“The older, the spicier”, a folk saying that uses the nature of ginger to describe experienced and sharp-minded people, both in life and business. And in the stock market, there are also a few companies that truly embody the spirit of “the older, the spicier”, such as Ms. Tran Thi Thai – a seasoned female entrepreneur in the sugar cane industry and a leader at Son La Sugar Joint Stock Company.

It is known that Ms. Thai was born in 1939, making her the oldest person on the Vietnam stock market at 86 years old. Ms. Thai is currently on the board of directors of several sugar cane companies, such as Kon Tum Sugar Joint Stock Company (Ms. Thai is the biological mother of Chairman Dang Viet Anh and the sister of Tran Ngoc Hieu – a member of the Board of Directors), Son La Sugar Joint Stock Company (SLS), Can Tho Sugar Joint Stock Company (Ms. Thai is the sister of Chairman of the Board of Directors Tran Ngoc Hieu)…

As an individual, Ms. Thai holds a 27.4% stake in Son La Sugar Joint Stock Company, 3% in Kon Tum Sugar Joint Stock Company, and also has ownership in Can Tho Sugar Joint Stock Company… Son La Sugar Joint Stock Company is particularly noteworthy as some members of Ms. Thai’s family hold significant power in the company.

Ms. Thai is currently the largest shareholder of Son La Sugar Joint Stock Company with nearly 2.7 million SLS shares. Thai Lien Company Limited, represented by Ms. Tran Thi Lien, Ms. Thai’s younger sister, is the second-largest shareholder according to the law, followed by Mr. Dang Viet Anh – Chairman of the Board of Directors of Son La Sugar Joint Stock Company. Together, this group holds 52.27% of SLS shares.

As for Son La Sugar Joint Stock Company (SLS), it is also one of the “veteran” companies in the sugar industry, established since 1995. Throughout its journey, SLS has gone through ups and downs, notably from 1997 to 2006, when the company’s production activities were inefficient and tended to decline, with a high possibility of bankruptcy. However, SLS is now known as one of the stable business units, paying annual dividends to shareholders.

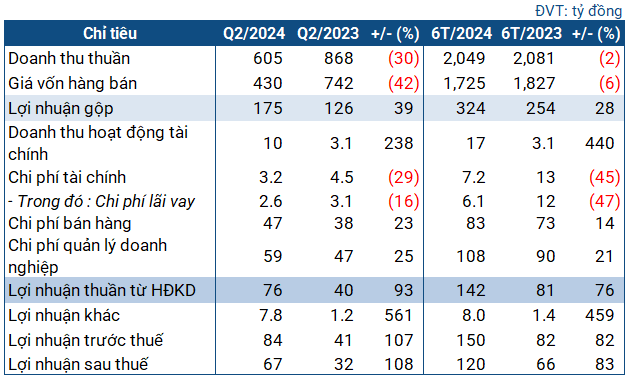

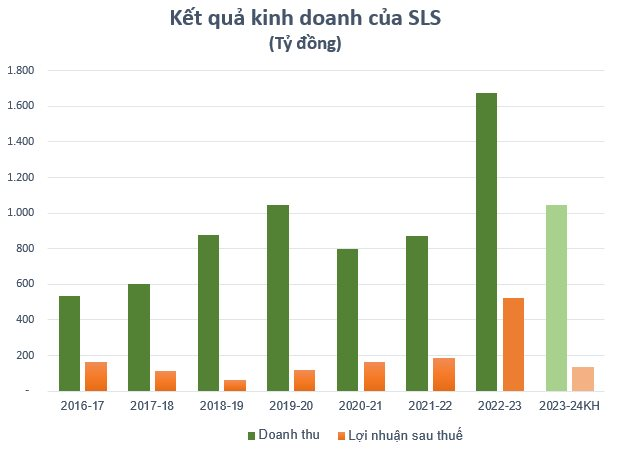

SLS recently announced its financial results for the second quarter of the 2023-2024 fiscal year, with net revenue reaching only 187.9 billion VND, a decrease of nearly 50% compared to the same period in the previous fiscal year. In this period, thanks to a significant increase in financial operating income by 3.4 times, the company’s net profit reached 70 billion VND, a decrease of 35% compared to the same period in the previous fiscal year.

This is the lowest profitable quarter in the past 6 quarters for SLS, officially breaking the streak of “hundreds of billions in profit” continuously since the second quarter of the 2022-2023 fiscal year.

Nevertheless, in the cumulative 2 quarters of the fiscal year, SLS still exceeds 38% of the full-year profit plan. It should be emphasized that the profit has decreased but still managed to surpass the prudent business plan of SLS (a decrease of 74% compared to the record high level of the 2022-2023 fiscal year). In addition to concerns about El Nino, the company has stated that it will continue to invest in developing raw material areas.

Looking at the longer term, the profits of SLS have been relatively stable according to the cycle of sugar prices (sugar cane is a cyclical industry) and have been on an upward trend. Especially in recent quarters, the company has regularly pocketed hundreds of billions in profit. In particular, in the fourth quarter of the 2022-2023 fiscal year, there was a sudden increase to 523 billion VND thanks to a sharp increase in sugar prices.

