NTP Manufacturing Facility

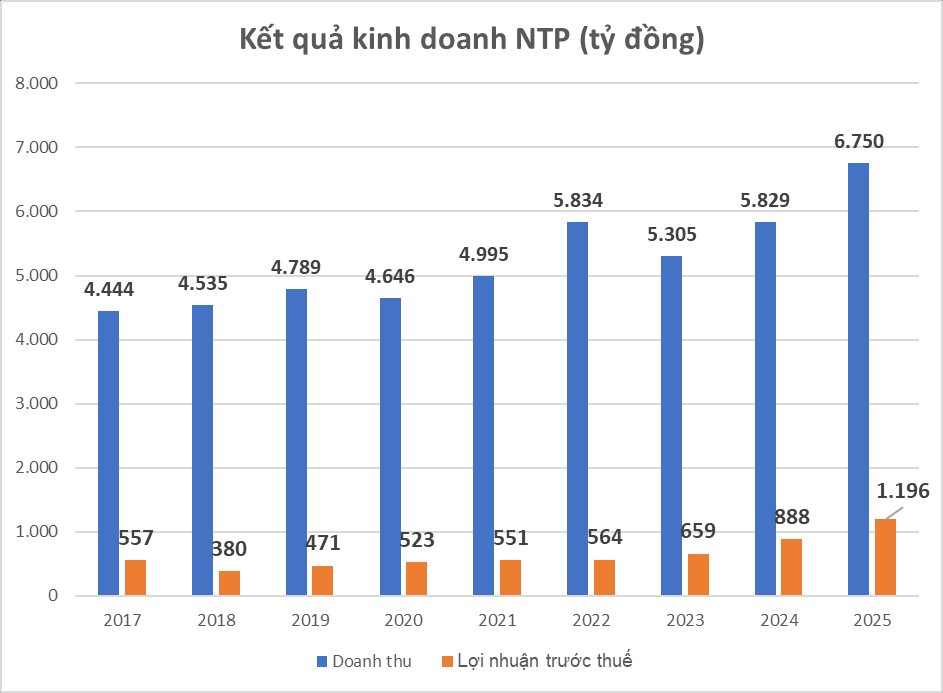

Tien Phong Plastic Joint Stock Company (stock code: NTP) has released its Q4/2025 consolidated financial report, showcasing robust performance despite ongoing volatility in the construction materials market.

In the final quarter, net revenue reached over VND 1,881 billion, a slight increase from VND 1,826 billion in the same period last year. Gross profit remained stable at VND 597 billion. A notable highlight was a 40% surge in financial revenue to VND 43 billion, coupled with reduced operational expenses.

For the full year 2025, Tien Phong Plastic recorded significant growth with net revenue of VND 6,750 billion, a 15% increase from VND 5,829 billion in 2024. Controlled production costs led to a gross profit of VND 2,092 billion (compared to VND 1,769 billion previously). Remarkably, financial revenue soared to VND 167 billion, nearly doubling the previous year’s figure and significantly contributing to overall results.

After deducting operating costs (sales: VND 640 billion, management: VND 294 billion), Tien Phong Plastic reported pre-tax profit of VND 1,196 billion, joining the elite group of trillion-dong profit enterprises.

Net profit reached a record high of VND 992.8 billion, up 35% from VND 735.6 billion in 2024, elevating EPS to VND 5,805.

As of December 31, 2025, total assets stood at VND 7,047 billion, a 10% increase. Notably, inventory surged 43% to VND 1,441 billion from VND 1,005 billion, reflecting an aggressive stockpiling strategy.

Despite this, liquidity remained strong with cash and financial investments exceeding VND 3,100 billion.

Regarding capital structure, short-term debt decreased significantly from VND 1,481 billion to VND 1,164 billion. Equity reached VND 4,231 billion, with retained earnings totaling over VND 1,303 billion.

On the stock market, NTP shares closed at VND 66,400 on January 20, valuing the company at VND 11,357 billion.

Chairman Dang Quoc Dung addressing the year-end conference

Tech & Telecom Stocks Surge: ELC, CMG Skyrocket, FPT Lags Behind

KBSV forecasts a robust recovery in global IT spending by 2026, with projected growth reaching 9.8% according to Gartner.

DNSE Sets New Record in Margin Loan and Advance Payment Debt

DNSE has unveiled its Q4 and full-year 2025 financial results, marking a year of unprecedented achievements. In 2025, the company recorded a remarkable revenue of over 1.467 trillion VND, a 77% surge year-on-year. Pre-tax profit soared to more than 340 billion VND, while post-tax profit exceeded 272 billion VND, reflecting a 50% increase compared to 2024. Additionally, outstanding margin loans and advance payments for securities reached a new high of over 5.832 trillion VND.

Đất Xanh Services Offers Full Equity Transfer of Đất Xanh Miền Nam

The Board of Directors of Dat Xanh Services has approved the plan to transfer all shares in Dat Xanh Mien Nam.