Following the vibrant HoSE trading session, the stock VTP of Viettel Post Joint Stock Corporation (Viettel Post – VTP code) continued to impress on March 13 with multiple records set.

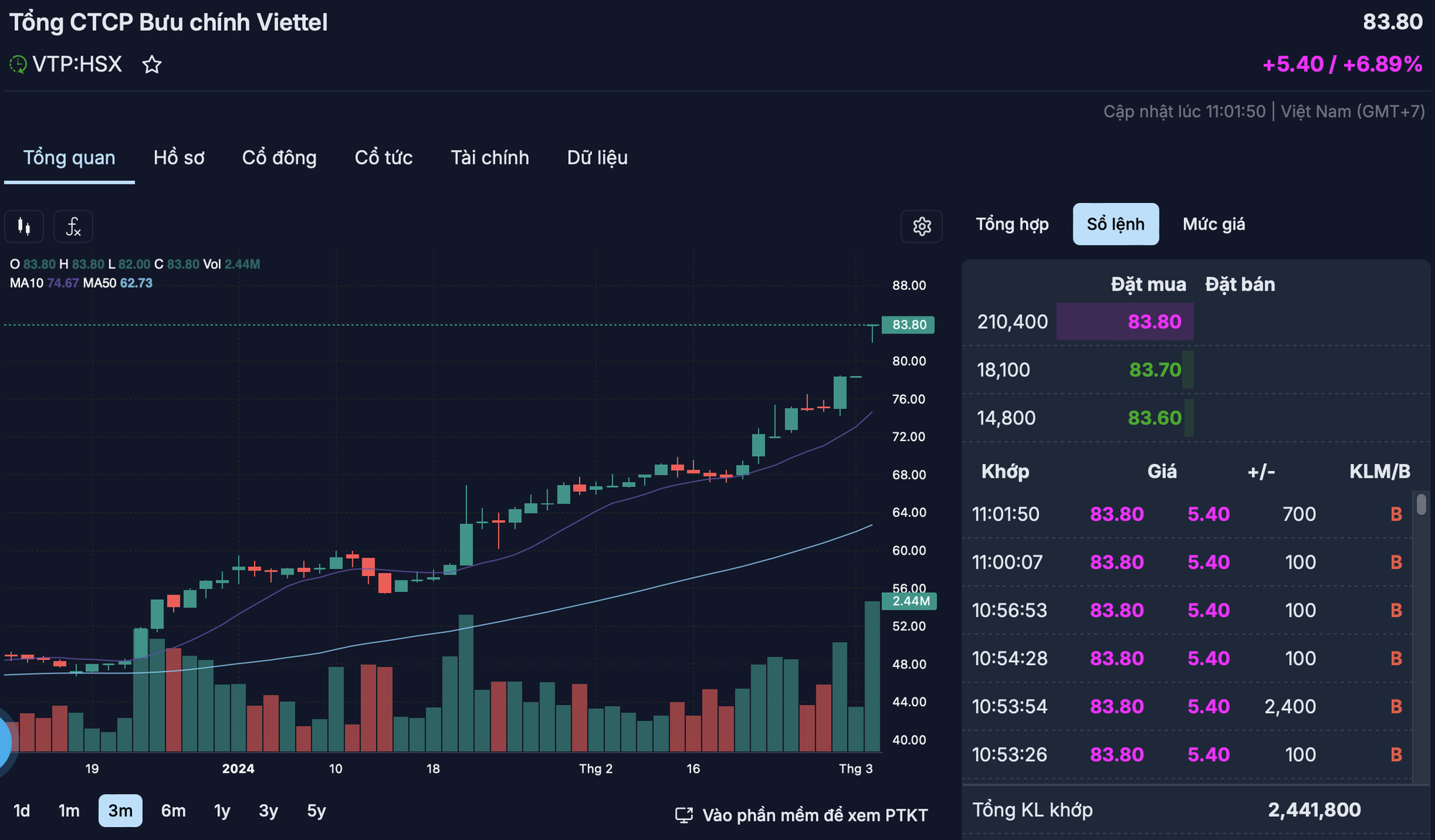

First was the unprecedentedly active trading with a trading volume of over 2.4 million units in the morning session, corresponding to a transaction value of over VND 200 billion. This is the highest liquidity of VTP since the stock was listed on the stock exchange.

