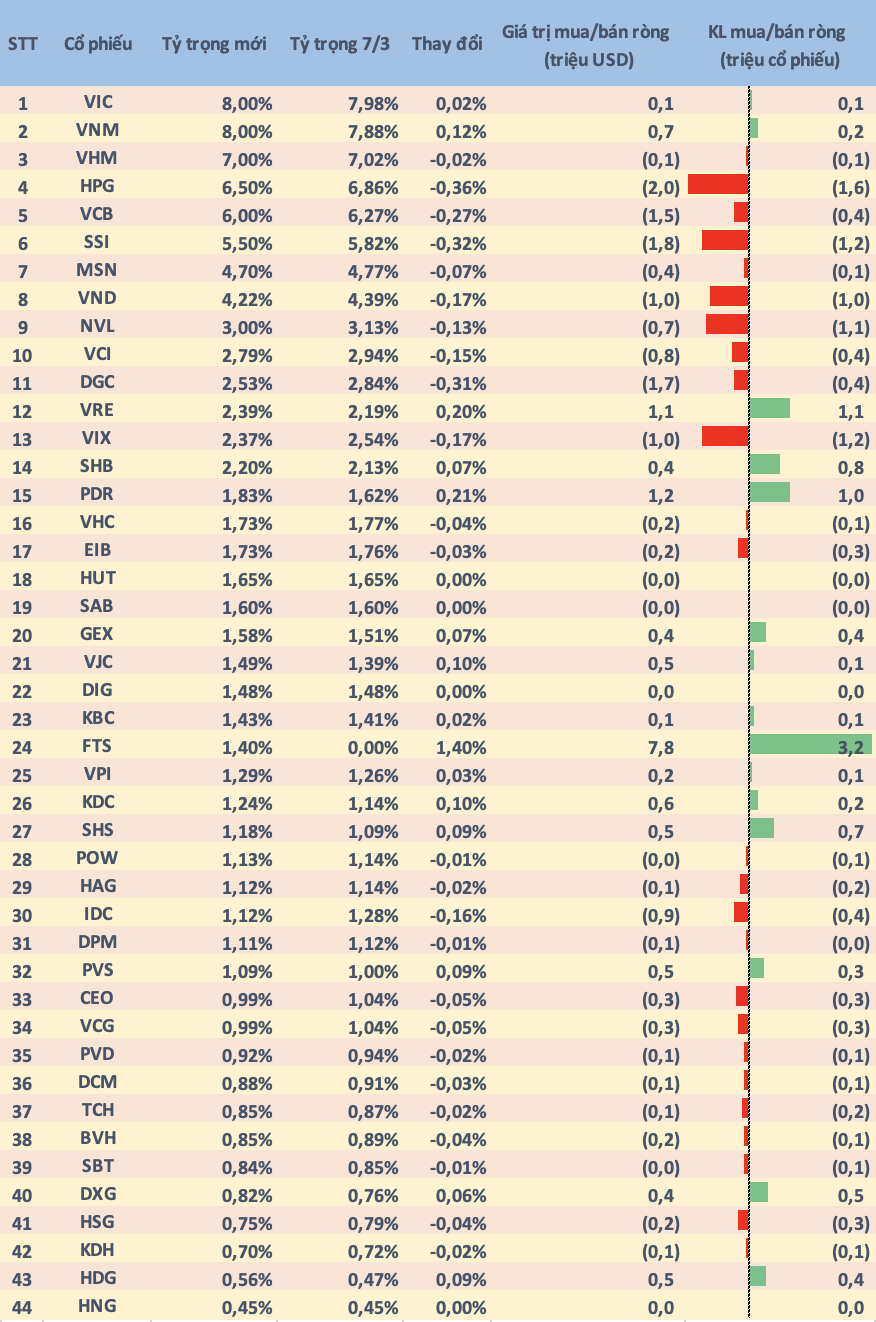

The MVIS Vietnam Local Index – the underlying index of the Vaneck Vectors Vietnam ETF (VNM ETF) – has just announced its quarterly rebalancing for Q1/2024. In this rebalancing period, the MVIS Vietnam Local Index has added only one new stock, FTS (FPT Securities), and hasn’t removed any stocks, thereby increasing the total number of stocks in the index to 44.

As of March 7th, the size of VNM ETF’s portfolio reached over 557.6 million USD (~13,750 billion VND). The estimated amount of FTS shares to be purchased by the fund is around 3.2 million, accounting for 1.4% of the portfolio. In addition, the fund will significantly increase the weightings of some other stocks, with VRE (1.1 million shares) and PDR (1 million shares) being the two largest net purchases.

