to 8%. This momentum is driven by the synchronized recovery of three key pillars: industrial production, public investment disbursement, and domestic consumption.

As we step into 2026, the first year of the 2026-2030 five-year plan, the economy is expected to continue its growth trajectory, with GDP estimates ranging from 8.5% to 9.0%. Inflation remains under control, with an average CPI of around 4%, providing the State Bank of Vietnam with the flexibility to maintain an accommodative monetary policy.

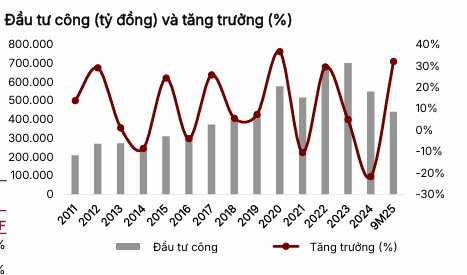

Additionally, the market outlook is bolstered by streamlined administrative reforms and an expanded fiscal policy. Annual capital investment is projected to reach approximately $63 billion—more than double the previous cycle—serving as a critical driver for infrastructure and urban development. This robust macroeconomic foundation is expected to propel the stock market toward higher benchmarks.

P/E Ratio of 12.7 and Inflow of Foreign Capital

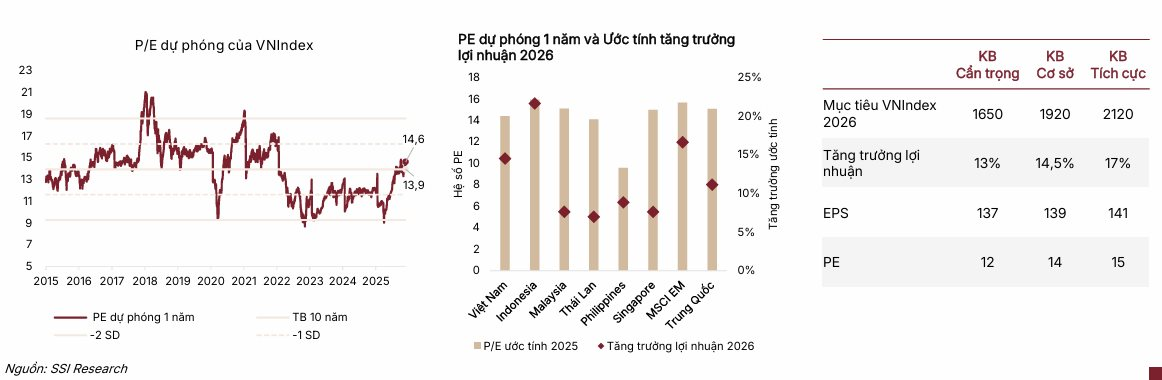

Amid concerns that the stock market’s rapid rise could lead to a deep correction, SSI Research’s December strategy report offers insights based on valuation data. Currently, the 2025 projected P/E ratio of the VN-Index hovers around 14.5 times, in line with regional averages.

However, the key lies in the 2026 earnings outlook. With projected earnings growth of 14.5% for listed companies (higher than the regional average of 11.5%), the 2026 P/E ratio is expected to retreat to 12.7 times. This figure is significantly lower than the 10-year historical average of 14 times. SSI Research concludes that this valuation remains attractive for long-term investors and shows no signs of an asset bubble.

Beyond valuation, the market upgrade narrative remains a focal point, with accelerated reforms such as eliminating pre-funding requirements, implementing STP systems for foreign institutional investors, and simplifying account opening procedures.

Notably, Decree 245/2025 has established a legal framework prohibiting lower foreign ownership caps than mandated, while laying the groundwork for a central clearing mechanism (CCP) expected to launch in the second half of 2026. SSI Research estimates that an upgrade to emerging market status by FTSE Russell could attract approximately $1.5 billion in passive capital from ETFs.

Based on these growth drivers and reforms, SSI Research has raised its 2026 VN-Index target to 1,920 points.

Potential from $48 Billion in Public Investment and Stock Recommendations

The Construction and Building Materials sector is identified by SSI Research as a key beneficiary in 2026, driven by two main factors: capital availability and the progress of public investment projects.

Citing estimates from the Ministry of Finance, SSI reports that total public investment for 2026 is expected to reach $48 billion, a 12% increase year-over-year. Notably, the first half of 2026 marks the completion of several major national infrastructure projects, including the expansion of the HCMC-Long Thanh Expressway, the Bien Hoa-Vung Tau Expressway, and Long Thanh Airport. This ensures a substantial backlog of work for infrastructure contractors such as VCG, LCG, HHV, CTD, and C4G.

On the policy front, the material shortage issue—a persistent challenge—is expected to be resolved through Resolution No. 66.4/2025/NQ-CP. Effective from September 2025, this resolution relaxes legal requirements for mining and construction material licenses for key infrastructure and public investment projects.

In addition to infrastructure, the residential construction sector is poised for recovery, supported by social housing policies. The Prime Minister has set a target of completing 100,275 units in 2025, increasing to 116,347 units in 2026. This provides building material companies with a basis for improved demand expectations.

For material producers, SSI Research highlights the supportive role of input costs. Prices of key raw materials like iron ore and coal are trending downward, easing cost pressures. In the steel sector, the imposition of anti-dumping duties on imported hot-rolled coil (HRC) steel is seen as crucial for protecting domestic producers’ market share.

Based on these insights, SSI Research offers positive recommendations for three stocks:

First is Hoa Phat Group (HPG). As the steel industry leader, HPG benefits from both recovering construction demand and protective tariffs. SSI projects a 37% net profit growth in 2025 and 28.8% in 2026. The one-year target price is VND 35,000 per share, representing a potential upside of approximately 30%.

Next is Ha Tien Cement (HT1), which directly benefits from major infrastructure projects in the South. HT1’s 2025 profit is projected to surge by 324.9% from a low base. The target price is set at VND 19,800 per share, indicating a potential gain of around 28%.

Finally, Coteccons (CTD) is on the watchlist with a target price of VND 86,800 per share. While SSI sees limited short-term upside (0.2%), CTD remains highly regarded for its position in residential and industrial construction.

Mountain Tycoon’s Turmoil: Ending the Trillion-Dong Debt Saga with Truong My Lan

QCG is tasked with resolving a payable stemming from the purchase, sale, and transfer agreement of the Bắc Phước Kiển land project with Sunny Island Investment Joint Stock Company, totaling 2,882.8 billion VND.

Economic Growth Surge: 20 Out of 34 Localities Achieve 8% Expansion

In November 2025, the Government’s regular meeting assessed the socio-economic situation and results for the month and the first 11 months of the year. The overall trend remains positive, with each month showing improvement over the previous one. Cumulatively, the 11-month performance has surpassed that of the same period in 2024 across nearly all sectors, highlighted by 10 standout achievements.

Expert Insights: Early Stages of a New Wave in the Market – VN-Index May Fluctuate Before Targeting 1,800 Points

Early adjustments in the market, if they occur at the beginning of the week, are likely to stimulate low-price demand, thereby creating a more favorable environment for the VN-Index to gradually approach the target range of 1,800 points in the remainder of December.