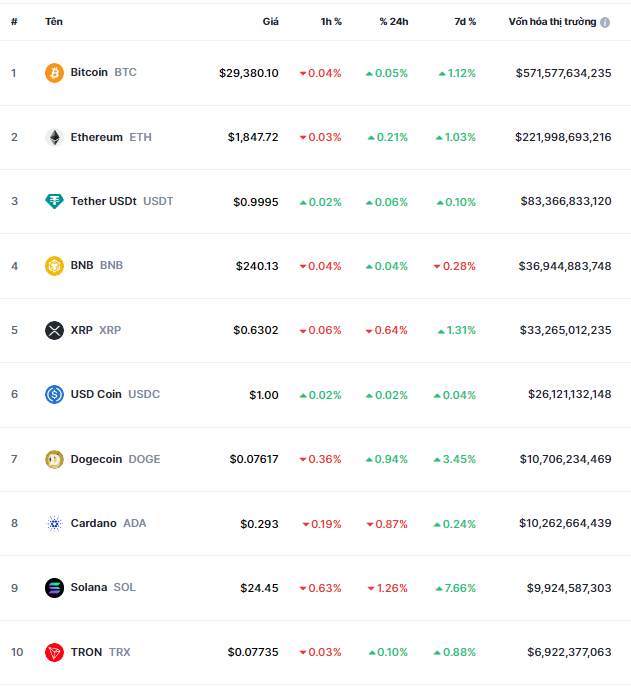

As of the morning of August 12th, the price of Bitcoin – the largest cryptocurrency – reached nearly $29,400, up more than 1% from the previous weekend. Ethereum also rose 1% to $1,850.

Most of the top 10 cryptocurrencies performed well, with Solana rising 8%, Dogecoin rising 3%, and XRP rising 1%.

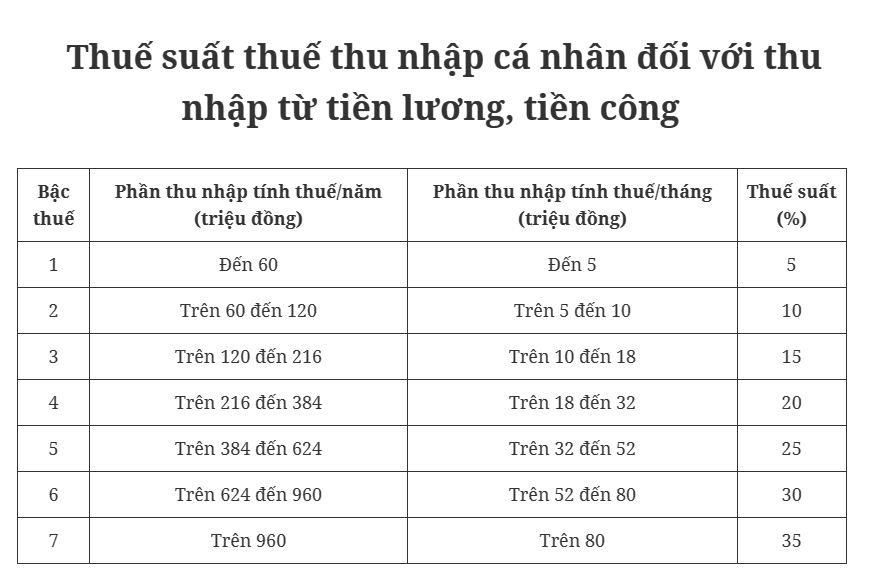

Top 10 Cryptocurrency Performance

Source: CoinMarketCap

|

CPI in the US increases weaker than expected

Last week, the market also welcomed important inflation news. In July 2023, the Consumer Price Index (CPI) increased by 3.2% compared to the same period last year, lower than the 3.3% forecast by experts. Core CPI – excluding food and energy – also rose 4.7% compared to the same period last year. This figure is lower than the experts’ forecast of a 4.8% increase.

Among them, Fed officials are paying more attention to core inflation because they believe that this indicator is a better predictor of future inflation. If core CPI continues to cool down, it will strengthen the scenario of the Fed’s pause in raising interest rates in September 2023, which will have a positive impact on risk markets, including cryptocurrencies.

Traders almost believe that the Fed will not raise interest rates at the September meeting, with a probability of 90%. Meanwhile, the likelihood of an interest rate hike at the November 2023 meeting is at 28%.

Fed tightens cryptocurrency oversight

On August 8th, the US Federal Reserve issued a new move to tighten financial activities of banks related to cryptocurrencies.

Specifically, the Fed requires banks in its system to submit and receive unsupervised approval letters from the Fed before issuing, holding, or trading in cryptocurrencies used as a means of payment, such as stablecoins tied to a fiat currency.

The Fed also announced the establishment of a new supervision program to support the enhanced management capabilities of banks in the field of cryptocurrencies, blockchain technology, and technology-based non-bank partner relationships.

The new program will emphasize improving and enhancing technology for the existing supervision process.

In a notice sent to banks, the Fed stated that to receive unsupervised approval letters, banks must demonstrate their ability to manage feasible risks, including having a prepared system to cope with and identify potential risks, cybersecurity threats, and financial illegality.

After receiving unsupervised approval letters, member banks in the Fed system participating in activities related to cryptocurrencies will still be subject to enhanced supervision and control, as well as enhanced supervision for the above activities.

The Fed’s announcement came a day after global online payment platform PayPal launched a new stablecoin called PayPal USD.

PayPal USD was introduced at a time when the cryptocurrency industry is going through a difficult period, following the collapse of the FTX cryptocurrency exchange, leading to numerous legal actions against major players in the cryptocurrency field.

The macro regulators of the US are becoming more cautious about cryptocurrencies. Last month, the US House of Representatives Financial Services Committee proposed a bill to establish a federal legal framework for stablecoins, focusing on registration rules and approval procedures for stablecoin issuers.

South Korea does not allow Binance to acquire GOPAX exchange

The world’s largest cryptocurrency exchange is facing difficulties in the process of obtaining the final license as a virtual asset service provider (VASP) in Korea.

Binance, the world’s largest cryptocurrency exchange, is facing difficulties in expanding in Korea because financial agencies have not granted permission for the company to acquire GOPAX, the 5th largest exchange in Korea.

In early February, China’s Binance cryptocurrency exchange took over Streami, the operator of GOPAX. Since then, Binance has faced difficulties in obtaining the final license as a virtual asset service provider (VASP) in Korea.

The financial authorities of Korea are dealing with this matter, delaying the approval process and urging GOPAX to submit additional legal documents and requesting Jeonbuk Bank, GOPAX’s partner, to participate in additional risk assessments.

Concerned about the slower-than-expected approval, Binance has replaced the top management of GOPAX several times this year alone. However, GOPAX has not made progress in working with the regulatory authorities in Korea.

Industry sources said that it is highly likely that Korea will maintain its current position on the expansion of Chinese capital here.

A source in the cryptocurrency industry said: “Financial supervision agencies in Korea still refuse to allow Chinese cryptocurrency companies to operate here, so it will be difficult for Binance to obtain a license without a strong change in the position of the regulatory authorities.”

The source added that Korea is tightening regulatory guidance across the entire cryptocurrency industry, so it is difficult for Binance to expand its foothold here at the moment.