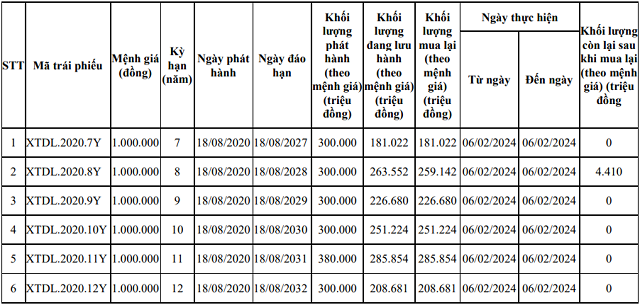

On February 15, 2024, Xuan Thien Dak Lak announced that it had repurchased 6 bonds ahead of schedule, including XTDL.2020.7Y, XTDL.2020.8Y, XTDL.2020.9Y, XTDL.2020.10Y, XTDL.2020.11Y, and XTDL.2020.12Y, with terms of 7, 8, 9, 10, 11, and 12 years respectively.

The total value of the early repurchase was announced to be nearly 1,413 billion VND, out of a total issuance value of 1,880 billion VND. Following the repurchase, the Company has settled all 5 bond lots, with only the XTDL.2020.8Y lot still in circulation with 4,410 units, equivalent to 4.41 billion VND.

|

Xuan Thien Dak Lak’s Early Bond Repurchase Results

Source: HNX

|

According to information from HNX, all bonds have an interest rate of 10.6% per year, with the XTDL.2020.10Y bond having an interest rate of 10.75% per year, paying interest every 3 months at the end of each period. They were all issued on August 18, 2020, and initially scheduled to mature from 2027 to 2032 over a period of 6 years. The registration company is Saigon – Hanoi Securities Joint Stock Company (SHS).

Xuan Thien Dak Lak Co., Ltd. was established on March 7, 2017, with its main business activities being electricity production, transmission, and distribution. The company’s headquarters is located at 109 Hoang Hoa Tham Street, Tan Tien Ward, Buon Ma Thuot City, Dak Lak Province.

At the time of establishment, the company had a chartered capital of 3,000 billion VND contributed by 5 shareholders, including Mr. Nguyen Van Thien owning 85%, Xuan Thien Ninh Binh Co., Ltd. and Xuan Thien Ha Giang Co., Ltd. each owning 5%, Xuan Thien Hoa Binh Co., Ltd. owning 5%, and the remaining 2% belonging to Xuan Thien Yen Bai Co., Ltd.

Mr. Nguyen Van Thien is the older brother of Mr. Nguyen Duc Thuy – Chairman of LPBank and the son of Mr. Nguyen Xuan Thanh – a founding shareholder of Xuan Thanh Group.

Mr. Nguyen Van Thien

|

In the latest amendment to the company’s business registration content on April 10, 2023, Xuan Thien Dak Lak’s charter capital was reduced to 1,148 billion VND. The shareholder structure also changed significantly, with Ea Sup 3 Joint Stock Company owning up to 99.02%, and the remaining portion belonging to Mr. Pham Van Tuat and Mr. Dinh Van Tan, each owning 0.44%, and Xuan Thien Ninh Binh Co., Ltd. owning 0.1%. At the same time, the role of the General Director cum legal representative also changed to Mr. Mai Xuan Huong.

Xuan Thien Dak Lak is known as a member of Xuan Thien Group, which manages, operates, and operates the Xuan Thien – Ea Sup Solar Power Plant Cluster in Ea Sup District, Dak Lak Province.

The project has a total investment of nearly 20,000 billion VND and was put into operation in November 2021 with a capacity of 831 MWp, making it the largest solar power plant cluster in Southeast Asia and the second largest in the world at that time, according to information released by Xuan Thien Group.

Xuan Thien – Ea Sup Solar Power Plant Cluster, Dak Lak Province

|

In a recent development, on January 22, 2024, the People’s Committee of Dak Lak Province revoked more than 13.2 hectares of land belonging to Xuan Thien Dak Lak Co., Ltd. in La Lop Commune, and transferred the entire area to the People’s Committee of Ea Sup District for management in accordance with the land use planning and regulations of the law. The People’s Committee of Dak Lak Province also adjusted the total area of Xuan Thien’s project from over 1,370 hectares to over 1,237 hectares.

The People’s Committee of Dak Lak Province stated that the above-mentioned land revocation was implemented in accordance with the Conclusions of the Government Inspectorate issued on December 25, 2023. The fact that the Provincial People’s Committee allowed the investor to lease more than 238 hectares of land for the implementation of the Xuan Thien – Ea Sup 4 solar power plant project (with an installed capacity of 150 MW) exceeded the land limit by 13.2 hectares (the maximum limit being 225 hectares), which constituted a violation of regulations.

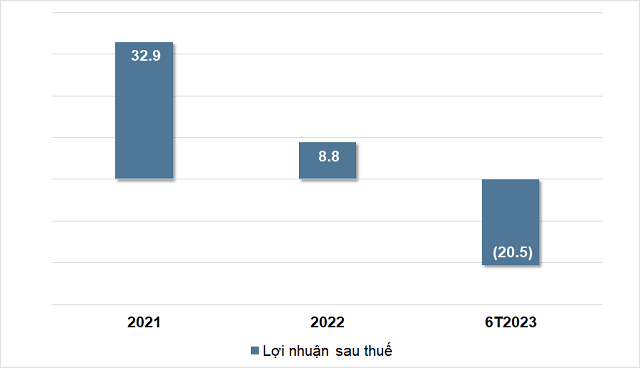

In terms of business operations, Xuan Thien Dak Lak’s net profit has shown a declining trend in recent years. At the end of the first 6 months of 2023, the company recorded a loss of nearly 21 billion VND, while in the same period it had a profit of nearly 27 billion VND, leading to a return on equity (ROE) of -1.75%.

As of the end of June, the company’s total debt was 3,788 billion VND, 3.24 times its equity, including 1,426 billion VND in bond debt, which was 1.22 times its equity.

|

Xuan Thien Dak Lak’s Business Results for the period 2021-6M2023

Unit: Billion VND

Source: VietstockFinance

|