Illustrative image

According to the preliminary statistics of the General Department of Customs, Vietnam imported nearly 4.12 million tons of fertilizers in 2023 with a value of over 1.41 billion USD, up 21.3% in volume but down 12.8% in value compared to 2022.

The import price recorded a sharp decrease compared to 2022, averaging at 343 USD/ton, down 28%.

In terms of market, China is Vietnam’s largest supplier with over 2.4 million tons, equivalent to over 662 million USD, accounting for nearly 50% in both volume and value.

Russia is the second largest market with 288,727 tons, equivalent to over 132 million USD, accounting for more than 7% in production output. Laos is Vietnam’s third largest fertilizer supplier with 279,752 tons, equivalent to over 92 million USD, accounting for 6.8%.

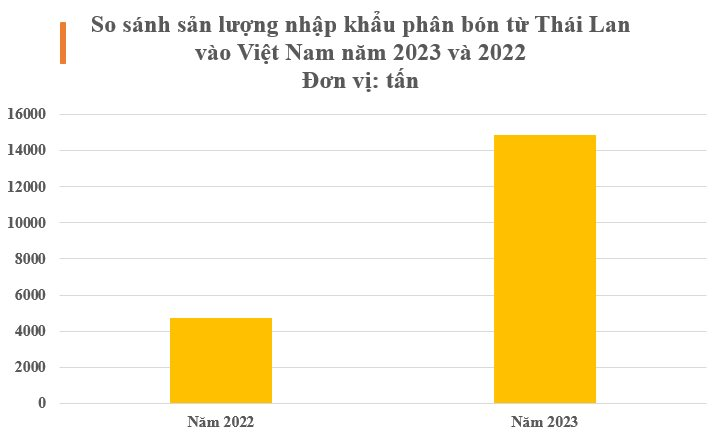

Of note, Thailand is a country that is experiencing a strong growth in fertilizer exports to Vietnam, with the highest growth rate among suppliers, at 215%. Specifically, in 2023, Vietnam imported 14,844 tons of fertilizer from Thailand, valued at over 5.7 million USD, tripled in output and increased by 54% in value. However, despite the strongest growth rate, the share of Thailand as a supplier is very small, less than 1%.

The average import price reached 384 USD/ton, down 51% compared to the previous year.

Fertilizer is known as the “lifesaver” of Vietnamese agricultural products – a product that earned over 5 billion USD in 2023, with China being the largest customer, accounting for over 80%. China’s demand for Vietnamese agricultural products remains high and is expected to continue to boom in 2024. According to statistics, Vietnam has about 1,000 fertilizer production enterprises, with a production capacity of about 11 million tons of fertilizer for both inorganic and organic fertilizers.

For Thailand, according to Modor Intelligence, the Thai fertilizer market is estimated to reach 2.26 billion USD in 2023 and is projected to reach 3.08 billion USD in 2028, with a CAGR growth rate of 6.40% in the forecast period (2023-2028).

The use of fertilizer in Thailand is an indispensable part of agriculture, due to the decline in arable land and the increasing role of agricultural exports in the economy. However, Thailand has limited raw material supply for fertilizers, so it imports both raw materials and mixed types for production and distribution in the country at a high level.

Ammonium fertilizer is the most important fertilizer in the world, accounting for 56% of total global consumption in the 2015-2022 period. Following that, urea and potassium fertilizers account for 24% and 19% of total fertilizer consumption during the same period.

According to the International Fertilizer Association (IFA), global fertilizer production in 2023 is expected to recover positively by 4% in 2023, before increasing by 1.8% in 2024. Meanwhile, Rabobank’s forecast is more optimistic with a general increase in global fertilizer market of 3% in 2023 and 5% in 2024. This is the basis for the expectation that the global fertilizer industry will improve in 2024.