The strong active buying signal in blue-chip stocks in the afternoon session helped many large-cap stocks improve their prices. VCB and GVR re-entered the leading group, along with VIC, VHM, VRE, helping the VN-Index escape from many ups and downs to close at the highest level of the session.

The closing index increased by 0.42%, equivalent to +5.09 points. This result is not easy to achieve when there have been continuous declines. The VN-Index had a retest of the morning low before there was a high buying pressure in the pillar group in the last 15 minutes of continuous matching.

Compared to the morning session, the VN30 basket had 19 stocks declining, 9 stocks increasing, but the score was much better: This index closed up 0.12% compared to 0.07% in the morning. At the end of the day, there were 10 stocks increasing/16 stocks declining. The improvement came from some positive recovery stocks, which also contributed to supporting the VN-Index.

The largest pillar in the market, VCB, decreased by 0.55% in the morning session, but closed up 1.22%, equivalent to an increase of 1.78% today. VCB even jumped to the top position in the leading group, contributing more than 1.5 points to the VN-Index. The trading volume of VCB in the afternoon session was only about 84.4 billion dong, showing a light selling pressure. Another impressive stock is GVR, which reversed from a 0.56% decrease in the morning session to a 5.22% increase at closing, equivalent to a 5.82% increase in the afternoon, with good liquidity of 10.93 billion dong. GVR surpassed both VHM and VRE, contributing 1.4 points to the VN-Index.

The three large pillars of the Vin group did not change much this afternoon: VIC decreased slightly by 0.31% compared to the morning close price, but closed up 3.19%. VHM increased by 0.22%, equivalent to a 1.32% increase. VRE also went up by 0.39%, equivalent to 6.03%. Thanks to the good performance of these pillars, the VN-Index gained strongly in the last 15 minutes of the session. In fact, this was the strongest increase of the day, setting the seventh consecutive session of gains.

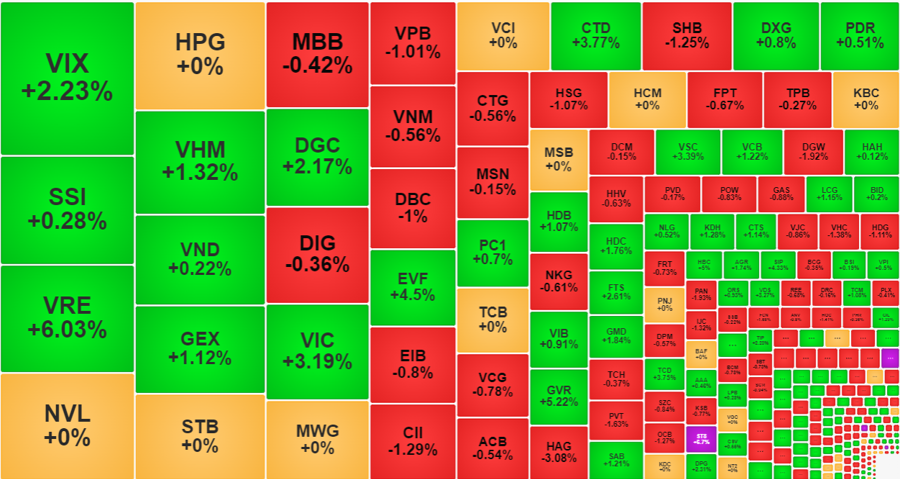

The ability to maintain the high level of the index creates conditions for other stocks with good growth potential. Although the breadth is still tight with 245 stocks increasing/231 stocks declining, the number of increasing stocks is higher than in the morning. Specifically, HoSE ended the session with 92 stocks increasing by more than 1%, compared to 70 stocks in the morning. This group accounted for 31.4% of the total trading value of the exchange, with many highly liquid stocks such as VIX with 909.7 billion dong, a 2.23% increase; GEX with 506.2 billion dong, a 1.12% increase; DGC with 448.2 billion dong, a 2.17% increase; EVF with 293.5 billion dong, a 4.5% increase; CTD with 279.1 billion dong, a 3.77% increase; VSC with 135.6 billion dong, a 3.39% increase…

Foreign investors also had a spectacular reversal in their position today. Specifically, they bought 1,555.4 billion dong on HoSE while selling 1,196.2 billion dong, a net purchase of 359.2 billion dong. This group was net sellers of 223.9 billion dong in the morning session. This is the second session that foreign investors have reversed their position in the afternoon. Impressive stocks bought include MSB +232.9 billion dong, VIX +145.8 billion dong, VHM +119.5 billion dong, VRE +114.6 billion dong, VIC +112.3 billion dong, DGC +74.2 billion dong. On the selling side, there were MWG -86.2 billion dong, STB -84.9 billion dong, VPB -74.7 billion dong, CII -74.3 billion dong, GEX -63.1 billion dong, HCM -42.9 billion dong…