In the draft amendment of the Value Added Tax Law currently being reviewed by the Ministry of Finance, one of the proposed amendments that has attracted attention is the increase of the taxable revenue threshold for household and individual businesses from 100 million VND/year to 150 million VND/year. However, many opinions suggest that the taxable revenue of 150 million VND/year is still relatively low.

The draft amendment of the Value Added Tax Law is expected to be submitted to the National Assembly for opinions in the 7th session held in May 2024 and approved in the 8th session in October 2024.

TAXABLE REVENUE OF 150 MILLION VND/YEAR IS STILL LOW

The current Value Added Tax Law stipulates that households and individual businesses with annual revenue from production and business activities in the lunar year of up to 100 million VND are exempt from paying value added tax and personal income tax as prescribed by law.

In addition, households and individual businesses are responsible for accurate, honest, and complete tax declaration and timely submission of tax documents; they are responsible for the accuracy, honesty, and completeness of tax documents as required by law.

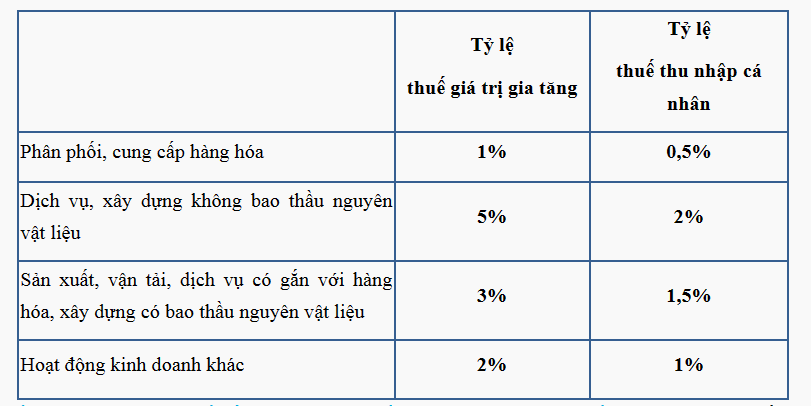

The tax rates on revenue (value added tax rate, personal income tax rate) are determined based on the sectors and industries in which households and individual businesses operate.

Since the amendment of the Value Added Tax Law took effect from January 1, 2014, the consumer price index (CPI) has increased significantly. Therefore, the Ministry of Finance proposed to the Government to amend the threshold for tax-exempt sales of goods and services by households and individual businesses from 100 million VND/year to 150 million VND/year in Article 25, Clause 5 of the draft Law.

It should be noted that households and individual businesses are not allowed to deduct expenses and have to pay tax based on the total revenue received. Accordingly, if a household or an individual business achieves monthly revenue above 12.5 million VND, equivalent to about 400,000 VND/day, they are already subject to tax.

According to the VCCI, raising the threshold for tax-exempt revenue will help many small businesses and households engaged in small-scale business activities avoid the need to declare and pay taxes. However, according to feedback from many businesses, the taxable revenue threshold of 150 million VND/year is still relatively low.

Therefore, the VCCI suggests that the drafting agency consider amending the regulations on the taxable revenue threshold for households and individual businesses to about 180 – 200 million VND/year. At the same time, they should consider classifying by industry, similar to Article 12.2.b of the draft on direct tax calculation methods, for example, the distribution, supply of goods having a higher threshold than the service sector, construction, etc.

Sharing the same opinion as the VCCI, the Ministry of Transport has proposed raising the revenue threshold from 150 million VND to 250 million VND, equivalent to about 10,000 USD. Quang Ngai province even proposed exempting value added tax for households and individual businesses with revenue below 300 million VND/year.

Meanwhile, Ho Chi Minh City has proposed that the threshold for tax-exempt sales of goods and services by households and individual businesses should not be determined by a fixed value but should be determined based on corresponding reductions for personal circumstances and dependent persons to be consistent with the regulations on personal income tax reductions.

Trong Tin Accounting and Tax Consulting Company proposed raising the threshold for tax-exempt revenue from 150 million VND to 180 million VND, or to establish the regulation and entrust the Government to determine it to ensure flexibility and accordance with the actual situation and the poverty line in Decree 07/2021/NĐ-CP.

UNREASONABLE TAXABLE INCOME THRESHOLD

According to the analysis of the VCCI, comparing the income tax exemption for business individuals and salaried individuals reveals the inconsistency. Currently, salaried individuals have a reduction of 132 million VND/year for cases without dependents, 184.8 million VND/year for cases with one dependent, and 237.6 million VND/year for cases with two dependents.

“Based on the assumption that each worker has one dependent, the taxable income threshold for salaried individuals is currently higher than the taxable revenue threshold for value added tax by business individuals. This is not to mention that in order to generate revenue, business individuals will incur expenses, which salaried individuals do not have”, the VCCI stated.

In practice, different sectors have different cost structures and tax rates, even with the same revenue. For example, in the trade sector, such as retail stores and grocery stores, input costs account for a large proportion of revenue. In the service sector, input costs are insignificant, and the value added portion is larger, resulting in higher taxes.

The Ministry of Planning and Investment also suggested that the Ministry of Finance supplement quantitative data-based calculations, explanations to clarify the reasons for the regulation of the annual revenue threshold for tax-exempt goods and services of households and individual businesses of up to 150 million VND, to ensure compliance with the reality and encourage private economy, encourage individuals, and households to legitimately make wealth and not miss any revenue sources.

In response to feedback from agencies and units, the Ministry of Finance explained that the proposed increase in the revenue threshold for business households and individuals from 100 million to 150 million VND is based on the inflation index and the actual situation.

“If based on the inflation index, the taxable revenue threshold would only be about 130 million VND; however, in order to support business individuals, the Ministry of Finance proposed to raise it to 150 million VND”, the Ministry of Finance clarified.

Furthermore, raising the tax reduction threshold for business households to 250 million VND will affect local state budget revenues, especially in areas with low revenues. In addition, this regulation will not encourage households and individuals engaged in business activities to convert to enterprises. Therefore, the Ministry of Finance proposed to keep it as proposed in the draft Law.