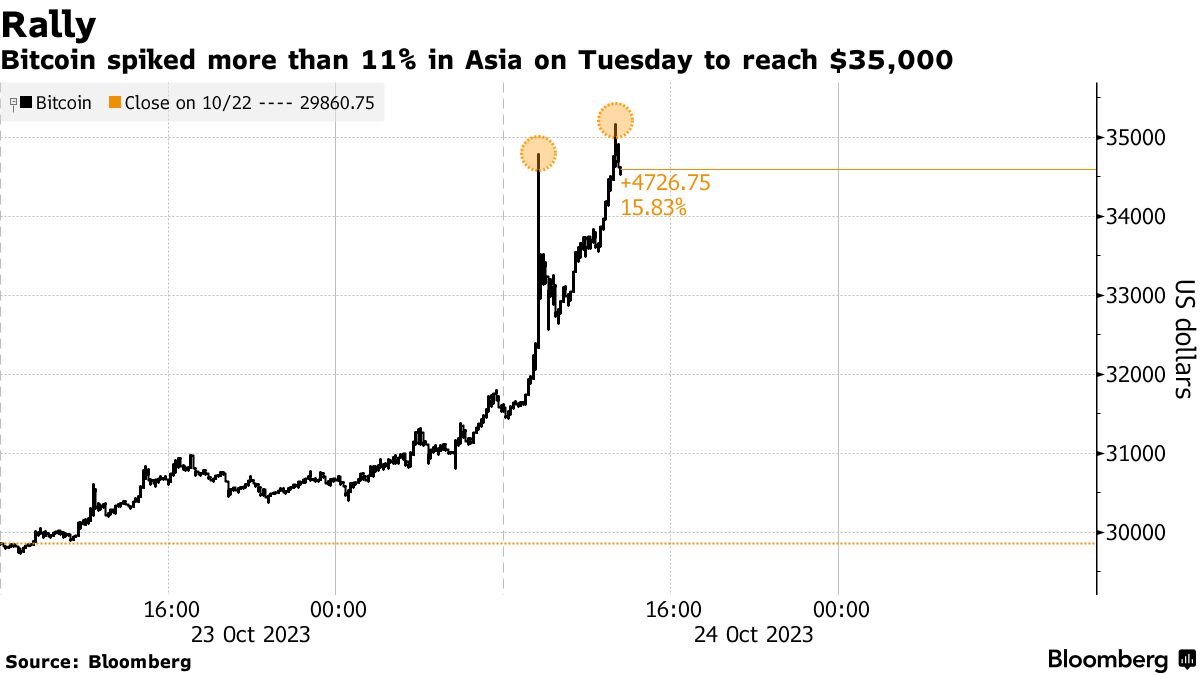

Bitcoin surged by up to 11.5% and surpassed the $35,000 mark before cooling down to $34,580. The digital currency has seen a 109% increase compared to its 2022 low.

Investors are currently anticipating the approval of the first-ever Bitcoin ETF in the US, which could fuel a speculative frenzy into the world’s largest cryptocurrency. Asset management giants like BlackRock and Fidelity Investments are among the companies racing to offer this product. Crypto enthusiasts believe that the approval of the ETF will enhance the acceptance of cryptocurrencies.

The market is exhilarated following the news that the US Securities and Exchange Commission (SEC) will not appeal the ruling of the Columbia District Court. The SEC believes that their previous decision to reject Grayscale Investments’ Bitcoin ETF was a mistake.

To this day, the SEC continues to reject the establishment of ETFs directly investing in Bitcoin, citing risks such as fraud and market manipulation in the underlying Bitcoin market. The appellate court’s decision and the continuous filing of registration documents by asset management giants have sparked speculation that the SEC will eventually compromise.

By Vu Hao (According to Bloomberg)