It is worth noting that raw sugar prices in the world market have recorded a “vertical” increase since early April 2023, reaching 23.94 US cents/lb on April 14th, also the highest level since the first quarter of 2012. In the domestic market, benefiting from the high global sugar prices, the price of sugar cane raw materials is also following the upward trend in the world.

With stable business operations, the company associated with Tran Thi Thai’s name is also known for its tradition of regularly paying high dividends. Since its listing in 2012, Son La Sugar Joint Stock Company has distributed cash dividends to shareholders every year. In recent years, the dividend payout ratio has often exceeded 50%.

In addition to the tradition of dividend payments, SLS has also attracted investors’ attention by maintaining a high earnings per share (EPS) of over 10,000 VND. One of the advantages that helps SLS achieve this result is being exempt from corporate income tax due to operating in economically and socially difficult areas.

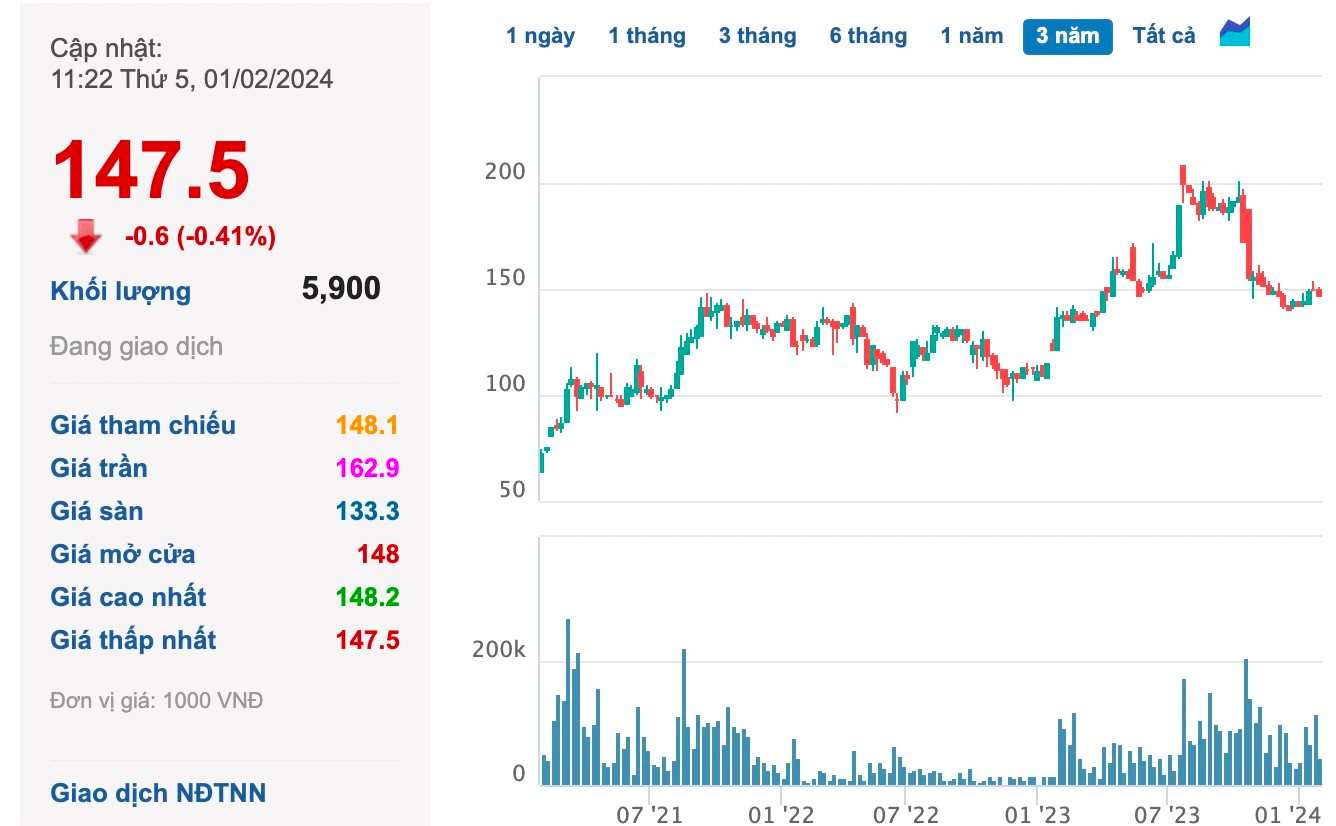

Not only achieving hundreds of billions in annual profits and high EPS, in the stock market, despite strong fluctuations, SLS shares have been traded at prices above 100,000 VND per share throughout the past year, remaining firm in the group of “three-digit” stocks.

Therefore, since its listing in 2012, the SLS stock can be considered a seasoned stock on the market and has always been among the most expensive stocks in the whole market.