Illustrative Image

According to statistics from the General Department of Customs, Vietnam’s textile and garment exports in November reached nearly $3 billion, a 6.5% decrease compared to October.

Cumulatively, in the first 11 months of the year, the country earned nearly $36 billion from this sector, a 6.7% increase compared to the same period last year.

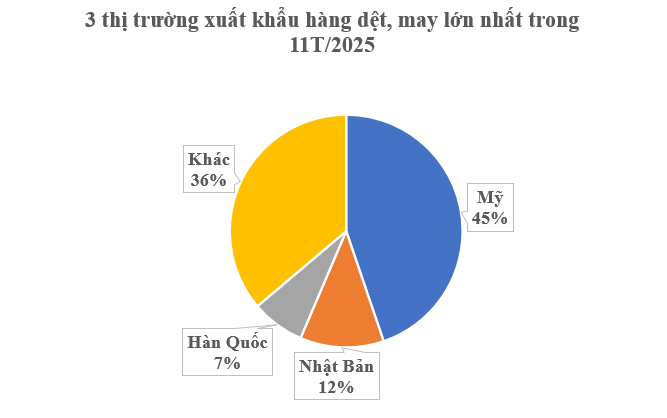

In terms of markets, the United States remains Vietnam’s largest export destination, with over $16 billion, a 10% increase compared to the same period in 2024.

Japan ranks second with over $4.1 billion, a 6% increase compared to 10M/2024. South Korea is the third-largest market with over $2.6 billion, though it saw a 9% decline compared to the same period in 2024.

According to the Vietnam Textile and Apparel Association (VITAS), 2025 marked a remarkable recovery for the industry, with notable highlights. The textile and garment export turnover is estimated to reach $46 billion, a 5.6% increase compared to 2024. The sector’s trade surplus is estimated at $21 billion, reinforcing its role as a pillar in the national trade balance. The domestic value-added ratio reached approximately 52%, indicating significant progress in sourcing raw materials and accessories locally.

Looking back at 2025, the textile industry faced numerous challenges, including escalating U.S.-China trade tensions leading to tariffs on many textile products, a complex geopolitical landscape, and reduced consumer spending in the U.S. and EU.

Consumers tightened their budgets, forcing businesses to accept smaller orders, rush production, and meet shorter delivery times, which directly impacted profit margins for key product lines. Traditional markets faced significant pressure.

Despite these challenges, Vietnamese enterprises maintained stable production and retained their market share in 138 global export markets, with key markets including the U.S., EU, Japan, South Korea, China, and countries in Africa and the Middle East.

VITAS’s 2025 development strategy focused on three main pillars: diversifying export markets, diversifying partners and customers, and diversifying products. As a result, the industry expanded its product lines and increased investment in domestic raw material and accessory supplies.

The trend toward sustainable and eco-friendly fashion has become a mandatory requirement from major importing markets. Vietnam’s textile industry has made strides in producing recycled fibers, natural fibers, and environmentally friendly products, aligning with global sustainable consumption trends. Looking ahead, the industry aims to achieve export targets of $48–49 billion in 2026 and $66–66.5 billion in the 2026–2030 period. Key strategic pillars will continue to focus on market diversification, attracting investment in domestic raw materials, applying science and technology, and automating processes, while also developing Vietnamese brands globally.

Globally, in 2024, the three largest textile exporters were China, Vietnam (surpassing Bangladesh to take second place), and Bangladesh. Vietnam’s exports reached nearly $44 billion, solidifying its position as the world’s third-largest textile exporter.

BIDV Card and Operations Center Director: QR Pay Overcomes Key Shortcomings of Traditional QR Money Transfers

The bank representative suggested that regulations should be considered to prohibit individual-to-individual transactions for goods payments, aiming to incentivize a shift toward QR code payments.