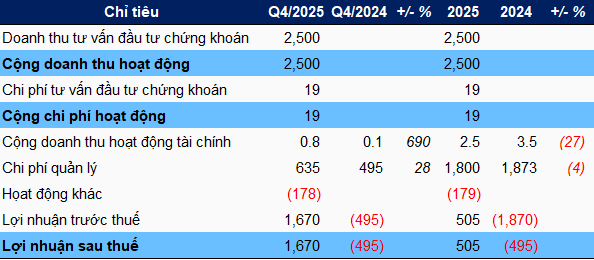

TCVN reported an operating revenue of VND 2.5 billion in Q4/2025, entirely derived from securities investment advisory services. This segment also accounted for the company’s sole operating expenses.

After adding a small amount of financial revenue and deducting management costs (primarily employee salaries) and other expenses, the company achieved a net profit of nearly VND 1.7 billion, a significant improvement compared to the loss of nearly VND 495 million in the same period last year. This result also contributed to a full-year net profit of nearly VND 505 million.

|

Q4 and full-year 2025 business results of TCVN

Unit: Million VND

Source: VietstockFinance

|

By the end of 2025, TCVN’s total assets stood at just over VND 15.4 billion, a 15% increase from the beginning of the year, primarily due to a rise in unfinished construction costs by more than VND 1.4 billion. The company’s assets remain predominantly short-term, notably marked by a significant shift as cash holdings plummeted from nearly VND 13.2 billion to approximately VND 1.9 billion, while new investments held to maturity totaling VND 9 billion and prepayments to suppliers of nearly VND 1.9 billion emerged.

Revenue resurgence following leadership upheaval

2025 marked the first year TCVN generated operating revenue since 2021, with the entire amount recorded in Q4/2025—a period of significant leadership changes at TCVN.

| TCVN resumes operating revenue after 5 years |

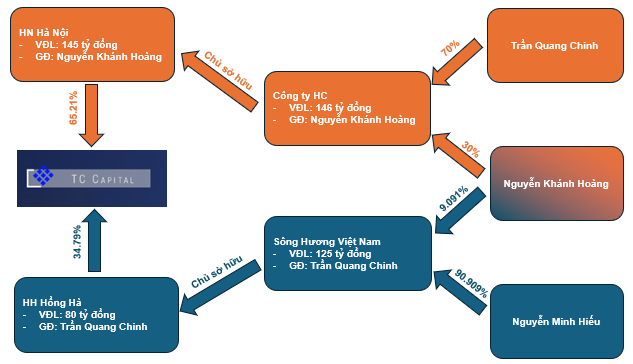

In November 2025, TCVN’s entire charter capital of over VND 20.8 billion was transferred from TC Capital Advisory Limited (45.21%), Mr. Nguyễn Hoàng Thái (34.79%), and Mr. Đặng Quốc Hùng (20%) to HN Hà Nội LLC (65.21%) and HH Hồng Hà LLC (34.79%)—two entities established just two months prior in September.

The Board of Directors underwent changes, with Ms. Vũ Thanh Vân, representing HH Hồng Hà, and Ms. Bùi Ngọc Tú, representing HN Hà Nội, appointed as new members. Ms. Vũ Thanh Vân currently serves as both Chairwoman of the Board and CEO of TCVN.

During Q4, TCVN’s workforce expanded significantly from 6 to 14 employees.

Further investigation reveals that HN Hà Nội initially had a charter capital of VND 95 billion, contributed by HC Trading and Investment Consulting LLC (HC Company)—established in January 2025 with a charter capital of VND 5 billion from Mr. Trần Quang Chinh (70%) and Mr. Nguyễn Khánh Hoàng (30%). This capital was later increased to VND 100 billion in October 2025.

In recent developments, HC Company raised its capital to VND 146 billion on December 25, 2025, with ownership structure unchanged. Two days later, HN Hà Nội also increased its capital to VND 145 billion.

As for HH Hồng Hà, this entity began with a charter capital of VND 50 billion, owned by Sông Hương Việt Nam LLC. Sông Hương Việt Nam was established in November 2024 with a charter capital of VND 110 billion, contributed by Mr. Nguyễn Minh Hiếu (90.909%) and Mr. Nguyễn Khánh Hoàng (9.091%)—the latter also being an investor in HC Company.

Similar to HC Company and HN Hà Nội, both Sông Hương Việt Nam and HH Hồng Hà increased their capital in December 2025. Specifically, on December 25, Sông Hương Việt Nam raised its capital to VND 125 billion, maintaining its ownership structure. Two days later, HH Hồng Hà increased its capital to VND 80 billion.

Currently, at HN Hà Nội, Mr. Nguyễn Khánh Hoàng serves as Director and Legal Representative. Meanwhile, Mr. Trần Quang Chinh holds these roles at HH Hồng Hà.

|

New ownership network at TCVN

Source: Author’s compilation

|

– 16:01 16/01/2026

Foodcosa Reports Record Profits in Q4 2025, Barely Breaks Even for the Year

Despite a prolonged streak of poor business performance, Ho Chi Minh City Food Corporation (Foodcosa, UPCoM: FCS) unexpectedly recorded its highest-ever quarterly profit in Q4/2025. However, the full-year results still yielded only a slim profit, insufficient to significantly enhance its financial foundation.

Masan High-Tech Materials and Two Subsidiaries Strengthen Executive Leadership Team

Masan High-Tech Materials and its two subsidiaries have recently approved changes in leadership, including the appointment of a new CEO and additional Vice Presidents.

Top Executives Step Down from Leadership Roles

SMC Investment and Trading Joint Stock Company, Song Da 11 Joint Stock Company, Hai Minh Joint Stock Company, and Saigon – Hanoi Securities Joint Stock Company have announced leadership changes, including new appointments for the positions of CEO, Board of Directors members, and Board of Supervisors members.