The stock market is often influenced by both money flow and fundamental factors, and their interaction can lead to different market reactions in 2024, according to SSI Research in its updated market outlook report.

FOCUS ON REAL ESTATE RECOVERY

In terms of fundamental factors that can affect the market, 2023 saw various measures taken to “buy time” for the real estate and finance markets to return to normal. A recovery is expected in order to help the financial system avoid major challenges in 2024.

SSI believes that economic recovery will become more pronounced in the second half of 2024, with exports increasing due to the global decrease in interest rates and consumer confidence gradually returning. Domestically, the focus will continue to be on the recovery of the real estate sector, as real estate companies need to quickly resolve legal issues related to projects and the current high mortgage lending rate.

If liquidity in the real estate market and corporate bond market does not recover quickly, consumer confidence will be affected.

The key highlights of the real estate sector in 2023 include the relatively slow resolution of legal issues related to existing real estate projects and the passage of important new regulations (Land Law, Housing Law, and Property Law) by the National Assembly to enhance protection of homebuyers’ rights and strengthen the market.

In 2024, if the legal issues of existing projects are not resolved in a timely manner, M&A activities are forecasted to increase significantly, focusing on projects with full legal compliance. The estimated supply is expected to improve positively from the low level in 2023.

Liquidity in the mid-range segment of major cities continues to improve despite the slow pace due to high housing prices. On the other hand, the resort real estate sector may continue to face challenges. In general, capital raised from the sale of projects with full legal compliance can provide real estate companies with additional time to resolve legal issues for projects that are still pending.

The real estate market recovery is expected to be differentiated across segments and will take more time to fully recover. Real estate companies with strong financial health will be the ones capable of overcoming challenges in 2024.

The non-performing loan ratio of banks may reach its peak in Q3/2024 and then decrease.

The prospects for the real estate and banking sectors may not be favorable immediately in 2024. The expected recovery process will progress slowly, not to mention several closely monitored factors, including the draft land tax currently being developed by the Ministry of Finance, which will have a significant impact on real estate demand. Other closely monitored factors include the global geopolitical situation and domestic economic recovery support policies.

VN-INDEX SOARS DUE TO INDIVIDUAL CAPITAL FLOW

In terms of money flow, record-low interest rates will be the main driving force, particularly for individual investors. Bank deposits continue to increase as other investment channels are limited (gold prices have risen significantly, while the real estate and corporate bond markets require more time to recover).

This capital flow could return to the stock market in different stages of 2024. Since individual investors accounted for 92.2% of the average daily trading volume on the whole market in 2023, it is predicted that the VN-Index will experience significant jumps in 2024 thanks to this capital flow.

Although foreign investors had a net withdrawal in 2023, this trend will reverse in 2024 following the Federal Reserve’s gradual interest rate cuts and the opportunity for the Vietnamese stock market to be upgraded by FTSE Russell in 2024-2025. The long-awaited upgrade to an Emerging Market status is a significant event for investors. Although foreign capital inflows may not recover immediately, the selling pressure from foreign investors is expected to be weaker than in previous years.

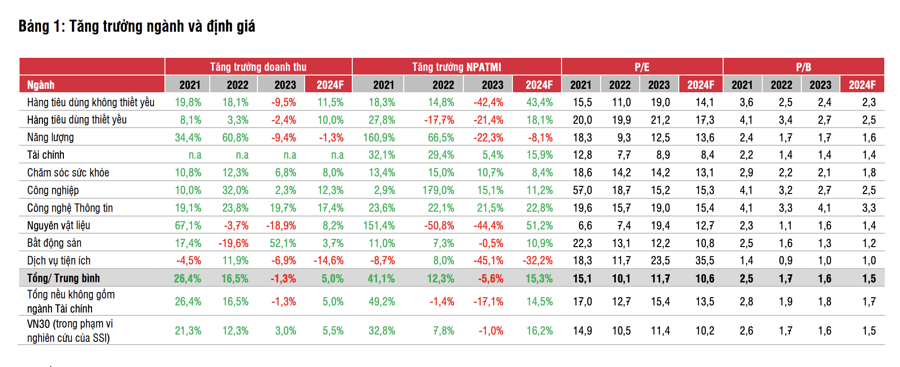

The estimated 2024 profit growth of the 83 stocks within SSI Research’s scope reached 15.3% compared to a 5.6% decline in the previous year. Although the 2024 profit growth may not be strong, SSI expects some sectors to significantly recover and achieve after-tax profit growth of over 30% compared to the same period, including steel, retail, and prominent securities sectors.

In addition, SSI has a positive view on the Information Technology and Industrial Park real estate sectors based on their long-term growth potential. The 2024 PE of the market is 10.6 times as of February 6, 2024.

SSI Research believes that the fair value for the VNIndex at the end of 2024 is 1,300 points, although there may be times during the year when the market surpasses this threshold. In terms of investment themes for the year, profit growth will be the main driver for stocks to outperform this year. In addition, in the context of record-low interest rates, high dividend yields are becoming an attractive factor.