On the contrary, several stocks in VNM ETF’s portfolio are expected to have reduced weightings after the Q4 rebalancing, mainly the top holdings. Among them, HPG (1.6 million shares), SSI (1.2 million shares), VND (1 million shares), VIX (1.2 million shares), NVL (1.1 million shares)… are expected to be net sold with significant estimated quantities.

Details of VNM ETF’s estimated portfolio in the Q1/2024 rebalancing:

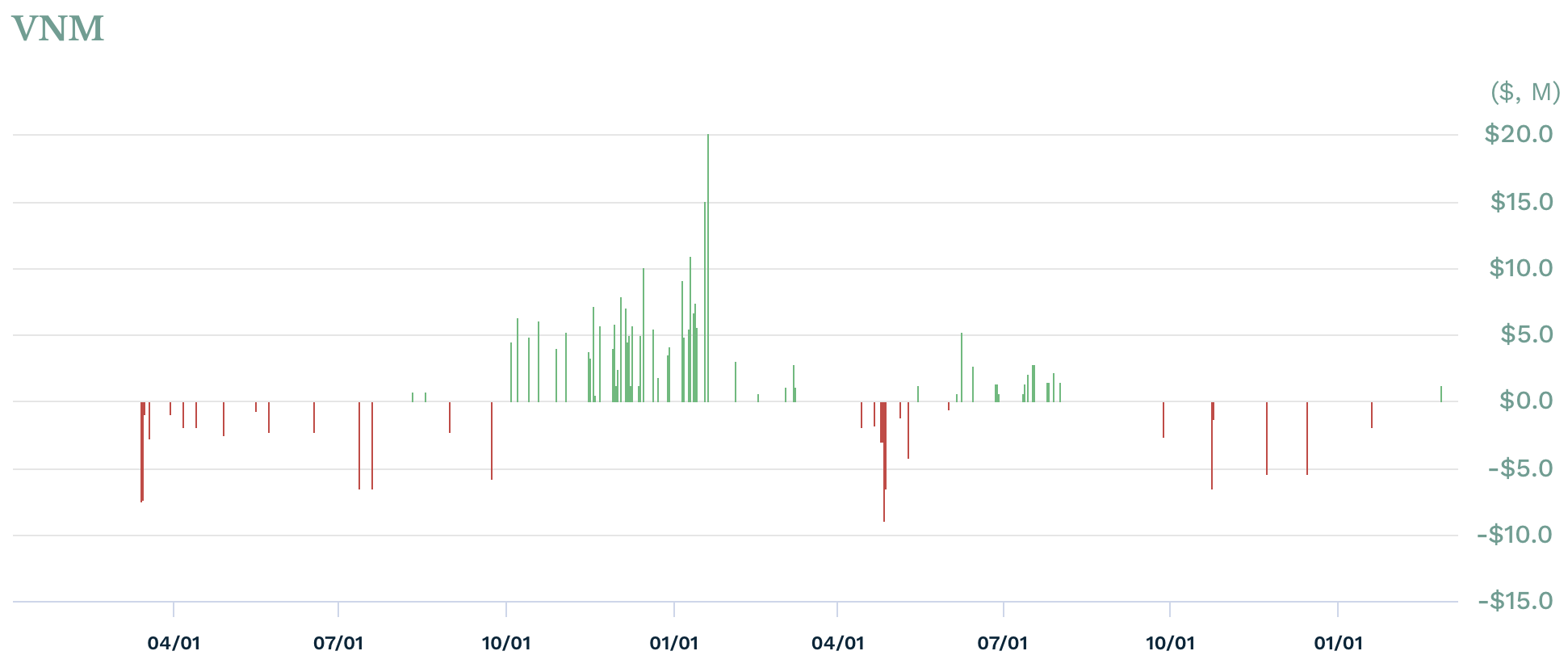

VNM ETF officially switched its benchmark index to the MVIS Vietnam Local Index (consisting of 100% Vietnamese stocks) since March 17th, 2023, after experiencing a strong outflow from late 2022 to early 2023. Capital started flowing in the opposite direction from mid-April to early May, causing this ETF to experience significant net withdrawals.

The fund gradually regained inflows from June, but then witnessed another wave of outflows from late Q3. The capital outflow occurred sporadically, but each round had a fairly large value of over hundreds of billion VND. Overall, in 2023, VNM ETF experienced a total net outflow of 71.3 million USD (~1,700 billion VND). From the beginning of 2024 until now, the fund has had mild outflows with a value of only slightly over 0.6 million USD.

Last week, the FTSE Vietnam Index – the benchmark index of the FTSE Vietnam ETF – added EVF without removing any stocks, thereby increasing the total number of Vietnamese stocks to 27. Both VNM ETF and FTSE Vietnam ETF will complete their rebalancing in the coming week, and the new portfolios will become effective after the market close on Friday (March 15th) and officially traded from the following Monday (March 18th).