Money quickly poured in, driving VTP to soar to a new ceiling price at VND 83,800 per share, an increase of nearly 50% since the beginning of the year. It is worth noting that despite reaching its highest (adjusted) price level ever, this stock is still in high demand, with over 200,000 buy orders at the ceiling price by the end of the morning session.

The continuous hot rise of the stock has pushed Viettel Post’s market capitalization to a record of over VND 10,200 billion, 3.5 times higher than one year ago. This is also the first time the value of the “giant” in the express delivery service industry has exceeded the trillion threshold.

Viettel Post has a charter capital of nearly VND 1,218 billion and is a member of the Military Industry – Telecommunications Group (Viettel). Viettel Post’s logistics ecosystem is based on modern infrastructure, advanced technology, and provides a full range of services such as delivery, supply chain (warehouse, transportation, forwarding…), cross-border e-commerce, etc.

Viettel Post listed its stock on UPCoM from November 23, 2018, with the stock code VTP. The opening price of the first trading session of VTP was VND 68,000 per share, corresponding to a valuation of nearly VND 3,000 billion. Therefore, after more than 5 years since listing, Viettel Post’s market capitalization has increased by 240% compared to the initial period.

In terms of business performance in 2023, Viettel Post recorded a revenue of VND 19,732 billion, a decrease of 9% compared to 2022. However, a sharp decrease in cost of goods sold helped gross profit increase significantly by 35%, reaching nearly VND 876 billion. After deducting expenses, Viettel Post had a net profit of over VND 380 billion, an increase of 49% compared to 2022.

In 2024, Viettel Post targets a revenue of VND 13,847 billion, a decrease of 29% compared to the achieved level of 2023, but the expected after-tax profit will slightly increase to VND 384 billion. In the next 5 years, the company aims to increase its revenue by 10 times compared to 2023, equivalent to a growth rate of 60-65% per year for both core and new business areas.

Aiming for the top position in the delivery market

According to a recent analysis report, ABS Securities evaluates the business prospects of Viettel Post in 2024 to be optimistic due to the focus on business areas with better profit margins such as delivery and logistics. Viettel Post has the advantage of being the third largest postal service provider in Vietnam, holding an 18.6% market share, ranking 3rd after VNPost and GHTK, and having the second largest network after VNPost.

Viettel Post is also the first logistics company in Vietnam to use Robot AGV technology for automatic sorting at distribution centers; owns a modern technology investment logistics system at 3 regional distribution centers, 4 Fulfillment distribution centers, and 98 provincial distribution centers across the country with a total warehouse area of nearly 740,000m2. Currently, Viettel Post is actively cooperating with e-commerce platforms, aiming to capture a 20% market share in delivery services by 2024 and gradually move towards the top position in the market.

In addition, the company is also intensifying infrastructure and logistics network investment in Vietnam and ASEAN countries (Laos, Cambodia, and Myanmar). In the period of 2024 – 2025, the company plans to allocate about VND 3,000 billion to expand warehouse infrastructure and invest in sorting systems. It is expected that in the future, Viettel Post will establish additional delivery companies in Laos and representative offices in Thailand, China, etc. Although 95% of the revenue comes from the domestic market, ABS believes that the international market is a new and large source of growth from 2025-2030;

Furthermore, the implementation of new technologies in operations, specifically the logistics park system, will help optimize costs. Viettel Post will utilize university-educated engineers to operate, reducing labor costs by 60 – 70% with the fastest goods circulation time, increasing operational efficiency; Although the market is fiercely competitive in terms of prices, VTP is expected to maintain the current shipping prices to ensure service quality.