In Q4/2025, Vietnam Construction and Import-Export Joint Stock Corporation (Vinaconex, HOSE: VCG) reported a decline in business performance, with net revenue of nearly VND 4,652 billion and net profit of approximately VND 244 billion, down 2% and 15% year-on-year, respectively. The primary reason was a 93% surge in selling and administrative expenses, reaching over VND 253 billion, significantly eroding profits.

However, full-year results remained record-high, with net revenue exceeding VND 16,064 billion, up 25%, and net profit nearing VND 3,933 billion, 4.2 times higher than the previous year, surpassing annual targets.

| VCG Concludes 2025 with Record-Breaking Performance |

This growth was driven by Vinaconex’s complete divestment of its 51% stake in Vinaconex Tourism Investment and Development JSC (UPCoM: VCR) in Q3, the developer of the 172-hectare Cat Ba Amatina resort project.

Over VND 7.7 Trillion in “Mysterious” Receivables

Thanks to the extraordinary gain, the company’s undistributed after-tax profit surged to nearly VND 4,763 billion by year-end, 2.5 times higher than the beginning of the year. Total assets also grew by 7%, reaching nearly VND 31,530 billion, with bank deposits increasing by 29% to over VND 5,200 billion.

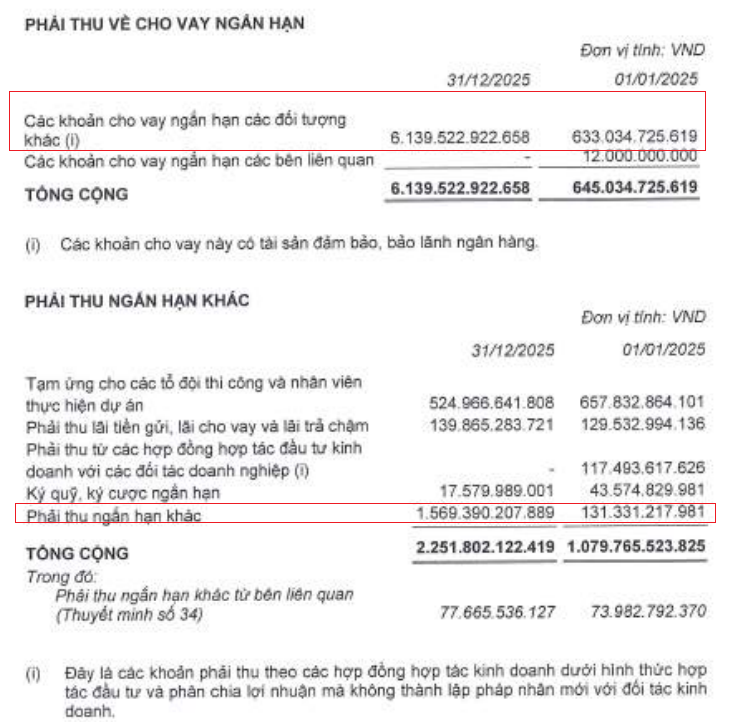

However, the most notable aspect of the balance sheet was the receivables. By year-end, Vinaconex’s short-term receivables skyrocketed to over VND 12,330 billion, 2.1 times higher than the beginning of the year. Of this, short-term loans to other entities accounted for half, at nearly VND 6,140 billion, almost 10 times higher. The company did not disclose the identities of the borrowers, only stating that these loans were secured by assets and bank guarantees. Additionally, other short-term receivables also surged to nearly VND 1,570 billion, 12 times higher than the beginning of the year, without detailed explanations.

Furthermore, VCG has a receivable of over VND 471 billion from Vietnam Airlines Corporation – JSC (UPCoM: ACV).

Source: VCG

|

Another notable point is that the company increased its bad debts to nearly VND 982 billion, up 78%, with VND 632 billion considered uncollectible.

Inventory stood at over VND 6,135 billion, down 14%, primarily in work-in-progress. Meanwhile, construction in progress plummeted by 76% to over VND 1,584 billion, as the company no longer recorded investment costs for the Cat Ba Amatina urban area project, which were over VND 5,564 billion at the beginning of the year.

Total liabilities were nearly VND 18,954 billion, up 3%, with financial debt at nearly VND 7,420 billion, accounting for 39% of total liabilities.

Stock Hits 7-Month Low

On the stock market, VCG shares experienced a sharp correction in late January 2026.

From January 23 to 30, 2026, VCG shares dropped by 17% to VND 19,150 per share. The decline occurred over six consecutive sessions, including two floor sessions, pushing the stock to its lowest level in over seven months before a slight rebound in the final session. Average liquidity during this period was nearly 16.9 million shares per day.

| VCG Stock Performance Since 2025 |

The stock’s performance comes as Vinaconex prepares for inspections scheduled for 2026 by the Government Inspectorate. Specifically, Division VII will inspect Vinaconex in Q2 regarding compliance with laws on construction investment, housing development, and real estate business in several projects where the company is the developer.

– 20:19 31/01/2026

Stock Market Week 26-30/01/2026: Restoring Balance

The VN-Index extended its recovery in the final trading session of the week, partially offsetting the sharp declines seen earlier. However, market sentiment remains cautious as liquidity continues to linger below the 20-session average. It’s likely the market will require additional accumulation time to absorb selling pressure before establishing a clearer trend in the coming period.

Vinaconex’s Largest Shareholder Makes a Notable Move

Pacific Holdings, a leading investment corporation and majority shareholder of Vinaconex with over 45% ownership, has recently taken decisive action to significantly reduce its chartered capital.